(Forbes) The U.S. Securities and Exchange Commission has published a detailed presentation shared by Bitwise, the venture-backed cryptocurrency index and fund provider, explaining why the startup believes the world is ready for the first bitcoin fund traded on a major exchange.

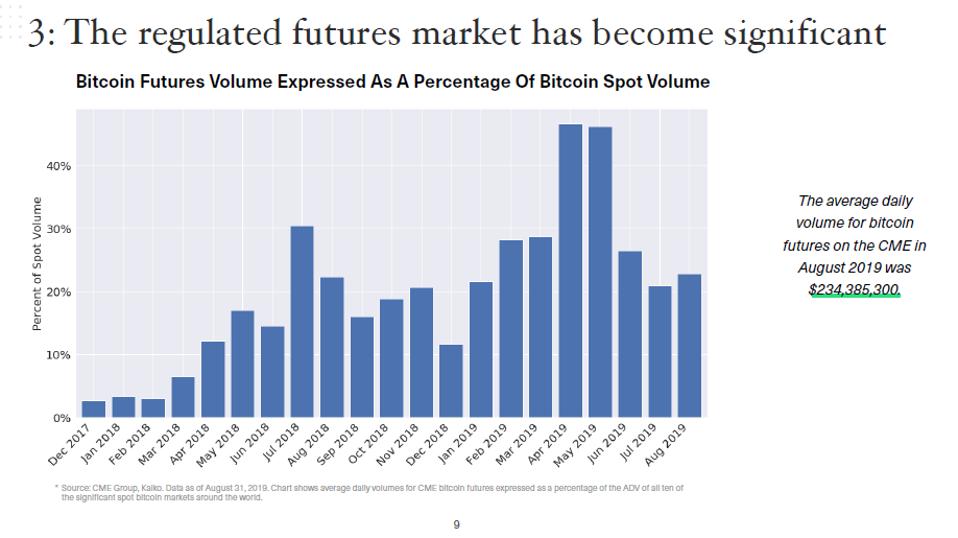

Buried in the document, presented one week ago by San Francisco-based Bitwise to SEC commissioners Robert Jackson, Hester Peirce, and Elad Roisman, is a three-pronged argument for why Bitwise believes the cryptocurrency market is mature enough to support such an exchange traded fund: spot market efficiency, institutional-grade custody of crypto assets, and a growing futures market.

As institutional investors increasingly look for legitimate ways to gain exposure to bitcoin, while not having to dabble directly in the cryptocurrency spot market, these developments could indeed result a huge boon to the cryptocurrency industry.

However, the publication of the documents by the SEC should not be taken as an endorsement by the regulator, which regularly shares similar information it receives with the public. Just today, in fact, SEC commissioner Jay Clayton expressed doubts over the likelihood bitcoin would have an ETF on a major exchange anytime soon.

“The reality is that the bitcoin market of today bears little resemblance to the crypto market of a few years ago,” says Bitwise global head of research Matt Hougan. “The crypto market today is one dominated by firms like Jane Street and Fidelity; it's one where regulated, institutional custodians provide world-class service and are insured by Lloyd's of London.”

The 31-page slideshow was posted by the SEC as part of a number of responses submitted to a request for comment by the regulator posted in February, seeking information about the proposed bitcoin ETF, officially called the Bitwise Bitcoin ETF Trust, which would trade on the New York Stock Exchange. Beginning on page 7 of the slideshow, the startup lists three changes that have occurred over the past two years, which Bitwise believes lays the foundation for its bitcoin ETF.

Excerpted from the presentation:

In stark contrast to the optimistic tone of the presentation, which can be seen in full here, SEC chairman Jay Clayton today kicked off the Delivering Alpha conference, in New York by saying of bitcoin that “if [investors] think there’s the same rigor around that price discovery as there is on the Nasdaq or New York Stock Exchange ... they are sorely mistaken,” according to a CNBC report. “We have to get to a place where we can be confident that trading is better regulated.”

While Grayscale’s Bitcoin Investment Trust (GBTC) has been trading over the counter since 2013, the SEC denied Tyler and Cameron Winklevoss’ application for a bitcoin ETF in July 2018, and a month later, in a mass announcement, rejected nine other bitcoin ETFs. Though the fight is far from over.

As recently as yesterday New York-based institutional cryptocurrency trading platform Tagomi posted comments arguing that the New York Department of Financial Services’ controversial BitLicense has gone a long way to providing the kinds of regulation the SEC expects. “Tagomi believes that holding a BitLicense is meaningful and a material consideration in our due diligence process,” according to the statement.

The SEC has until October 14 to make its decision.