It is the start of a bumper week of U.S. corporate earnings and one that will tell us more about the devastating impact of coronavirus on the economy.

The busiest week of earnings season will see Alphabet, Amazon, Apple, Tesla, Boeing and Exxon Mobil all report results.

In our call of the day, former Goldman Sachs hedge-fund manager Raoul Pal said the dollar was the world’s “biggest problem” and that the signal to sell equities was coming soon.

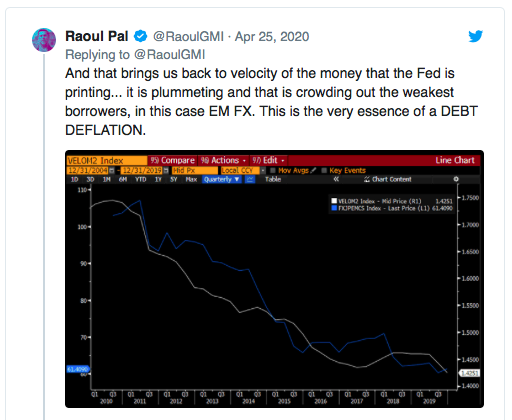

He said the narrative that the Fed printing money would causes a dollar collapse was “very wrong.”

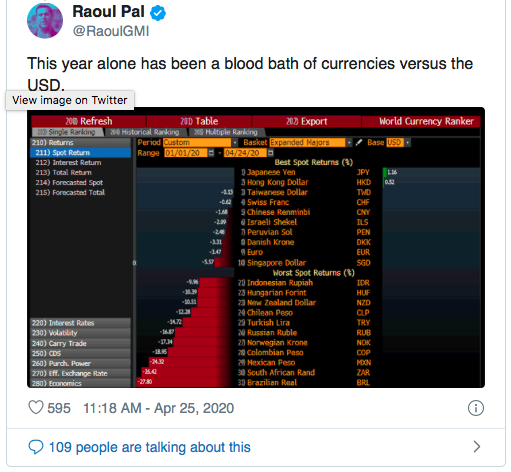

The chief executive of Global Macro Investor, who predicted the 2008 financial crisis, said: “You see the biggest problem the world faces is the dollar. We are in a viscous doom loop where slowing growth causes the dollar to rise, which causes slower growth, which causes the dollar to rise, as all borrowers play musical chairs to get access to the dollar to service debts.

“Dollar swap lines, QE, jawboning, etc. have done nothing to stop this,” he added in a post on Twitter.

He said no printing of money — by the Federal Reserve — would solve what he described as a “structural” problem. “All attempts to create more money to solve the dollar standard issue tend to devalue all fiat versus gold. Gold is rallying on debt deflation probabilities.”

“My guess is that the next debt deflation signal will come when bonds begin to price in negative interest rates. That day is coming soon... and that will be the signal to sell equities and the insolvency phase will begin.”

This article originally appeared on MarketWatch.