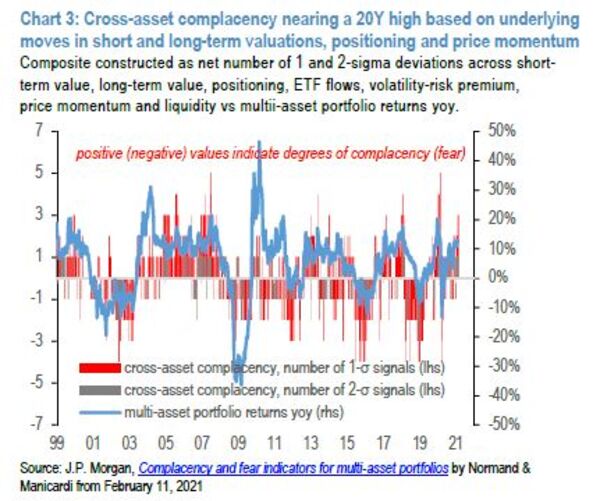

Global investors are the least fearful they’ve been in two decades, and perhaps the most greedy.

A JPMorgan Chase & Co. gauge of cross-asset complacency based on valuations, positioning and price momentum is nearing the highest level since the time the dot-com bubble burst and some companies found out burning cash faster than they made it wasn’t quite effective as a long-term survival strategy.

Some of that get-rich-quick spirit has already been in display in 2021 from Bitcoin’s flirting with the $50,000 mark to the craze for cannabis firms and speculative warfare over penny stocks. Global equities have added $7 trillion since New Year, digital currencies have ballooned to a market value of $1.4 trillion and high-yield bond sales are raking in records.

While all that raises concerns of untenable valuations across asset classes, investors continue to pour money into them amid confidence that unprecedented monetary and fiscal accommodation will keep the party going for some more time.

JPMorgan strategists seem to agree. While a “pause” is likely now, they say, there’s no reason to expect a substantive pullback from the rally fueled by the trillions of dollars being unleashed. The main risk on the horizon is a taper of bond-buying by the Federal Reserve once employment and inflation return to targets, but that’s not likely until later in the year.

“We’ve been comfortable advising investors to stay long most markets,” strategists led by John Normand wrote in a Feb. 12 note to clients. “When growth is above trend, monetary policy is ultra-loose and fiscal policy is on overdrive, markets tend to exhibit the financial variant of Newton’s Law: they stay in motion until acted upon by another force.”

This article originally appeared on Bloomberg.