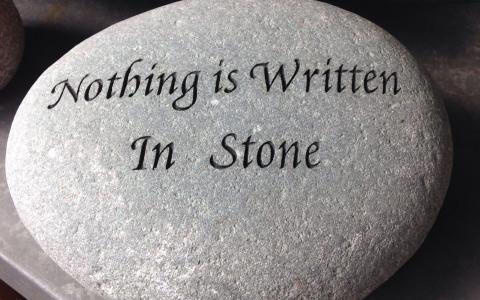

(Fortune) - Billionaire investor Leon Cooperman added his name this week to a growing list of Wall Street titans and investment banks predicting a recession. ‘It’s not written in stone, but that would be my guess’: Leon Cooperman joins chorus of billionaire investors warning of a U.S. recession.

The former hedge fund manager said he sees a recession coming in 2023 as the Federal Reserve attempts to curb rising inflation by raising interest rates.

"I think the Fed has totally missed it, and I think we have a lot of wood to chop," Cooperman told CNBC on Tuesday. "I would think the price of oil or the Fed would push us into a recession in 2023. It's not written in stone, but that would be my guess."

In March, the Fed raised its benchmark interest rate for the first time in four years by a quarter-point as Russia’s Ukraine invasion sent commodity prices soaring. Now, the central bank is whetting its appetite for a half a point hike next month as some officials call for an even faster pace of rate increases through next year.

The changing stance from the Fed comes as oil prices have surged to over $100 per barrel and inflation rates have moved to highs not seen in four decades. A strong jobs report in March, which showed the U.S. adding nearly half a million jobs and the unemployment rate falling to just 3.6%, also lent credibility to arguments the economy may be overheated and that the Fed has been slow to act.

Cooperman criticized the Federal Reserve’s delayed response to rising consumer prices over the past year, saying it now may be impossible to ensure a “soft landing” for the economy—in which inflation is curbed without creating a recession.

“We’ve borrowed from the future…We’ve had totally inappropriate monetary policies, and I think we have to make up for some of this,” said Cooperman, who is worth an estimated $2.5 billion. “I think we’re in store for a difficult period.”

Cooperman did note that inflation has typically been kind to stocks in the near term, but he added that when the Fed acts to combat rising consumer prices, it often spells disaster.

“Investors understand curbing inflation is tantamount to curbing growth,” he said.

Cooperman added that it's time for investors to be cautious and protect their portfolios amid rising market risks, saying: “In a bear market, he who loses least, wins.”

Cooperman is just one of many billionaire investors who have come out in recent weeks warning of a recession. Billionaire Carl Icahn issued an ominous warning to investors in March, saying a recession “or even worse” could be ahead for the U.S. economy. And DoubleLine Capital’s Jeff Gundlach said he sees inflation hitting 10% in April, forcing the Fed to raise rates at an unsustainable pace, thereby instigating a recession.

Even investment banks are beginning to make recession predictions as Wall Street starts to feel the heat of rising inflation and elevated oil prices. Deutsche Bank said its “base case” for the U.S. economy now includes a recession by the end of next year in a note to clients on Wednesday, and Goldman Sachs said it sees a 38% chance of a U.S. recession through 2023.

By Will Daniel