In 2019, major US stock benchmarks reached all-time highs. Still, nothing about 2020 feels certain. The 2020 United States presidential election, a US-China trade deal, Brexit, and global concerns over everything from the climate to sustained growth still loom on the horizon.

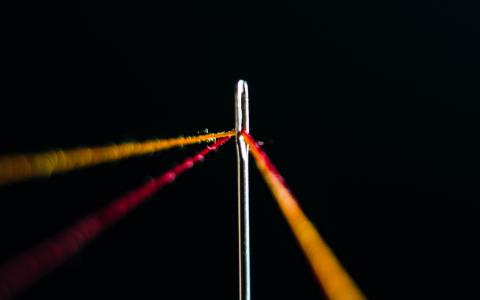

As State Street points out in their “2020 ETF Market Outlook: Threading the Needle” white paper, “in 2020 the margin for error — and opportunity — will likely be as small as it’s been in a very long time.” Thankfully, the State Street white paper provides a number of solutions for how to approach the coming year’s market.

As the white paper points out, the investment landscape is shifting from “tell me something good to show me something good.” Consumer strength is the primary reason that the US economy hasn’t succumbed to recession, but the consumer might be tiring.

While generally about two-thirds of the US economy is driven by personal consumption, the Bureau of Economic Analysis reported that third quarter US GDP growth was driven completely by personal consumption. And with falling corporate profits, additional tariffs scheduled for mid-December and Fed rate cuts likely on hold for a while, it may become difficult for the consumer to shoulder this larger burden.

That means the last bastion of American economic strength might be showing signs of fatigue, and investors will need to “thread the needle” when it comes to strategizing for 2020.

State Street’s “2020 ETF Market Outlook” white paper provides three themes that investors must keep in mind while looking at the market for the coming year and the decade that follows: Stay invested, but limit downside risks; actively balance risk in the hunt for yield; position to temper the impact of macro volatility.

Download State Street’s “2020 ETF Market Outlook: Threading the Needle” white paper

State Street provides individual white papers for each theme, and each dig down into strategies that will guide investors through the looming challenges.

In “Stay Invested, but Limit Downside Risks,” State Street advises investors to, “Target equities that may be impacted less by volatility. They point out that this is a different volatility regime for investors than the one they endured during the earlier stages of this still lumbering bull market.

State Street guides readers to balance downside and upside with diversified multifactor strategies, add capital discipline with dividend growth strategies, and to minimize risk with pure low-volatility strategies. They also provide guidance on their Business Cycle Approach and their Technical Volatility Approach.

Download State Street’s “Stay Invested, but Limit Downside Risks” white paper

In the “Actively Balance Risk in the Hunt for Yield” white paper, State Street consuls investors to seek a balance between income generation, credit risk, equity risk and macro volatility by employing active strategies. Suggesting, generating sufficient levels of income within bond portfolios should be more about balancing duration, credit and geopolitical risks and less about reaching for double-digit returns again.

Download State Street’s “Actively Balance Risk in the Hunt for Yield” white paper

In the “Position to Temper the Impact of Macro Volatility” white paper, State Street reminds investors that with stocks and bonds expensive, as well as susceptible to macro-induced volatility shocks, they should focus on strategies with low correlation to traditional markets.

The white paper digs into why with stock and bonds reaching all-time highs, Icarus level valuations may lead to a smaller safety net. It also provides suggestions for how to navigate macro risk and the alternative assets that may provide a cushion if markets turn south.

Download State Street’s “Position to Temper the Impact of Macro Volatility” white paper”

2020 is likely to be a year with little margin for error. Opportunities may be scarce and the markets may be even more volatile than they have been the last two years. With all the uncertainty looming, don’t stumble out of the gate. Read State Street’s “2020 ETF Market Outlook: Threading the Needle” White Paper.

Download State Street’s “2020 ETF Market Outlook: Threading the Needle” white paper