(Bloomberg) - A major buyer of securities issued by US banks to bolster capital is cutting exposure to regional issuers due to concerns about their ability to quickly recover from the current stress.

Cohen & Steers Inc. has sold regional banks’ so-called preferred shares in recent weeks, senior portfolio manager Elaine Zaharis-Nikas said in an interview with Bloomberg News. The collapse of Silicon Valley Bank in March and subsequent failures of other small lenders have exposed vulnerabilities that require a change in tack, she said.

“We have to take a step back and do a different type of analysis,” said Zaharis-Nikas, pointing to her firm’s expanded focus on metrics like liquidity, loans and assets. The firm has reduced exposure to preferred shares issued by US regional lenders as a result.

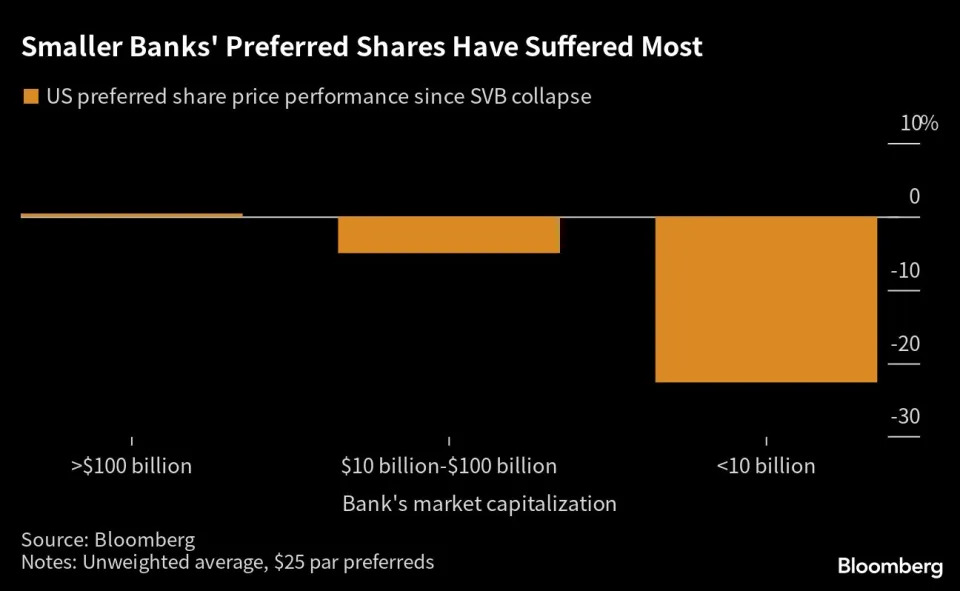

Since SVB’s demise, exchange-traded preferreds by banks with a market capitalization of under $10 billion have lost more than a fifth of their value on average, according to data compiled by Bloomberg.

By contrast, similar preferred shares by Wall Street heavyweights, including Bank of America Corp, Morgan Stanley and Goldman Sachs Group Inc, have gained about 0.5% over the same period.

Cohen & Steers is within the top 10 investors in exchange-traded preferred shares issued by US banks, based on Bloomberg-compiled data. These securities are issued by US lenders to fill regulatory requirements, in the same manner that European banks have been selling so-called additional tier 1 notes since the global financial crisis.

Investors were this week dealt another blow as JPMorgan Chase & Co. agreed to acquire First Republic Bank but not to assume ownership of either its preferred shares or its unsecured bonds. Trading in First Republic Bank preferreds, the price of which had already slumped more than 90% since early March, was suspended. The New York Stock Exchange announced on Tuesday that it will start delisting proceedings for eight First Republic securities.

First Republic’s Demise Fails to Mark the All-Clear on Banks

While the JPMorgan acquisition supports deposit stability, it “risks pushing up bank funding costs as creditor burden sharing becomes more common,” wrote Suvi Platerink Kosonen, a senior financials credit analyst at ING Bank NV, in a research note following the deal.

Prices of preferred shares by regional banks fell anew on Tuesday. A 7.75% perpetual issue by Pacwest Bancorp tumbled $4.74 to $10.8 as of 10:10 a.m. in New York, according to data compiled by Bloomberg. A Western Alliance Bancorp 4.25% issue was down $2.45 to $12.8.

Cohen & Steers is not in a hurry to build up exposure to US regional banks again, amid concerns that more distressed lenders could still emerge. “We want to see some more stability,” said Zaharis-Nikas. “We are waiting to see if the deposit flight has stabilized.”

(Updates with decision to suspend trading and start delisting proceedings in seventh paragraph, adds market moves in ninth paragraph)

By Tasos Vossos