(wealth consulting partners) -- A week ago today I touched down in San Francisco for one of the events I look forward to every year (14 years in a row to be exact!)...the annual ABA Wealth Management & Trust Conference.

It has been interesting to see how the conference has evolved over the years in keeping with the overall evolution in business strategy and competitive drivers for bank wealth management organizations. The conference title says it all, "Transforming Advice in a Digital Era."

While there is still a traditional fare of trust administration garnering CTFA credits and regulatory/compliance sessions on the menu, conference organizers have expanded the menu to reflect the growing importance of digitization and technology to both enhance client experiences and improve operational efficiency.

Kudos to ABA conference organizer Lauren Dwyer for pulling it together, advisory board chair Bill Martin, Chief Investment Officer of InTrust Bank…and the entire advisory board for putting together a very balanced, thoughtful agenda covering topics ranging from digital transformation to behavioral finance to practice management, fiduciary best practices and portfolio management.

If I were to weave together an overall narrative based on the sessions, and equally important, the hallway conversations, what comes to mind is that the banks and credit unions that are performing best are those that are leaning into change.

They're treating technology firms as strategic partners versus "vendors" and they're no longer walling off "innovation" and "digital" as silos but are instead incorporating them into the business itself and creating teams of technologists, product and marketing managers, data scientists and all-important subject matter experts to co-develop solutions with true utility and real-world application. They're also working hard to get closer to the customer than ever before and are obsessive about client segmentation, client journeys and client experience.

Successful firms are also very intentional...beginning with the end in mind -- a compelling target operating model that encompasses People, Process and Technology -- as opposed to falling victim to Shiny New Object Syndrome.

They're embracing agile, crawl-walk-run, test-and-learn approaches rather than building for waterfall-ready perfection (which by the time they launch is obsolete).

And, of course, they're using consulting firms like Wealth Consulting Partners to accelerate their efforts and deploy industry best practices :).

So diving in....the Exhibit Hall tends to act as the center of the universe at these events and I also have always found the types of firms sponsoring and exhibiting tells a story as well as the agenda and the attendees.

So it was encouraging to see more technology firms than ever before sponsor and exhibit at this year's conference.

From conference stalwarts like Fidelity, FIS, Envestnet, Fiserv, Fi-Tek, Infovisa, Innovest, Accutech and others to newer firms like DataRobot, Apex Clearing, Coconut Software, Jemstep and RobustWealth it was great to see firms covering front-, middle- and back-office capabilities and see bankers and #fintechs talking through problems and solutions.

Technology took center stage on the agenda as well with my first session of the conference being a pre-conference Focus Group addressing "5 AI Solutions Every Wealth Manager Needs" by DataRobot. H.P. Bunaesshared use cases including targeted marketing, relationship deepening, cash management and operational efficiency. Then with his opening remarks, conference chair, Bill Martin spoke about how critical it was for banks to leverage and integrate technology effectively and shared examples of how at InTrust they have built an integrated stack encompassing FIS, Salesforce, Smartleaf, Wealth Access and others. Other sessions included Digital Disruption in Wealth Management - What's Next, moderated by John Yackel, Executive Managing Director of Institutional Business Development for Envestnet Wealth Solutions with panelists Stuart DePina (newly appointed CEO of Envestnet Data & Analytics after long stint as President of Envestnet Tamarac), Drew Sievers, CEO of Trizic and Kevin Hughes, Chief Growth Officer of MoneyGuidePro.

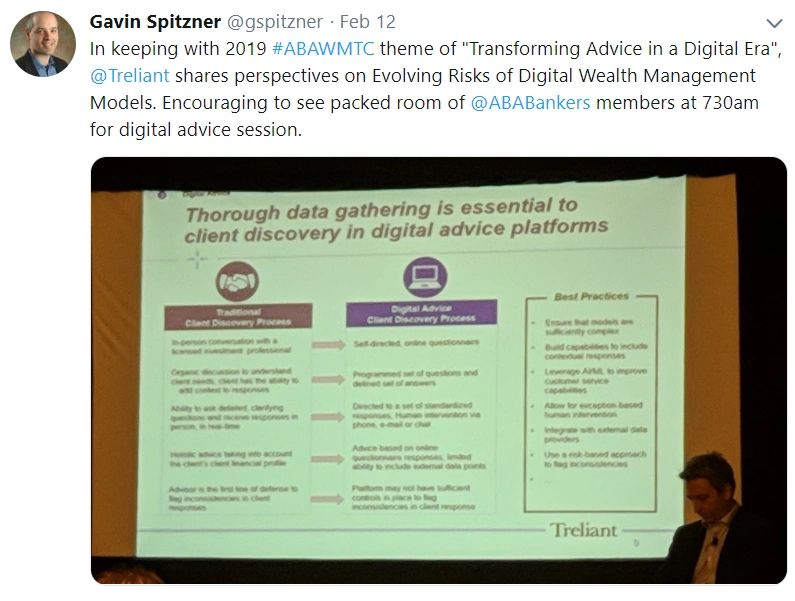

..as well as a fascinating Lunch and Learn session by Howard Tullman on broader technology innovation and adoption and implications for our business, a power breakfast session by Treliant on Evolving Risks of Digital Wealth Management Models ...

...and a thoughtful session entitled "Transformation of Advice and Work in a World of Thinking Machines" with Bill Martin interviewing Smartleaf co-founder Mark Nitzberg, now a leading figure in AI research at UC Berkeley about the impact AI will have on personalized advice delivery at scale.

At the same time, it was encouraging to see the agenda balanced with an equal focus on practice management-oriented sessions that spoke to the recognition that wealth management technology isn't a Field of Dreams scenario -- if you build it they will come -- whether that mean clients or adoption by your own people.

It's the "art" balance to the "science" of our business and there is an abundance of outstanding content available today to help support your firm's change management needs.

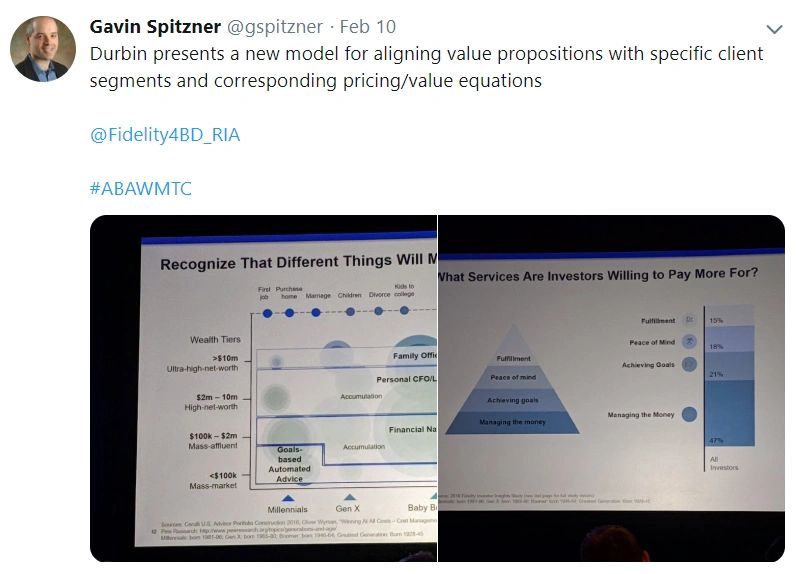

Mike Durbin, President of Fidelity Institutional provided our first keynote of the conference on The Future of Wealth Management presenting a data-based case for change and aligning our value stacks with investor segments to create new, sustainable economic models. Durbin also identified new growth engines across four vectors: Emotional Quotient, Intelligence Quotient, Sustainability Quotient and Digital Quotient.

Next up on main stage was the dynamic Ben Sorensen, of Optimum Associates speaking about Collaborative Leadership and Building and Leading Top-Performing Teams. Dr. Sorenson shared some very practical tips predicated on the notion that optimal team performance comes from trusted relationships, applicable both to our advisor/client relationships as well as internal associate-to-associate relationships and can be summed up in his formula T = E Squared: i.e., Trust = Expertise plus Empathy.

He shared that based on research 92% of initial assessments are based on empathy, not expertise (hence the need in the industry to radically sharpen our client-facing advisors EQ capabilities).

Dr. Sorensen shared some practical tips for building trust within our teams including giving and receiving effective feedback, chiefly, creating a feedback-rich environment where feedback is part of the culture (good and bad). During a table exercise, my group talked about why it's important to ingrain this so that we don't fall into the trap of not providing helpful feedback when the outcome of say, a client meeting, is positive.

Those are missed opportunities to improve and if we only are critical when there are bad outcomes, people are much more likely to be defensive.

An absolute standout session for me was a session ostensibly focused on "Premium Fees for Premium Service: Strategies for Defending Against Fee Compression" but with leaders with as much insight and experience as Thomas Carroll and Sam Guerrieri, heads of Wealth Management for SunTrust and Canandaigua National Bank, respectively and moderated by David Lincoln of WISE Gateway with his years of experience conducting research in the space, we were treated to a far-ranging discussion that addressed the value side of the equation as much as pricing practices.

A few highlights from the session:

- Firms are generally only seeing material fee pressure on the lower end of the spectrum. Higher net worth individuals with more complex needs recognize the higher value services and advice beyond pure investment management and are willing to pay for value. Thomas shared that at SunTrust, 84% of clients are now on their standard fee schedule, which given how high that is compared to industry norms, led to a round of applause from his peers.

- Both Thomas and Sam spoke about the breadth of wealth management and private banking services they provide HNW clients of which investment management -- where there is industry-wide fee compression -- is just one service.

- When clients do leave, it's never about fees...it's service.

- Both firms spoke about how much emphasis they put on ensuring team buy-in to the value proposition ("pricing with pride") so that they don't go down the path of least resistance and discount fees.

- They also both spoke to something we're seeing in the RIA space in particular, unbundling of fees to better align value to fees (as opposed to a blanket AUM-based fee). Examples include family governance, next gen education, financial planning, etc.

- Both firms also shared how much focus they're putting on the challenge all firms are facing in retaining the next generation during wealth transfer events. Examples of approaches being deployed include pairing a junior advisor with a senior advisor with the senior maintaining the 1st gen relationship and the junior working with G2, G3.

The last session I'll touch on was our final keynote, with Dr. Daniel Crosby, Chief Behavioral Officer of Brinker Capital, presenting findings from book, "The Behavioral Investor".

Given the ultimate measure of our success in the wealth management business is whether our clients actually follow through on our advice and achieve specific outcomes, it is critical that we understand inherent decision-making flaws and understand what clients want from us (and here Dr. Crosby made a powerful case that while technology and AI can help us scale customized advice, technology is not going to replace the need for human advice where so many things investors desire can't be scaled. Check out the Crosby's book if you want more info....https://www.amazon.com/Behavioral-Investor-Daniel-Crosby/dp/0857196863

There you have it, my highly subjective (I can only attend so many sessions since I haven't been able to clone myself yet and there are all those concurrent sessions) takeaways from the 2019 ABA WM&T Conference. Highly subjective too because I tend to focus on areas that align to my consulting practice -- fintech, client experience, business strategy, practice management-oriented themes -- so apologies to all the other great speakers and sessions I wasn't able to cover.

I look forward to seeing you all next year as ABA WM&T returns to Orlando, February 23-25, 2020.