After one of the strangest years ever, ETF debuts are once again ramping up to capture cash flooding the industry.

About 100 new ETFs have debuted so far in 2021, the best start to a year in at least a decade, according to data compiled by Bloomberg. That compares to 54 by this time in 2020 and 45 in 2019.

As stocks continue to break records and the economic recovery in the U.S. heats up, investors are pouring money into ETFs -- which is enticing issuers in the $6 trillion industry to release new strategies that can gobble up the cash.

Entering the Fray

Issuers have released more than 100 ETFs so far this year

Source: Bloomberg

“ETFs continue to attract more assets with big inflows this year, and big inflows attract reasons to list more ETFs,” said Christian Fromhertz, chief executive officer of Tribeca Trade Group.

In the first quarter alone, U.S. listed ETFs attracted more than $243 billion total, the biggest haul on record. More than $200 billion poured into equity funds alone.

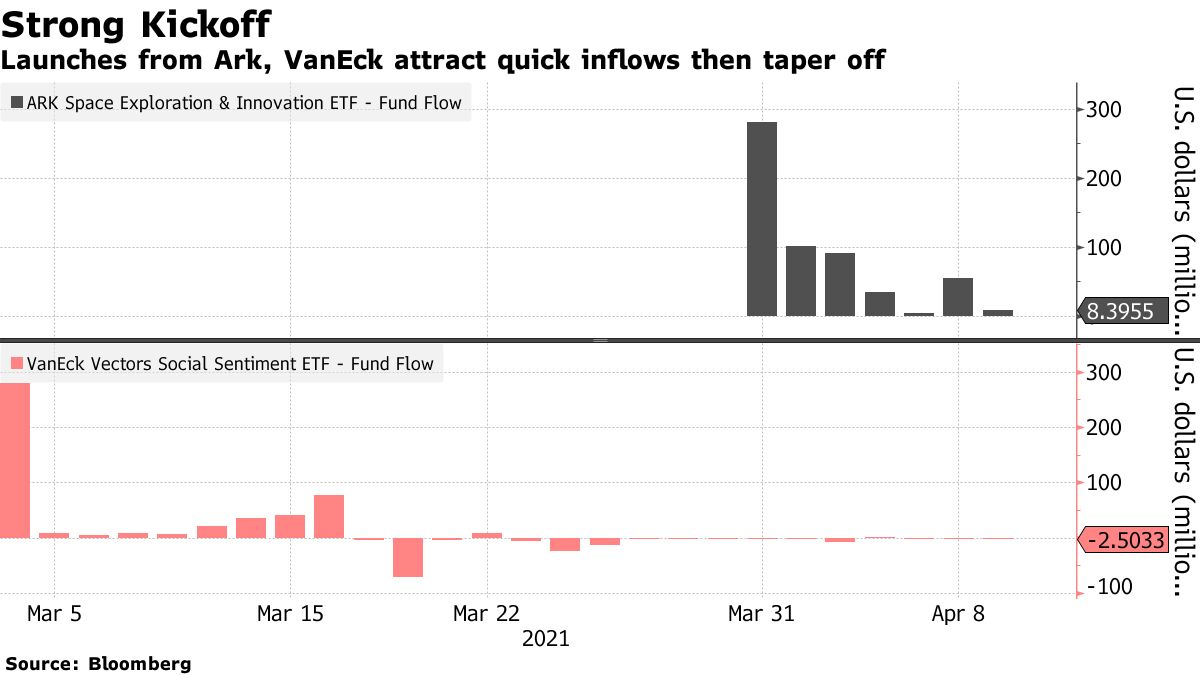

Products released in 2021 include the VanEck Social Sentiment ETF (BUZZ) -- whose promotion from Barstool Sports Inc. founder Dave Portnoy has helped it gain $355 million -- as well as Cathie Wood’s new ARK Space Exploration ETF (ARKX), which has $649 million in assets so far.

BlackRock recently scored the biggest-ever launch for an ETF with its U.S. Carbon Transition Readiness ETF (LCTU), although large institutional investors were likely lined up by the money manager before its release.

“The uptick in launches can also be explained in part by the emergence of two new categories of ETFs -- structured outcome funds and active non-transparent ETFs,” said Ben Johnson, Morningstar Inc.’s global director of ETF research.

Those two groups combined have accounted for roughly 30% of all new ETFs launched in 2021, according to Morningstar data. Under the active non-transparent category, both Fidelity Investments and Gabelli Funds brought new products to market.

Meanwhile, Innovator Capital Management and First Trust Advisors released structured outcome funds, which offer a reduced downside in exchange for limited upside.

Issuers are also rolling out loads of thematic funds, often favored by retail investors for their common-sense approach to betting on hot market niches. That includes the Defiance Next Gen H2 ETF (HDRO) tracking companies involved in developing hydrogen-based energy sources and the MVP ETF from Roundhill Investments based around professional sports.

“Trading by individual investors has played a big role in this increase,” said Matt Maley, chief market strategist for Miller Tabak + Co. “In other words, Wall Street is providing some supply for the demand for these products.”

This article originally appeared on Bloomberg.