(ISS) Over 95% of advisors report using fintech for trading and clearing, portfolio rebalancing, and investment analytics, according to a recent survey of 814 advisors conducted by ISS MI Market Metrics in May 2023. The research, part of its ongoing Selling Retail Investment Products through Intermediaries series, revealed a high level of interest in the use of financial technology provided by asset managers, home offices, and third-party fintech sources, but how much advisors rely on third-party fintech sources was heavily dependent on the task at hand.

Trading and clearing were decidedly the most popular uses of fintech amongst advisors, as only 3.8% reported not using technology for these purposes. Despite that heavy usage, there was little room for third-party fintech providers to offer their services: over three quarters of advisors reported using software provided by a home office for trading and clearing.

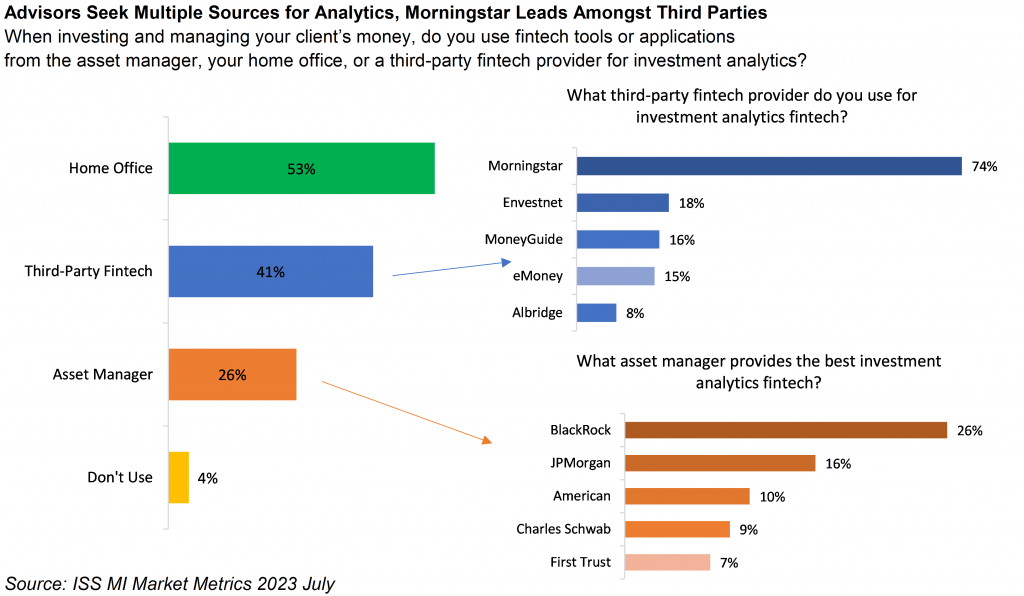

In contrast, investment analytics proved a more competitive ground for managers and third-party firms alike, with 26% of advisors reporting to use asset manager software and 41% reporting to use third-party software for this purpose. Among asset managers, BlackRock served as the most popular provider of investment analytics, capturing 26% of the asset manager market share, nearly 10 points ahead of the second-place manager, JPMorgan. Of the 41% of advisors that use third-party providers for investment analytics, advisors reported a rather lopsided answer, with 74% mentioning Morningstar, over four times more frequently than the next most cited firm, Envestnet (18%). While the third-party market specifically is concentrated, it remains only a fraction of the total market. Over two-thirds of advisors reported not using Morningstar’s analytics at all.

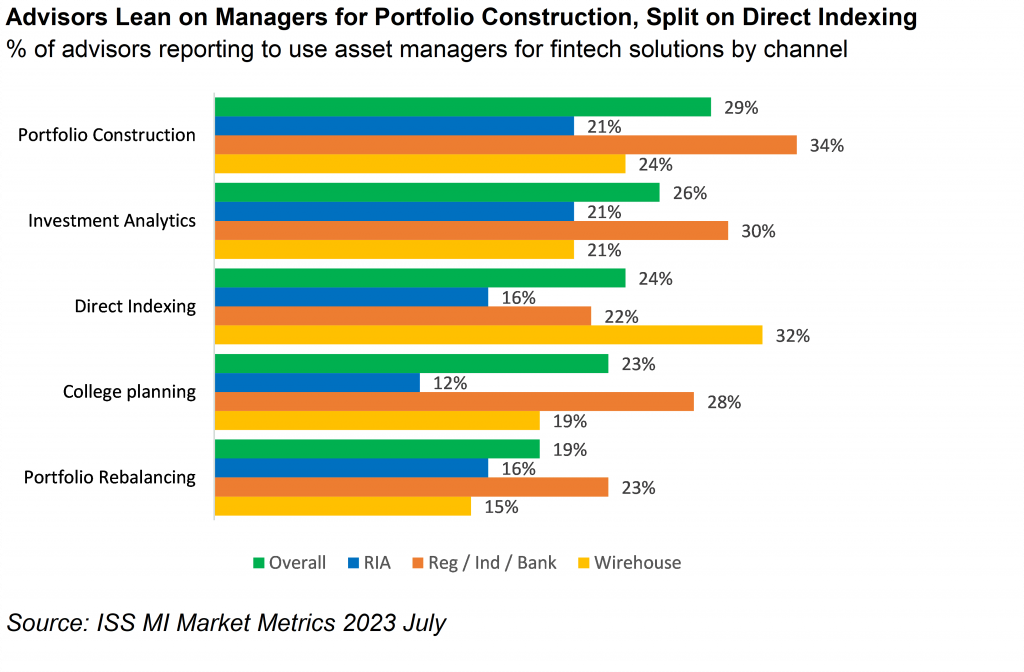

Portfolio construction and direct indexing were other fields in which asset managers saw high uptake of their software, as 29% of advisors reported relying on them for the former task and 24% for the latter. Vanguard proved to be the most popular manager when it came to direct indexing, with one in five advisors reporting their platform as the best, though other managers found success within specific channels. Wirehouse advisors—the most enthusiastic adopters of direct indexing relative to other distribution channels—reported Morgan Stanley as their preferred platform. Among respondents in the RIA channel, which reported the lowest use of direct indexing solutions, Schwab tied with Vanguard; 21% of surveyed RIAs identifying them as their preferred managers for direct indexing. Blackrock, which offers portfolio construction services through its Aladdin software suite, was reported as the most popular manager by all three channel segments for the task, with 1 in 4 advisors reporting them as their preferred provider of portfolio construction software.

When crafting fintech solutions in these markets, it will be important for both asset managers and third-party providers to keep in mind advisors’ preferences and concerns. Ease of use was top of mind for the vast majority of advisors surveyed, with 80% reporting it as a top three factor in selecting fintech tools. Best-in-class features and level of integration rated similarly, with 43% and 44% of advisors rating them key factors. Perhaps most important to note was the relative unimportance of peer recommendations as well as existing reputation and longevity in advisors’ decision-making. With only 5% of advisors considering market longevity and 2% considering peer recommendations as their number one factor, newcomers to the fintech market can rest assured that managers will seek out the highest quality product, not the most entrenched.