(Amplify) Put yourself in the shoes of a new client at your firm: You’ve just signed the forms and it’s all starting to feel very real. Now, your advisor is requesting that you compile a lot of financial information, asking in-depth questions about your risk and time horizons, and is talking about next steps to transfer your funds. Oh, and it’s also time to tell near-strangers all your money-related hopes and dreams, your family “secrets,” and your vision for the future. It can be overwhelming on a good day.

The wealth management onboarding process might be repetitive to the financial advisor and support team, but for new clients, it’s the first inside look at how you run your enterprise. With digital account opening, you have a chance to simplify the process and make onboarding as stress-free as possible.

In today’s blog, we’re taking a look at why your firm needs to digitize the new client onboarding process, as well as four key benefits of Amplify’s modern, streamlined system.

The Need for Digital Account Opening

There are two main reasons why your firm needs digital account opening: client onboarding and operational efficiency.

Client Onboarding

One recent report showed that 74% of potential customers will seek out another service provider if the onboarding process is too complicated – that’s nearly three out of four!

Each client touchpoint (and especially these initial ones) offers a chance to showcase your firm’s culture and values. The more personalized and efficient the onboarding, the more likely you are to make a solid initial impression. And in today’s world, clients expect a seamless setup. With digital onboarding capabilities, you can deliver an experience that’s as tailored as their streaming entertainment queue.

Operational Benefits

Did you know that paper processes account for 60% of NIGOs? Just by switching to a digital account opening process, you can reduce the possibility of both manual errors and NIGOs.

Plus, if your team has more than one custodian, a digital multi-custodial account opening solution allows you to follow a single process instead of one for each custodian. That streamlines training, reduces errors and increases your firm’s overall efficiency.

Amplify’s Digital Account Process: 4 Key Benefits

1. One package for clients

One of the biggest value-adds of Amplify’s digital account process is that you can create a single document package for your clients containing both firm and custodian forms, simplifying the process for them.

Many firms using traditional onboarding methods end up sending multiple emails with multiple documents, which can be confusing for the client, dragging out the signing process and leading to missed signatures. Amplify rolls all those documents into a single bundle with one signature for a smoother and more efficient result.

2. Real-time tracking

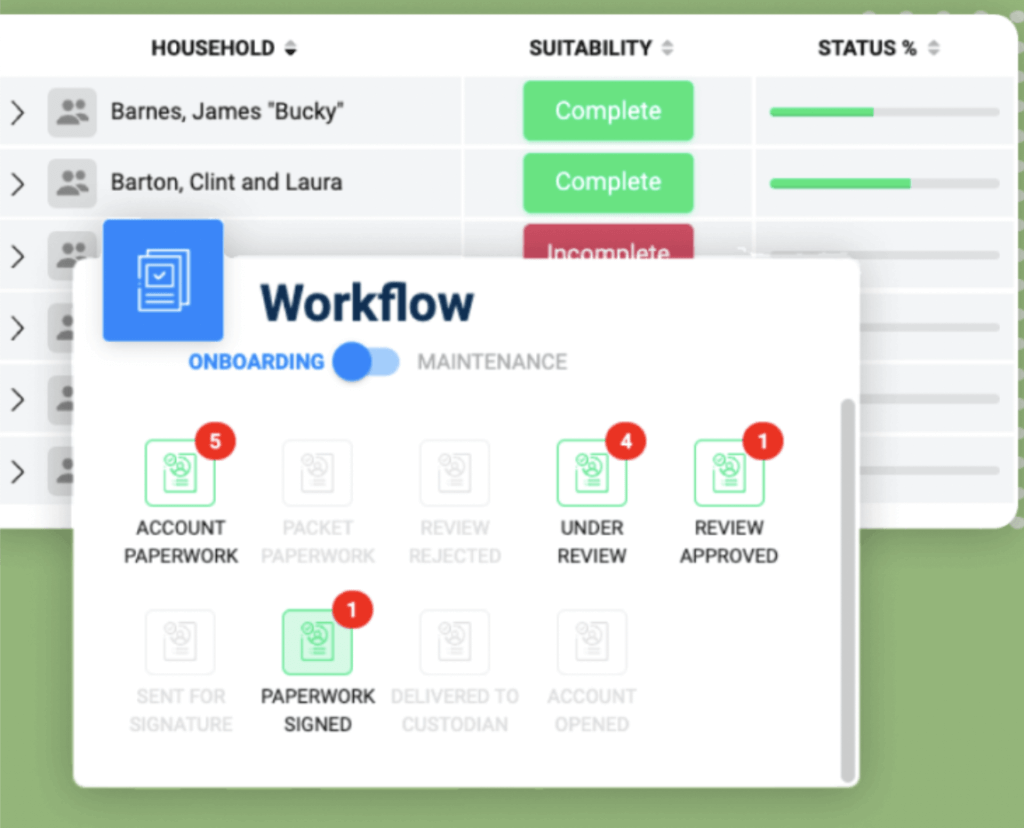

Financial advisors can keep track of the new client onboarding process through Amplify’s real-time tracking system.

With the Workflow dashboard, you can understand where accounts are in the onboarding process at a glance. A click reveals details at the account level within a household to provide true visibility.

3. Visibility and reporting across the enterprise

Those same visibility funnels we mentioned above are presented across the entire Amplify system, allowing you to easily view:

- Book-of-business, household and account level detail

- Key stats, asset allocation, custodial breakdown and more

- Risk management insights and exposure across the entire firm

- Executive-level reporting

- Our system accounts for multi-advisor teams and even enterprises with thousands of financial advisors. However your firm is configured, Amplify can match your needs.

4. Scalable processes

As your firm gains new clients and advisors, your team becomes more complex. Amplify addresses that growth with an approach based in simplicity. We know that digital scalability is crucial to the continued success of wealth management firms – and the more user-friendly your tech, the better equipped you are to meet client needs.

With our cloud-based technology, we provide a platform for wealth management firms to modernize and adapt to changing client expectations. Amplify prioritizes ease of use, anywhere access and reliability, so you can celebrate your new clients without the headache of manual processes. This creates space for operating efficiency that can lead to true scale and multiple expansion as you grow your enterprise.

Want to learn more about how you can increase efficiency and client satisfaction? Schedule a demo of Amplify to upgrade your digital processes today.