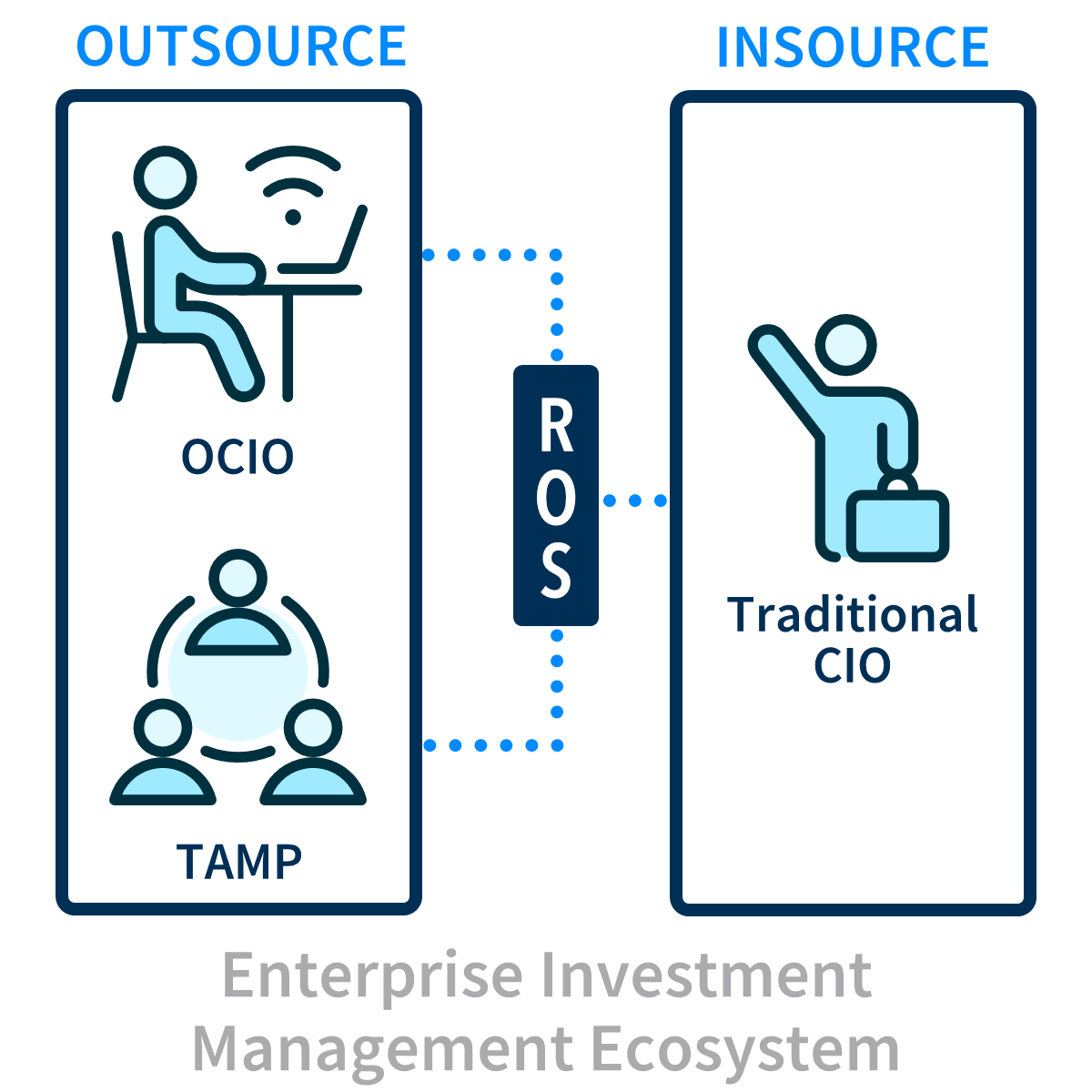

(Amplify) In the evolving world of wealth management, channels for effective, professional investment management are in flux. Many RIA firms are outsourcing the investment management function to third-party asset managers or strategists, while others prefer hiring a full-time or “de facto” Chief Investment Officer (CIO) to manage investments in-house.

Outsourcing the CIO role offers cost savings, access to a wider range of investment strategies, and the ability to scale operations effectively. On the other hand, hiring an in-house CIO allows for continuity, personalized attention to clients, and alignment with the firm's culture and objectives. Making the right choice for your firm generally means weighing cost-effectiveness against quality control. An RIA Operating System (ROS) can help you make informed decisions by providing a global perspective and raw data on both approaches.

More companies are turning to third-party providers like Turnkey Asset Management Platforms (TAMPs) or Outsourced Chief Investment Officer (OCIO) consultants to outsource their investment management function. While this move enhances efficiency and specialization, it's important to be aware of potential challenges. Depending solely on a turnkey solution can leave a firm vulnerable if the partnership ends, and you may be caught short lacking an internal process or framework to pivot. TAMPs offer cost-effective solutions when compared with developing in-house infrastructure, but it's essential to assess their ability to tailor services to your firm's unique needs and avoid fragmentation.

More companies are turning to third-party providers like Turnkey Asset Management Platforms (TAMPs) or Outsourced Chief Investment Officer (OCIO) consultants to outsource their investment management function. While this move enhances efficiency and specialization, it's important to be aware of potential challenges. Depending solely on a turnkey solution can leave a firm vulnerable if the partnership ends, and you may be caught short lacking an internal process or framework to pivot. TAMPs offer cost-effective solutions when compared with developing in-house infrastructure, but it's essential to assess their ability to tailor services to your firm's unique needs and avoid fragmentation.

In-house management through a CIO provides control over the investment process, allowing firms to align strategies with goals, risk metrics, and client preferences. This control enables more timely decision-making and adaptation to market changes. It also contributes to topline revenue by capturing a higher percentage of the investment management fee. However, managing investments in-house brings challenges, including operational complexity, and higher costs. Building and maintaining infrastructure and hiring qualified professionals requires ongoing investment and a strong brand to retain top talent.

The decision to outsource or hire a CIO doesn't have to be singular in nature. Taking a modular approach, firms can adapt the Insource:Outsource ratio over time. This approach is valuable for firms looking to recruit diverse advisors, formalize their investment philosophy, or consolidate acquired practices. To support this approach, an RIA Operating System (ROS) is crucial. Without a capable ROS, firms struggle with fragmented systems or costly proprietary tech development. A fintech platform that enhances the current value chain and offers flexible expansion capabilities is key to the growth of the maturing RIA space.

When deciding whether to outsource or hire a CIO, consider the specific needs of your firm, particularly weighing cost-effectiveness vs. quality control. Both approaches have benefits and challenges. An RIA Operating System (ROS) can provide valuable insights to aid the decision-making process in a linear fashion over time. By taking a modular approach and leveraging technology, wealth management firms can navigate the investment management landscape more effectively and position themselves for future success in the evolving industry. Ideally, optimization of the portfolio management process—coupled with other scalar efficiencies, of course—should translate into both current ROI and an increased multiple for your brand at the time of sale.