Single dad travels all the time and has big assets to pass on and bigger virtue to signal. Sensitivity is everything.

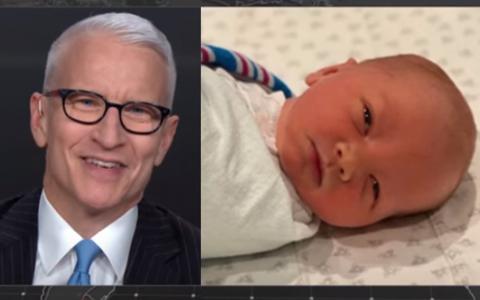

Anderson Cooper’s newborn son Wyatt started life with every material advantage and a lot of big questions. Call it the Vanderbilt Curse.

Sure, Cooper is worth an estimated $100 million and can afford the best care, education and parental support as long as he’s around.

However, he’s also a single dad with no steady boyfriend in the picture despite rumors that contracting a surrogate reunited him with longtime partner Ben Maisani.

And he travels all the time on various CNN passion projects. That’s one of the things that drove a wedge between him and Maisani in the first place.

Right now COVID quarantine keeps dad at home but unless fatherhood dramatically shifts his career priorities, the flights will start up again in a few months.

With no stay-at-home parent, Wyatt is either going to have to become a frequent flyer himself or live with a team of nannies.

Poor little rich boy

That scenario sounds familiar to people who remember how Cooper’s mother Gloria Vanderbilt grew up and the helicopter style around the way she raised her sons.

Gloria’s early drama revolved around who would get custody of her and her trust fund, which at the time was worth a little less than what Cooper has amassed for posterity today.

Her father was dead. Her mother was controversial. Relatives bickered over how Gloria would be raised and how her money would be spent.

Anderson Cooper will be 53 next month. While life expectancies vary, there’s a statistically significant chance he’ll be dead before Wyatt graduates from high school.

In two-parent situations, the surviving partner can pick up as legal guardian. Otherwise, relatives or family friends can be assigned in case something goes wrong.

Cooper is estranged from his half-brothers and they’re much older anyway. Even if they shared a continuing bond, they’ll probably predecease him.

These decisions have financial repercussions. If Cooper dies before Wyatt reaches legal adulthood, he’d need to pass on any inheritance through a trust.

Control over the trust was the center of the fight over Gloria. If Cooper learned anything from those stories, he’ll lock everything down immediately, just in case.

Trustees and alternatives should be named. Procedures for resolving disputes should be spelled out, with no loopholes or wiggle room.

Gloria Vanderbilt’s grandson will need the strongest inheritance plan $100 million can buy. And odds are good Cooper is starting from scratch anyway.

Behavioral economics

When Cooper had a steady boyfriend, they might have written each other into their separate wills. However, that relationship ended two years ago and despite rumors nobody is admitting that it has started again.

Smart lawyers would have written new wills after the breakup along with a separation of any shared property.

While Cooper and Maisani picked out a few houses together, ownership records are vague. From the way Cooper titled his New York home, I suspect that the Connecticut retreat, for example, is owned by an LLC and not a trust.

That’s a good thing. If Maisani owned a piece of the LLC, it would have been relatively easy to buy him out and consolidate the legal questions around the property.

However, Cooper has lived alone since the split. Until now, it was unclear who he would have named as his heirs.

Now Wyatt is in the picture and he’s the obvious choice. The paperwork needs to be revised again. Big decisions need to be made.

The entire family has always been skittish about trust funds and dynastic wealth transfer in general. Cooper might decide to leave his estate to his favorite causes and force Wyatt to make his own way in life.

With a younger dad, that would be a straightforward approach. Here, though, the issue of life expectancy requires a little more nuance.

The estate plan needs a mechanism to care for Wyatt if Cooper dies early. Guardianship and financial support have to be spelled out.

If Cooper lives to see Wyatt’s adulthood, it isn’t an issue. At that point, the guardianship and associated trusts no longer apply.

Right now the houses are formally run by Cooper’s business manager. That’s not really how this usually works when children are involved.

Moral clauses for a #metoo world

All of this points to something relatively unusual in households with this much wealth: a blank estate planning slate.

Cooper never really had to plan for future generations, and any planning he did is irrelevant now.

That’s an opportunity for him and the lawyers to set the terms of how his baby boy will be raised in his absence.

Standards of living can be set for guardians and trustees to obey. Household budgets can be left loose or specified down to the expense category.

And incentives and discipline can be put in place as well to ensure that Wyatt lives up to Cooper’s expectations.

It’s not hard to imagine a scenario in which the trust mandates a carbon-neutral, gender-sensitive, politically progressive upbringing if Cooper isn’t around to make sure it happens.

Trust creators have a lot of leeway to set the terms the heirs need to live by if they want the money. No compliance means no distribution.

This can follow Wyatt into adulthood as well. Educational standards can be set. He'll be free to flout the family rules but it will cost him.

While the way he votes can't be mandated and his constitutional rights will still apply, money can be a powerful motivator to behave the way Cooper wants.

Of course Cooper might simply think his son will conform to his behavioral standard because his moral authority is just too overwhelming to argue against.

All parents know that's a dangerous bet. He'll learn. And if he isn't willing to let history take its course, it's time to make the family money do the talking.