(Forbes) Annuities versus bonds: Which is the better tool? To understand this question and to really get an appropriate answer, we have to recognize where the market is in relation to how each of these types of tools work. There is no one-size-fits-all approach; it is important to work with a qualified licensed professional to determine what best fits your goals and objectives.

Typically, when interest rates go down, bond values go up; conversely, when interest rates are going up, bond values go down.

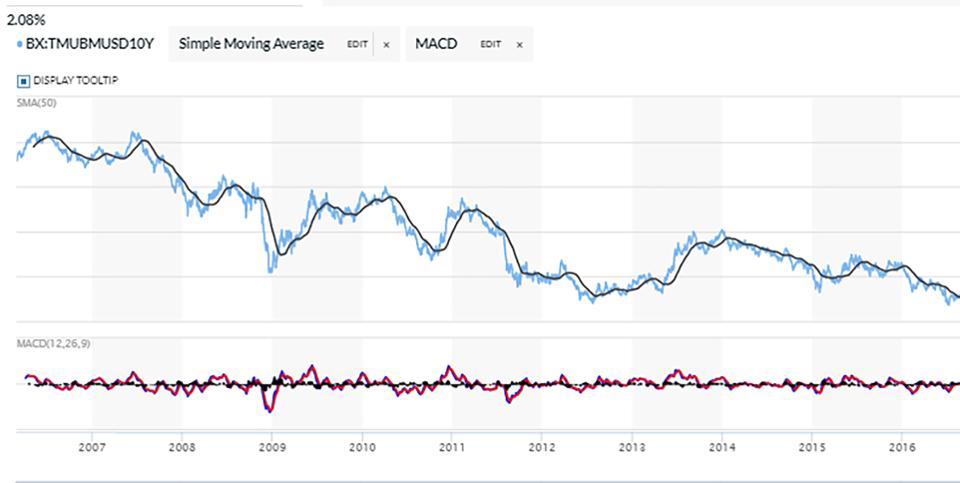

In May 1990, the 10-year Treasury rate peaked at 9.09% and has been on an overall downward trend ever since.1 It hit its lowest point of 1.37% on July 8, 2016, at which time it began a recovery of sorts.2 As of this writing, the 10-year Treasury is hovering around the 2.09% level.3 Since 2016, rates have recovered slightly, and as of March, they have settled into a 2.5% 10-year note.3

Having said this, bonds have had a tremendous run over the last 28 years. Investing in these instruments has returned not only valuable income during this time but also capital appreciation.4Roger Ibbotson’s report in “2017 SBBI Yearbook”discusses long-term gains between large cap stocks and long-term bonds. In his report, he notes that over a 90-year period, large cap stocks have produced 10.02% per year on average, while long-term bonds produced 5.51% during the same period. However, over a 10-year period that started in 2006 and lasted through 2016, the ROR was virtually the same at 6.95% for stocks and 6.48% for the same long-term bonds (2017 SBBI Yearbook). Quite impressive for a conservative investment. But again, understanding their relationship with interest rates helps to explain this phenomenon. A lot of the bonds’ growth during this time was due to capital appreciation with the declining interest rates. Like the illustration shows below, it is good to understand the relationship that bonds have with interest rates.

During the time noted, I believe it has been a good place to invest. As interest rates have fallen, principal values get a boost. MarketWatch.com shows that over a 10-year period from 2006 through 2016, the trend was definitely down.

However, since the end of 2016, interest rates have moved up considerably, only to start trailing off again at the end of 2018 and continuing through the present. Currently, the 10-year Treasury is just above 2%.5

Another consideration is that inflation typically follows interest rates. It is certainly possible that inflation could be a factor in your future. If interest rates surge ahead in the next few years, it will be important to maintain a steady growth rate to maintain purchasing power. This could put bonds at a disadvantage for the next several years as interest rates increase to a more normal rate.

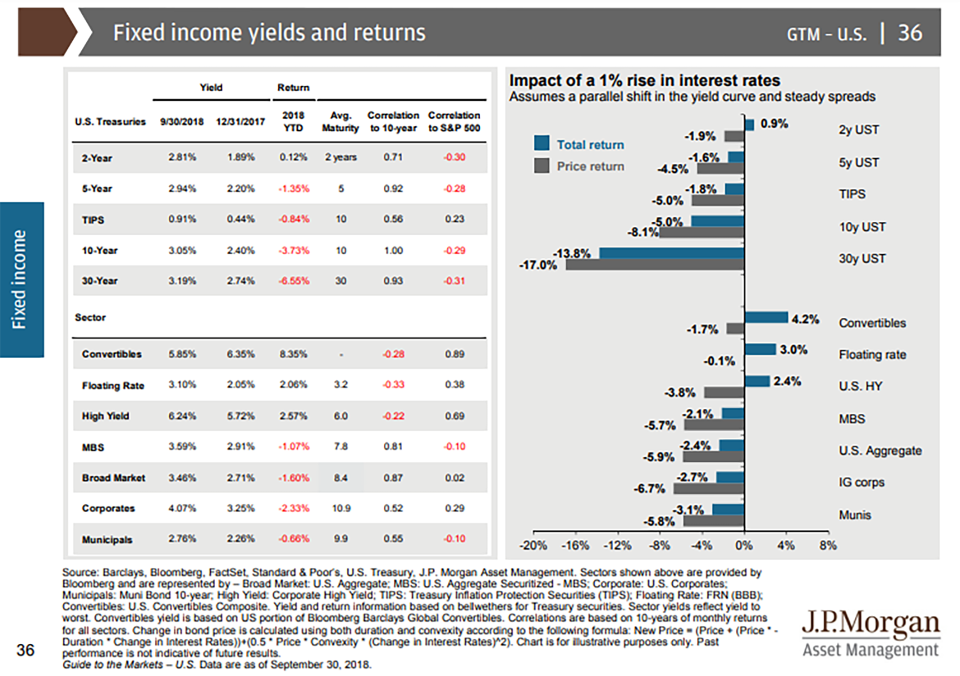

You may be thinking, “How much can interest rate increases affect my bond holdings?” This is a very good question. JP Morgan issued a study in 2018 in its “Guide to the Markets” that says the duration (or the length of time the bond holds your money) is a key part of how interest rates affect your principal value.6

For example: Their chart assumes an increase of just 1% in interest could potentially cause a 2-year Treasury to drop by just -1.9%. However, your 30-year Treasury could potentially decrease in value by -17%! This means your bond portfolios could have issues when interest rates start to move upward. Yes, I know if you keep your bond to maturity, you will get your principal back. But what happens if you cannot keep it to maturity? What happens if you walk out on life before this bond matures? The value of your bond could be cashed in at a much lower amount.

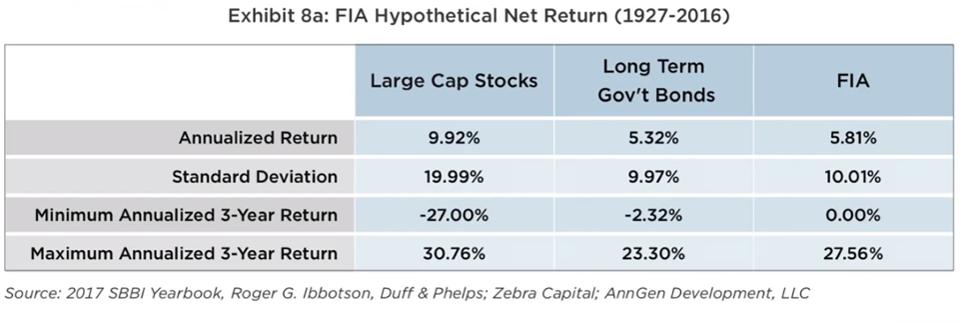

From January 1994 through December 1998, small-cap stocks underperformed large-cap stocks by a total of 30%.7 Roger Ibbotson added a category in his book “2017 SBBI Yearbook” for Fixed Index Annuities, or FIAs. FIAs have become more popular since the Great Recession of 2008. These insurance-based products have become an alternative for those seeking added safety in their income-producing assets. Ibbotson’s research shows that, on average, they’ve produced nearly the same return as their more aggressive counterpart large cap stocks without downside market risk! The way these products are designed allows the annuitant to experience some of the upside of the market-linked index, without the downside market risk.

This becomes increasingly important to individuals who are approaching retirement. Since the Great Recession of 2008, we’ve enjoyed a tremendous rally in the S&P 500 Index, up nearly 260%.8

However, if you suffer a substantial loss right before you retire, or you use an asset class that has typically been considered “safe” but that may now be out of favor, it could cause potential issues.

This is where one of these annuities can make a BIG difference to those who use this product correctly. Had you used an FIA prior to the 2008 downturn, the worst-case scenario would be a year or two with no gains, but there would have also been no losses due to the market.

Having said all of this, it does not mean you should immediately purchase one of these vehicles. It does mean you should at least review the benefits with a licensed professional to see how these products could help offset some of the risk of your portfolio.

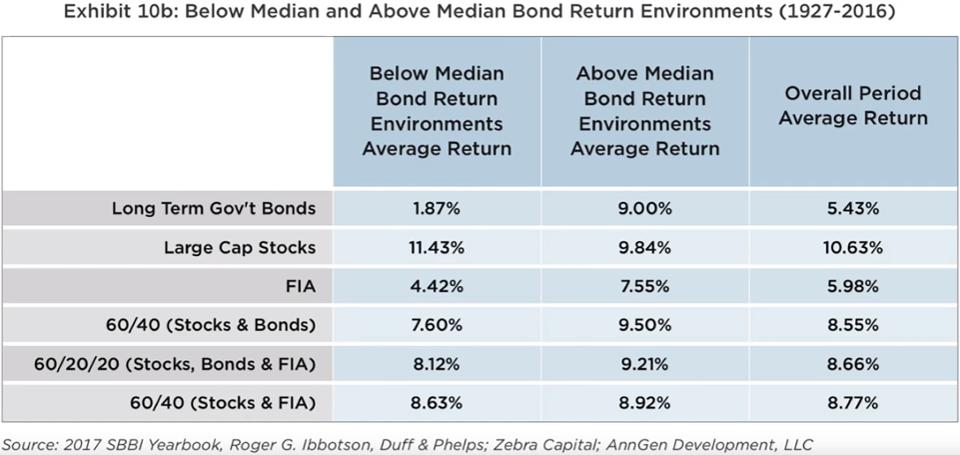

Another area Ibbotson talks about in his book is where he thinks these asset classes are going in the coming years.

The chart above shows different asset classes and how these holdings performed during the time period. With interest rates starting to rise, it makes it more difficult to make money in the traditional bond market. In fact, by adding the FIA to the mix as an additional fixed asset or in place of the bond segment as an alternative, it can allow for indexed interest without the downside risk of the market.

My conclusion is to be open-minded. When it comes to retirement planning, we only get one shot! Don’t blindly accept or reject the opinion of others who may have a different agenda than you do. Trust but verify, and always look at the facts — even my research could have flaws! When you accept only one opinion or when you choose to dislike something because of a name or a negative article online, it could be to your own detriment.