Some insurers are getting out of what was once a robust market for variable annuities with optional living benefits riders as interest rates plummet.

Years of low interest rates have been a challenge for U.S. life insurers, but the additional rate drops during the COVID-19 pandemic made it even more difficult for companies to price guaranteed products. During the worst of the pandemic-related disruption, the 10-year Treasury benchmark fell to 0.52%. Yields have since rebounded from those levels but remain quite low.

Prudential Financial Inc., once an industry leader in variable annuities with optional living benefits riders, announced in November 2020 that it would no longer offer the product.

During a Goldman Sachs virtual conference in December 2020, Prudential CEO Charles Lowrey said interest rates were "lower than any of us ever contemplated." Rates under 1% were too low for new business into the company's current crop of living benefit riders, he explained.

"At some point, the product just doesn't work," Lowrey said.

Aegon NV's U.S.-based Transamerica signaled in December 2020 that it also plans to move away from its variable annuity products with living benefit and death benefit riders, as well as long-term care and fixed annuity products.

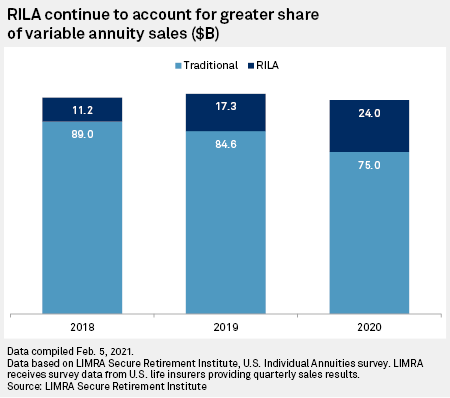

Both insurers said they are not completely exiting the variable annuity business, but are shifting toward accumulation or investment-only products. The industry saw a move toward accumulation-only products in 2020, with products like registered index-linked annuities, or RILA, doing particularly well.

RILAs, sometimes called buffered variable annuities, are hybrids of fixed-indexed and variable annuities. The product is similar to fixed-index annuities in that they provide market-loss protection, although clients may still experience some losses. While both contracts cap or limit market performance, RILAs generally provide higher upside potential.

In 2020, RILAs sales grew to $24 billion or roughly 25% of variable annuity sales, according to LIMRA Secure Retirement Institute survey results. Traditional variable annuity sales fell to $75.0 billion from $84.6 billion in 2019.

Variable annuity block transactions

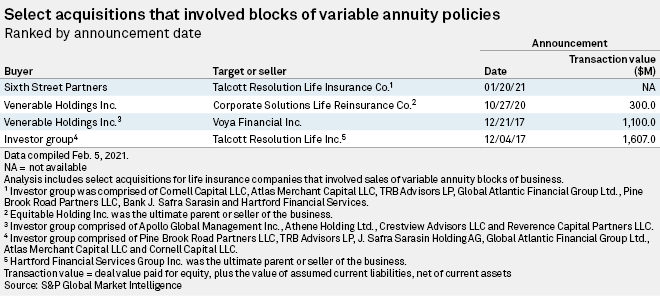

There has been some activity in the variable annuity space over the past several years, as insurers moved to dump old blocks of business.

In 2018, Hartford Financial Services Group, Inc. completed a deal to sell its runoff life and annuity business, Talcott Resolution Life Insurance, to a group of investors in a deal that had a calculated transaction value of roughly $1.6 billion. The investor group subsequently sold that business to Sixth Street Partners in early 2021 for approximately $2 billion, according to The Wall Street Journal.

Venerable Holdings Inc announced in October 2020 that it would acquire Equitable Holdings Inc.'s Corporate Solutions Life Reinsurance Co., which has been in runoff since 2002. Corporate Solutions closed all reinsurance treaties to new business in 2004, but maintains reinsurance agreements for third-party variable annuities with guaranteed minimum death benefit and guaranteed minimum income benefit riders.

Also, Venerable agreed to reinsure approximately $12 billion of variable annuities sold by Equitable between 2006 and 2008. That block of annuities contained policies that included guaranteed death and income riders with a 6% to 6.5% guaranteed growth on the benefit base.

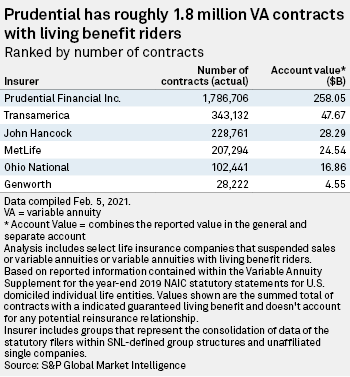

Prudential and Transamerica have stated they will explore opportunities to potentially off-load the business. According to year-end 2019 regulatory filings, Prudential had roughly 1.8 million variable annuity contracts with some sort of living benefit rider attached. These numbers do not factor in any contracts that may be under reinsurance agreement. Transamerica had a little more than 343,000 variable annuity contracts, the filings showed.