(CoinDesk) - Are Cryptocurrencies an Inflation Hedge? Theoretically Yes, Factually No Says S&P

Some argue that crypto assets could be in demand in a high-interest rates/high inflation environment because they could serve as a store of value, however crypto's track record is too short to prove this, S&P said.

Ratings agency S&P Global on Tuesday took note of cryptocurrencies' appeal as assets that protect investors from the effects of inflation, while also stressing the lack of data to support the popular narrative.

"Crypto assets could theoretically be a hedge against inflation," the New York-based agency said in a press release shared with CoinDesk, noting adoption in some emerging markets battling high inflation.

"Some argue that crypto assets could be in demand in a high-interest rates/high inflation environment because they could serve as a store of value. We think the track record for crypto is too short to prove this," the New York-based agency added, drawing attention to bitcoin's (BTC) weak correlation with U.S. inflation expectations.

Crypto propounders consider bitcoin, the world's largest digital asset by market value, as a store of value asset like gold, thanks to a programmed code that halves bitcoin's pace of supply expansion every four years.

The so-called mining reward halving contradicts the ever-increased fiat money supply globally. (Propounders believe massive money printing by central banks is inflationary). The broader crypto market, including decentralized finance (DeFi), is considered an alternative to a centralized fiat banking system.

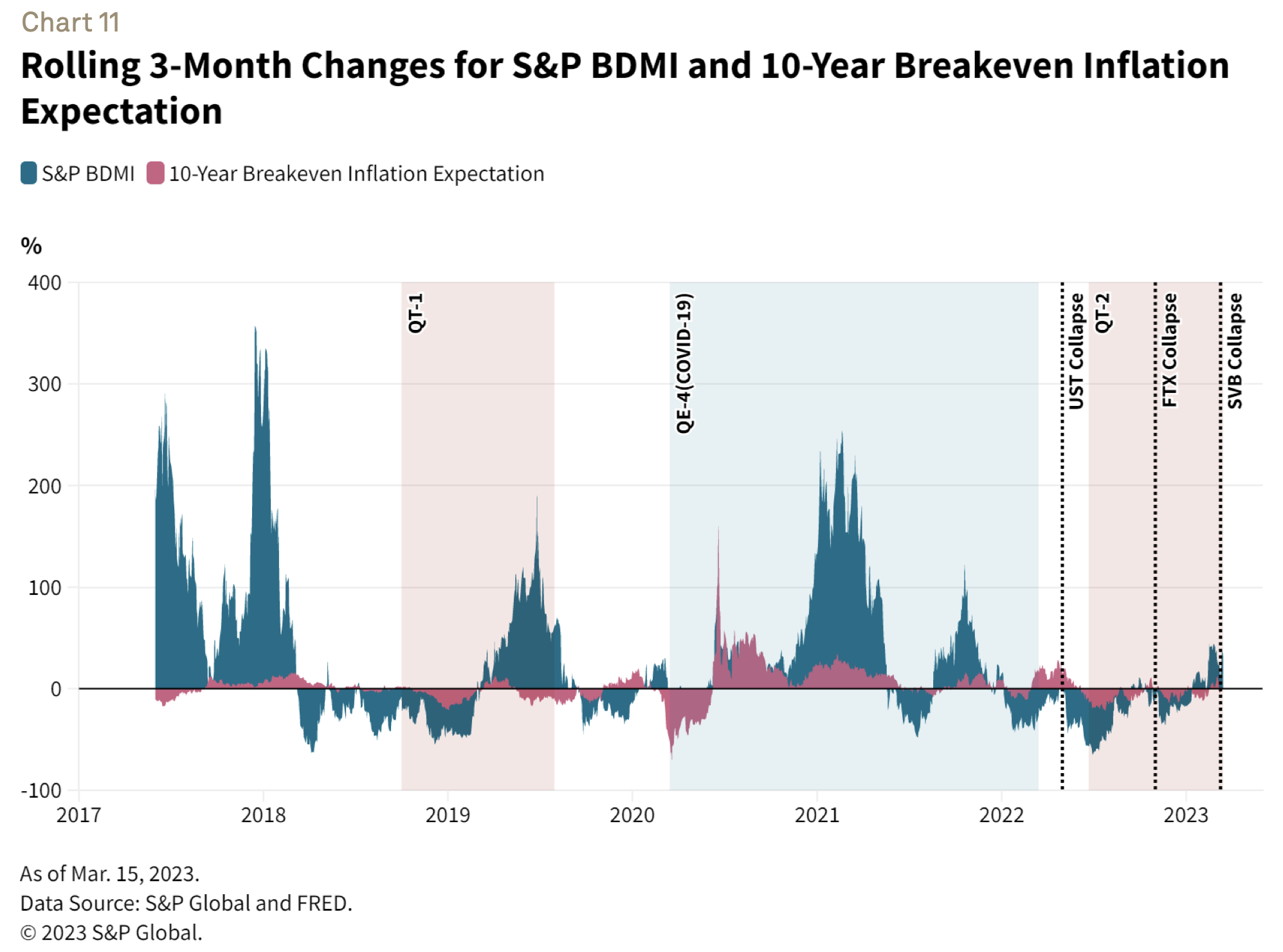

However, past data suggest otherwise. The agency's findings show that historical correlation between the daily returns of S&P BDMI (the agency's crypto index) and the U.S. two-year and 10-year breakeven inflation expectations is just 0.10. The correlation between the rolling three-month returns for S&P BDMI and 10-year breakeven inflation expectations shows no conclusive pattern agency said.

In other words, there is little association between the crypto market and inflation expectations. A strong correlation of at least 0.75 might be needed to validate the inflation hedge narrative.

Breakeven inflation rates are measures of investors' expectations for inflation over a specific period derived by subtracting the yield on inflation-protected bonds from the yield on nominal bonds.

Bitcoin's market value tanked by over 70% last year even though inflation in the U.S., as measured by the consumer price index, averaged 8%, per Statista.

The chart shows several periods where an increase in inflation expectations has failed to lift crypto market valuations. There have been periods when the two were simultaneously positive or negative.

In contrast, the agency said that gold's daily returns have consistently tracked inflation expectations since 2013, adding, "There is evidence of Granger Causality between the 10-year Breakeven Inflation Expectation index and the S&P GSCI Gold index at a 95% confidence level."

The Granger Causality test is a statistical hypothesis test for determining whether time series X is helpful in forecasting Y.

"The same test fails for Bitcoin," S&P Global noted.

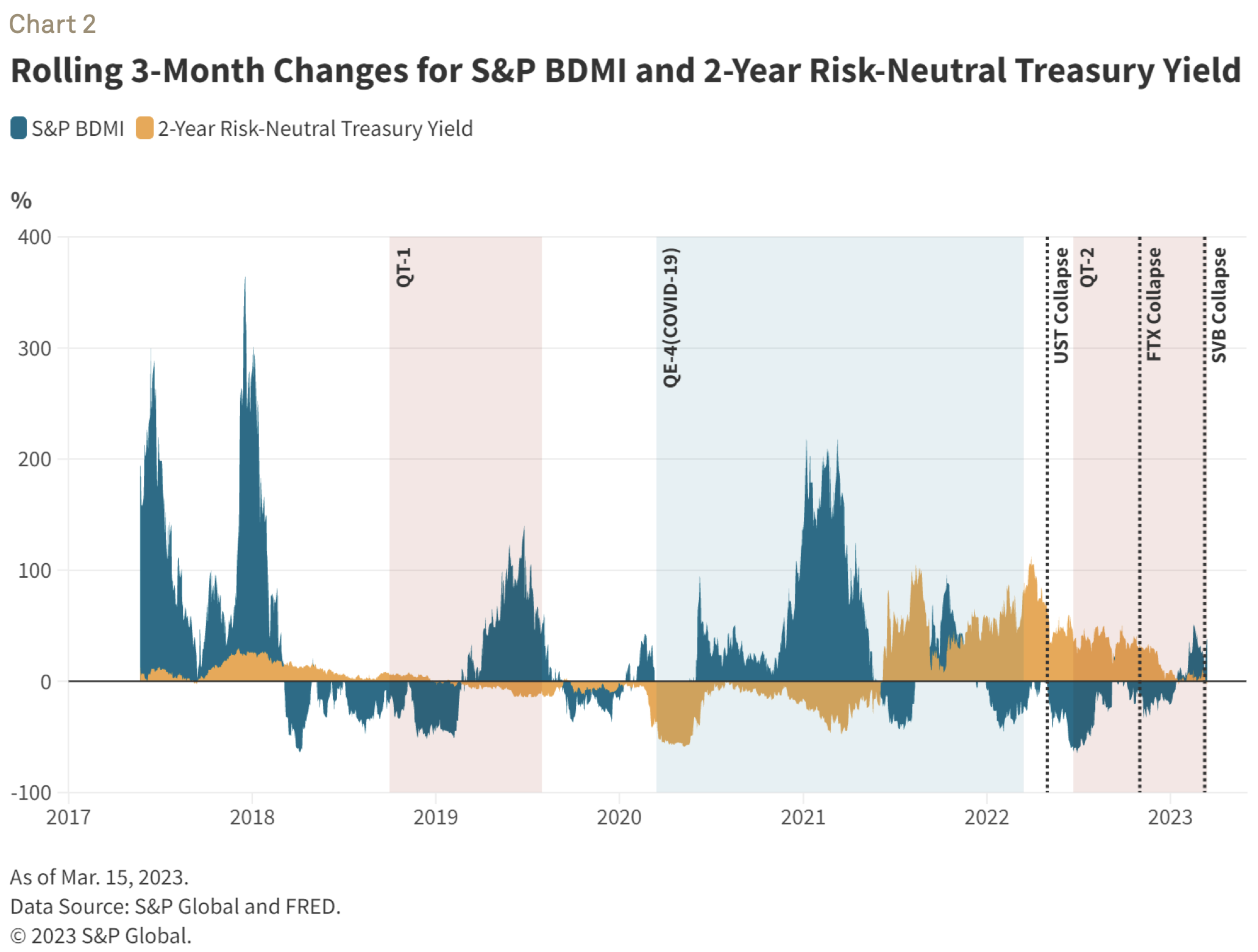

At the same time, cryptocurrencies seem sensitive to cost of borrowing in the economy and tend to move in the opposite direction of the U.S. two-year Treasury yield, which is more susceptible to interest rate expectations than longer duration bond yields.

"On a daily rolling three-month basis, interest rates [two-year yield] and the crypto index have exhibited an inverse relationship 63% of the time since May 2017. This increases to 75% from May 2020, following the start of the COVID-19 pandemic," S&P Global said.

By Omkar Godbole

Edited by Parikshit Mishra

May 10, 2023