(Reuters) Ask a Federal Reserve official if the clutch of interest rate cuts it has delivered this year are helping the economy and you will get a swift answer: Yes.

Fed Chair Jerome Powell said as much on Wednesday after the central bank cut borrowing costs for the third time since July, saying officials “see now more clearly the effects of more accommodative monetary policy on various kinds of consumer activity.”

“You are seeing strong durable goods sales. You are seeing housing now contributing to growth for the first time in a while. And you are seeing retail sales,” Powell said at his news conference following the Fed’s interest rate announcement. “More broadly, monetary policy is also supporting household spending and home buying by keeping the labor market strong, keeping workers incomes rising, and keeping consumer confidence at high levels.”

Indeed, there is evidence that Powell and his colleagues are not tooting their own horns without some justification.

The housing market is showing green shoots as mortgage rates have dropped. Car loans are in greater demand, and sales of high-priced vehicles like pickup trucks are near a record. Stocks are reaching fresh highs. Consumers, fortified by a strong labor market, continue to spend.

It is not all wine and roses, however, as business spending, which has been hit by the Trump administration’s trade war with China, has so far not responded to the Fed’s easing with the same gusto.

Here is a look at the various ways the central bank’s rate reductions are already showing up throughout the economy:

HELP FOR HOUSING

Lower mortgage rates are helping to revive activity in the U.S. housing market, which stalled last year amid rising rates and higher home prices. Home construction added to growth in the third quarter for the first time in nearly two years, the Commerce Department said on Wednesday.

The pending home sales index, which is based on contracts signed in September, rose by 1.5% and is near a two-year high, according to the National Association of Realtors. Still, a shortage of homes for sale is limiting overall growth in the housing market.

The homes that are for sale are now becoming more affordable because of lower mortgage rates.

A home buyer earning the national median income would need to spend 20.7% of pay to make the monthly principal and interest payment on an average priced home as of the end of September when 30-year fixed rate mortgages were at 3.64%, according to an analysis by Black Knight Inc. That is down from last November, when payments ate up 23.7% of the median income and affordability reached a nine-year low.

Refinancing activity is also up since August as homeowners move to lock in lower rates and reduce their monthly payments.

DRIVING CAR AND TRUCK SALES

Banks are reporting resurgent demand for auto loans as rates have fallen, according to the Fed’s quarterly senior loan officer opinion survey.

Spending on consumer durables that are sensitive to interest rates, including cars, rose by an annualized rate of 7.6% in the third quarter, according to a report from Morgan Stanley.

Total sales have rebounded from a four-year low earlier this year and are back running at more than 17 million vehicles annually. Sales of pickup trucks and sport utility vehicles, which sport higher sales prices and now dominate the new-vehicle market, were just shy of a record in September.

WEALTH AND EASY MONEY

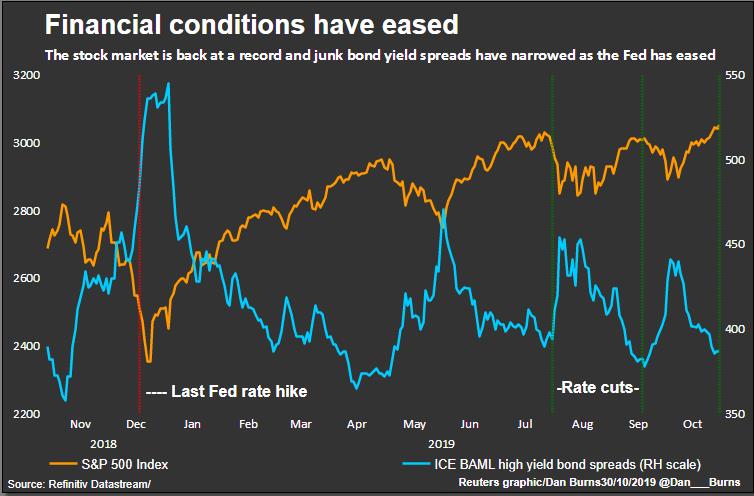

The S&P 500 index closed at a record high on Wednesday after the Fed announced the third rate cut. Investors are more optimistic about the economic outlook after positive developments in the prolonged trade dispute with China and the risks of a no-deal Brexit decreased.

The Fed’s actions to lower borrowing costs and improve liquidity in money markets could also be contributing to investor confidence. Some investors might be turning to stocks in search of higher returns at a time when bond yields are low.

“If you have a need to generate some sort of meaningful return, you’re going to buy stocks,” said David Spika, president of GuideStone Capital Management.

Since January, when Powell and the Fed signaled they had pivoted away from raising rates, conditions in key corporate credit markets have eased substantially. The yield spread for junk bonds - a measure of the added compensation investors demand for owning risky corporate debt rather than safer government bonds - has narrowed substantially.

WEAK SPOTS REMAIN

The big sore spot for both the Fed and the economy at large is a reluctance by U.S. businesses to spend, a hesitance Fed officials and corporate executives blame on Trump’s unpredictable trade policy.

In Wednesday’s first reading of gross domestic product for the third quarter, the Commerce Department said business investment was a net drag on the economy for the second quarter in a row. The last time that happened was a decade ago during the Great Recession.

Businesses also appear hesitant to borrow to fund investment. The Fed’s latest senior loan officer survey showed softening commercial loan demand for a fourth straight quarter, and year-over-year growth in commercial and industrial loans outstanding has fallen by half in the past six months.