(AssetMark) Here we stand, hoping we are on the other side of the pandemic, looking at the wreckage. A harsh economy, high expenses, and a bear market. From every angle, it feels ominous. Making a major life change during a downturned market can be scary.

It’s hard to become “recession-proof”, but these guidelines regarding market recovery, emergency savings, budgeting, and dollar cost averaging will get you further than many people.

What Is a Recession?

While there is no single definition of recession, economists generally agree that a recession refers to a sustained period (two successive quarters) of weak or negative growth in real Gross Domestic Product (GDP¾the value of final goods and services produced in the United States).

The National Bureau of Economic Research (NBER) takes a different approach altogether, defining a recession as a period between a peak and a trough in the business cycle with a significant decline in activity spread across the economy. This period could last from a few months to more than a year. The NBER also states that not all recessions will have two consecutive quarters of negative growth in real GDP.

There are alternative ways some experts measure economic output, assessing periods where growth is easing or below trend or by excluding volatile areas. These different methodologies can create confusion and make a “recession” difficult to gauge.

What Are the Effects of a Recession?

The impact of a recession is easier to assess, especially in conjunction with a bear (or volatile) market. A recession can lead to higher unemployment rates, slowing of home sales, financial stress at a household level, pay that doesn’t pace well with pricing increases, budget reductions, cost-saving moves, and lower production of goods and services.

Some may find promotions are harder to come by as businesses take a cautionary approach towards spending. New college graduates may also discover it more difficult to find work, which can create undue family stress. Additionally, the pain of a recession is typically not felt equally across society, potentially causing increased inequality.

How Long Do Recessions Last?

No crystal ball exists on how quickly we will see a recovery. While history may not repeat itself, it does tend to rhyme. So, let’s look at the market recovery data.

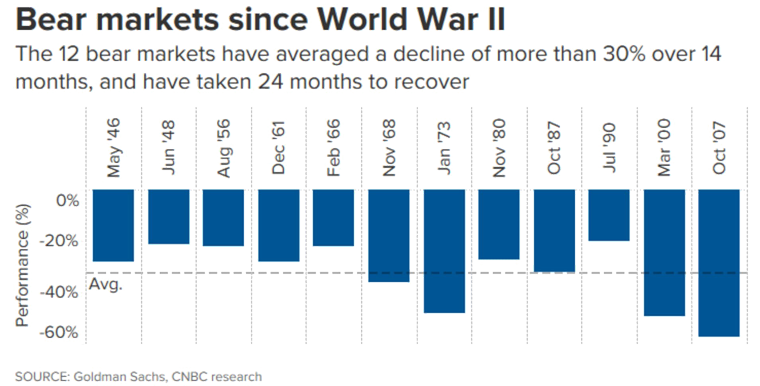

On average, the past twelve bear markets since World War II declined for over fourteen months and took 24 months to recover.

A person who is ready to retire likely worked for forty years or more. Does the 24-month average recovery time, which seems like a small fraction of their greater career and investment time, have an impact on retirement plans?

Is It OK to Retire During a Recession?

Retiring during a recession is certainly possible. If a client has diversified their income, saved enough in their retirement plan, trimmed costs, and maintained their investments, then retiring in a recession may still make sense.

But retirement timing may not be a straightforward question for many people. For example, a small business owner might avoid retiring during a downturned market because it could cause additional instability and disrupt the company that they worked hard to build.

It’s important to prepare early for hard discussions and have a logical plan in place to avoid reactive behavior.

3 Considerations for Clients Retiring During a Recession

People who are nearing their final days in the workforce may face sleepless nights as they watch investments plummet and living costs increase. Others may be discouraged by stress from work and be tempted to jump ship and retire early.

Part of planning for retirement is asking probing questions to reveal whether the grass really will be greener after retirement. Then, find ways to make it greener. Here are some considerations to help evaluate retiring during a volatile economy.

1. Is Full Retirement the Best Solution?

Many people today find they don’t want full retirement. They often enjoy the structure, fulfillment, social aspects, and status they gain through work.

After a few months of checking off bucket list goals, many people become restless. They search for ways to transform the door to retirement into a revolving door, so they can get back to work, where they’ve thrived for most of their adult lives.

It might be best to plan for a soft launch to retirement with consulting, volunteering, or sabbaticals rather than stopping cold turkey.

2. What Are You Retiring To?

It isn’t uncommon for people to retire during a stressful year, but it’s important to retire to something and not just from something. The transition to becoming a retiree can be surprisingly stressful, in itself, as people search for ways to use their free time without overspending during periods of high inflations.

What activities and pastimes make the grass look greener around the corner in retirement? Then create a strategy that reflects those priorities.

3. Who Else is Impacted?

Retirement is rarely a one-person decision. For many people, their spouses or children may be impacted by decisions that affect the family estate. If family hasn’t been involved in financial advisory meetings yet, this may be the best time to start. Anyone impacted should understand the financial goals and strategies of the estate, as well as the agreed-upon budget.

Including the rest of the family in the conversation can help build trust and comfort with long-term decisions. It’s in everyone’s best interest to make these conversations a family-level discussion.

How Does a Recession Affect a Retired Person?

Planning is critical for retirees, too. For those concerned about retirement plans falling short of the expensive environment, it’s important to have a conservative and realistic plan in place.

Inflation growth has slowed a bit but still remains high, around 6.4%, but expected to continue to decline in 2023, according to the Organisation for Economic Co-operation and Development.

Aligning, or realigning goals, taking into account spending, social security, and overall lifetime income can help to remain confident in the face of rollercoaster stock market or sensational news headlines. While difficult, it’s important to avoid emotional reactionary decisions in long-term financial planning.

5 Recession-Resistant Retirement Strategies

The obvious pieces of the puzzle—like cutting expenses where possible and limiting the costs associated with vacations, travel, clothing, and the bare necessities—lead us to wonder how else we can best prepare for the future.

These five recession-resistant strategies can help clients successfully navigate retirement decisions.

1. Keep Appropriate Emergency Funds

Adjust emergency savings funds for inflation to support increasing costs of family needs and lifestyle—and for pre-retirees possibly longer periods of unemployment—that may come with a recession.

Whether placed in high-yield cash accounts, or having setup a security-blacked lines of credit (SLBOC), having cash assets at the ready can preempt being forced to liquidate valuable investments to pay for something unforeseen, like healthcare costs, home repairs, or other unexpected expenses and reduce stress.

2. Set a Realistic Budget

Retirement budgets must include items like automatic expenses (like rent/mortgage, utilities, cell phone, credit cards, car payments, memberships, subscriptions, tuition, etc.) and necessities like groceries, household goods, pet food, and clothing. Next comes the balancing of additional safety nets, like increasing retirement contributions, emergency funds versus the discretionary fun bucket to enjoy life.

Don’t wait until forced into a corner to trim expenses. With an uncertain economy, it’s a good idea to shore up the budget early. Trim spending now and increase retirement contributions while the market is lower—buying more for less, more on that in a moment.

3. Get Organized and Complete the Family Preparedness Kit

Make sure finances are in order. Consolidate where it makes sense, to have a proper view into savings accounts, debt, retirement plans, social security, hard assets, other accounts, or investments and make it a family-level discussion. This is the easiest way for financial advisors to provide insight and clarity on a financial plan. Ask your AssetMark consultant about the Family Preparedness Kit.

4. Prepare for All Scenarios

Pre-retirees should also create plans for additional scenarios, like what they would do if they were to be laid off. Be on the lookout for new opportunities and ways to diversify your income, or pick up a new skill, if signs of layoffs are approaching. Working clients should also focus on contributing more to retirement plans and building up their emergency savings for any unexpected expenses.

5. Avoid Emotional Decisions

Remember that financial plans were made based on long-term projections that account for market adjustments and bear markets. Moving money to a more conservative option or tinkering may not be the best play. When the market recovers, the funds may be locked in some of those losses.

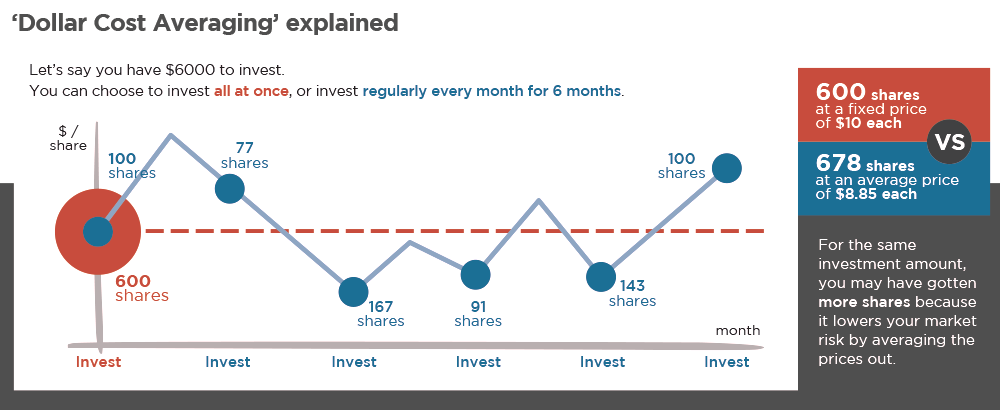

Looking toward recovery, current contributions into a retirement program equate to buying more shares because the price is lower putting funds in an even better position once the market bounces back.

Hence, the reason why increasing contribution rates while the market is low can create additional benefit. This strategy is called dollar cost averaging, a concept retirement plans follow when consistent contributions are deposited.

Candid client-advisor conversations to revisit goals, time horizons, and investments are key to deciding whether it’s best to do nothing or make guided adjustments.

If you aren’t taking advantage of AssetMark Retirement Services, now is the time to choose a platform and support structure you can trust. Reach out today to get started with our team.