(Fortune) - August 5, 2024 was a trying day for investors worldwide, as stock markets from Japan to the U.S. were whipsawed without much warning, leaving analysts and economists scrambling to provide answers. A weak jobs report that triggered a key recession indicator, and the unwinding of some popular and influential trades amid changing central bank policies, were blamed for the fiasco.

As investors watched stocks plummet, the panic on Wall Street even led to calls for emergency rate cuts from veteran economists.

“It was amateur hour,” Mark Spitznagel, founder and CIO of the private hedge fund Universa Investments, said of the market drama. “I have never seen anything like that in my career.”

Since then, markets worldwide have mostly recovered from the pain, with the U.S. S&P 500 up roughly 5% from its Aug. 5 low. And while there are still concerns that the U.S. economy could be slowing, recession fears have largely been brushed off.

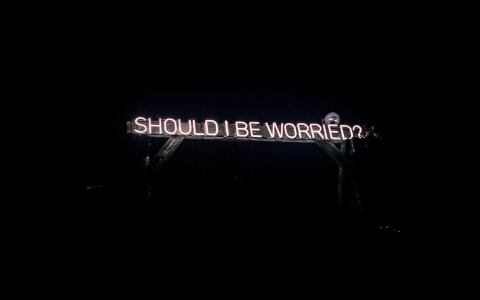

But Spitznagel, who is known for preparing for and profiting from big market crashes, warns the recent market volatility is simply another sign we’re nearing the peak of the biggest stock market bubble in history—and most investors aren’t prepared for the pain that will come when it pops. “These whips are the market process. This is the market zigging in order to zag.” he told Fortune. “This is a stark red flag, it's a stark warning sign.”

A 2007 redux—with a tighter timeline

Spitznagel said prior to past market crashes—including in 2007 before the Global Financial Crisis, and 2000 before the dot-com bust—stocks have seen periods of increased volatility. Euphoric stock market runs often end with increasingly extreme swings in investor sentiment. We could be seeing that again today, and on an accelerated timeline, according to the hedge funder.

“[It’s] a great comparison to 2007. But I think we're going to see a compressed path,” he said. “I don't think we've got a year of this…because the connectivity is greater…the fragility is greater.”

Spitznagel has argued for years that the Federal Reserve helped create the greatest credit bubble in human history by keeping interest rates near-zero for over a decade following the Global Financial Crisis, leaving the economy in a fragile state. Now, he says this bubble will soon pop under the weight of the Fed’s rate hikes, and the impact will be even more dire than during past market blowups because we’re living in an interconnected global economy where the Fed’s policies move markets worldwide.

“Dips are the price of stock market gains. You've got to be able to pay that price. The problem is, the big ones. They’re too destructive of a price,” he said. “That’s where we could be headed.”

Don’t risk it all betting against a bubble

A quick “conscience clearing” moment here: Spitznagel, who has been bullish over the past few years because of his belief that the Fed’s tightening takes time to impact the economy, noted that before bubbles pop, they tend to hit euphoric highs, which means his investors shouldn’t attempt to bet against the market or run for the hills.

“I think if anybody shorts the market or is too under invested relative to their temperament, they're going to get squeezed in at a euphoric height that is probably still coming in the months ahead,” he said.

For retail investors, the hedge funder always preaches patience, investing in basic S&P 500 index funds, and having a margin of safety so that if stocks do fall, you aren’t forced to sell at the worst moment. The biggest mistakes in investing are made when people sell near market lows, or buy near market peaks, according to Spitznagel.

“I think people just kind of need to have this come-to-Jesus moment. Close your eyes, think about a world where the market is down 50 to 75% and then think about opening your portfolio. Are you going to do something crazy? And now, think about it [being] up 20%, and open your portfolio. Are you going to do something crazy?” he said. “That’s the question you should be asking.”

By Will Daniel