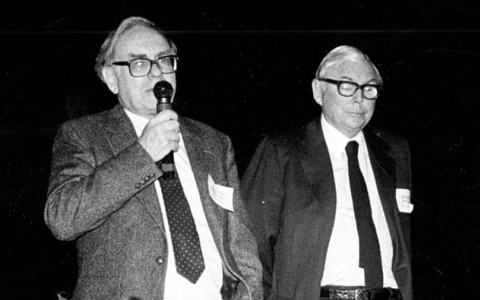

The passing of Charlie Munger, a pivotal figure alongside CEO Warren Buffett at Berkshire Hathaway, marks a significant moment for the company. Munger's role as vice chairman and board member since 1978 was integral, primarily serving as an advisor and confidant to Buffett.

However, his demise on Tuesday is not expected to markedly affect Berkshire's operations, as the conglomerate has largely been shaped by Buffett's vision and leadership since 1965.

On Tuesday, Berkshire Hathaway's Class B stock observed a slight decline, but the overall market response to Munger's passing was minimal, reflecting the stability and robustness of Berkshire's leadership structure and operational framework.

Berkshire Hathaway's current leadership includes Greg Abel, poised as Buffett's successor, managing the vast non-insurance segment, and Ajit Jain, overseeing the insurance operations. Both Abel and Jain have been significant contributors to the company's direction since 2018, with Abel increasingly assuming more responsibilities.

The anticipated future leadership post-Buffett's era comprises Greg Abel as CEO, Ajit Jain managing the insurance sector, and Ted Weschler and Todd Combs, currently handling a portion of Berkshire's equity portfolio, likely to oversee its entirety. Howard Buffett, Warren Buffett's elder son, is expected to assume the role of chairman.

Warren Buffett, with a controlling interest in Berkshire, holds a stake that carries substantial voting power, primarily through supervoting Class A stock. Post his demise, his significant holdings, valued at approximately $118 billion, will transition to a trust administered by his children, with a planned liquidation over ten years. This structure aims to safeguard Berkshire from external pressures, such as activist investors, in the years following Buffett's passing.

Buffett's optimistic outlook suggests that Berkshire's stock might rise posthumously, driven by speculations of a potential company breakup, which could value the conglomerate's components higher than its collective worth.

Berkshire Hathaway, a vast conglomerate, comprises major businesses like Burlington Northern Santa Fe railroad, Berkshire Hathaway Energy, and extensive property and casualty insurance operations, including Geico. The conglomerate also encompasses a diverse array of subsidiaries in sectors such as manufacturing, transportation, and retail.

Projected to earn over $35 billion after taxes from operations this year, Berkshire Hathaway's valuation stands at $785 billion. The trust established for Buffett's holdings will likely shield the company from external influences for a considerable period following his death.

Chris Davis, a Berkshire board member, emphasizes the board's future role in safeguarding the company against activists and maintaining its unique structure and culture. He acknowledges the need to protect the conglomerate's long-term asset value and cash flow generation potential, highlighting the board's responsibility to preserve Berkshire's distinct ethos post-Buffett and Munger.

In his letter to shareholders, Buffett reassured of the suitable succession plans, both in terms of the CEO and the Board of Directors, essential for the company's continuity. He expressed confidence in Berkshire's enduring legacy, emphasizing its design for longevity and its ability to maintain its reputation and resist institutional decay.

This scenario presents a profound reminder for wealth advisors and RIAs of the importance of strategic succession planning, the preservation of organizational culture, and the long-term vision in safeguarding the stability and growth of large, multifaceted corporations like Berkshire Hathaway.