(CoinDesk) - Bitcoin {{BTC}} plunged more than 10% from its new all-time high on Tuesday as heavy selling on crypto exchanges capped the price surge beyond $69,000, sending the price below $60,000 at one point.

-

Bitcoin hit a fresh all-time high of $69,200 on Tuesday, then tumbled to as low as $59,700 in a violent sell-off.

-

The correction triggered cascading liquidations, flushing out over $1 billion worth of leveraged derivatives positions across all digital assets, CoinGlass data shows.

BTC rose to $69,200 earlier during the day, but the order book on crypto exchange Binance showed large sell orders clustered at higher price levels, with over 300 BTC, worth about $20 million, to be sold at $69,000 and more than 500 BTC for sale at $70,000.

The selling pressure posed a significant barrier to bitcoin's price, sending the crypto lower. After the CoinDesk Bitcoin Index (XBX) briefly notched an all-time high of $69,208 at 15:04 UTC, BTC tumbled more than $1,000 in a minute. The sell-off then accelerated in waves, with the price first dropping below $65,000, then sinking further to as low as $59,700, CoinDesk Bitcoin Index data shows. At press time, BTC had bounced back to $62,800.

The pullback sent BTC down 7% over the past 24 hours, underperforming the broad-market CoinDesk 20 Index's (CD20) 3% decline, which held up better due to the relative strong performance of ether {{ETH}} and solana {{SOL}}. Other altcoin majors such as Cardano's {{ADA}}, dogecoin {{DOGE}} and shiba inu {{SHIB}} lost about 10%-12%.

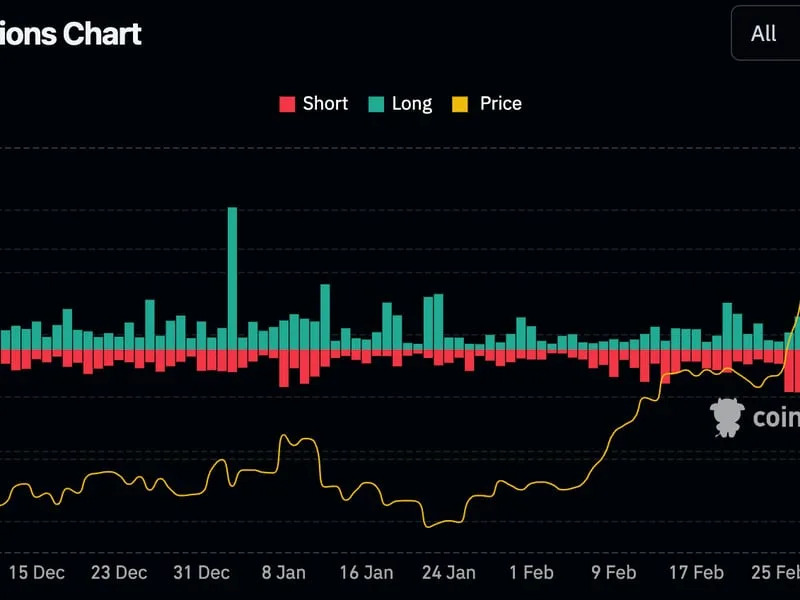

Crypto liquidations soar

The wild price action triggered a severe leverage wipeout, liquidating over $1.1 billion worth of derivatives trading positions across all digital assets through the past 24 hours, CoinGlass data shows. Some $870 million of the liquidated positions were longs, or bets on rising asset prices, according to CoinGlass.

Crypto liquidations across all digital assets (CoinGlass)

Liquidations happen when an exchange closes a leveraged trading position due to a partial or total loss of the trader’s initial money down or "margin" if the trader fails to have enough funds to cover the position's losses. When asset prices nosedive, the dynamic can kickstart a cascade of liquidations, exacerbating losses and price declines. Major liquidation events often mark a local top or bottom for the asset's price.

Tuesday's action even surpassed last August's $1 billion leverage flush, when bitcoin suddenly dropped below $25,000 from $28,000. The move marked roughly a local low in prices, though it was several weeks before bitcoin actually began moving again to the upside.

Will Clemente, co-founder of Reflexivity Research, noted that Tuesday's events reminded him of bitcoin's action around Thanksgiving 2020. At that time, bulls had their eye on an imminent takeout of the $20,000 level, but bitcoin hit $19,500 and cratered, falling in a very short period to roughly $16,000.

"Any dips are for shaking out over leveraged apes and buying at this point," Clemente said in an X post.

This move reminds me of the -15% leverage wipeout we had after testing ATHs for the first time in 2020 that Portnoy called “Thanksgiving Day Massacre”. Any dips are for shaking out over leveraged apes and buying at this point. Not doing anything, just sitting on my hands.

— Will (@WClementeIII) March 5, 2024

By Krisztian Sandor