(EFT Trends) - A recent trend in commentaries has had some disturbing elements, including suggestions that a traditional 60/40 portfolio no longer provides diversification, that bonds should be replaced with cash over the longer term, and that Treasuries no longer provide a hedge during equity drawdowns. As a fixed income manager, we’ve seen tightening cycles come and go, and we’ve learned that there is always a place for fixed income.

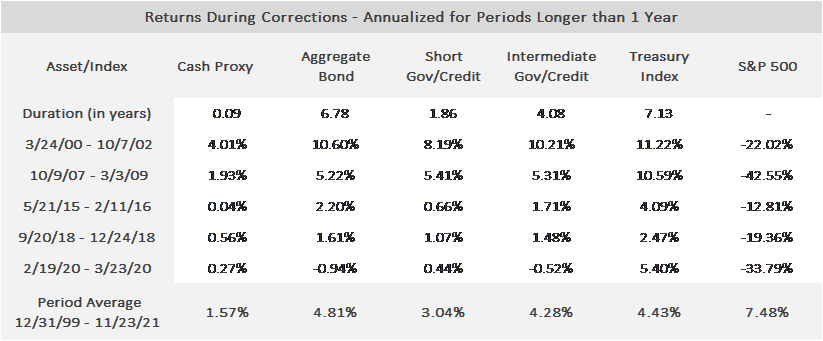

Duration works both ways. Why do bonds provide downside protection in a rough equity market? It’s about Treasuries and duration, not yield. In the short run, the safest sector (Treasuries) and longest duration provide the best protection. Fixed income indices have longer duration due to low yields, which has increased downside risks and is ammunition for the argument for owning less bonds (see table on p.2). But this works both ways and suggests that the diversification benefits of bonds during an equity correction will be higher.

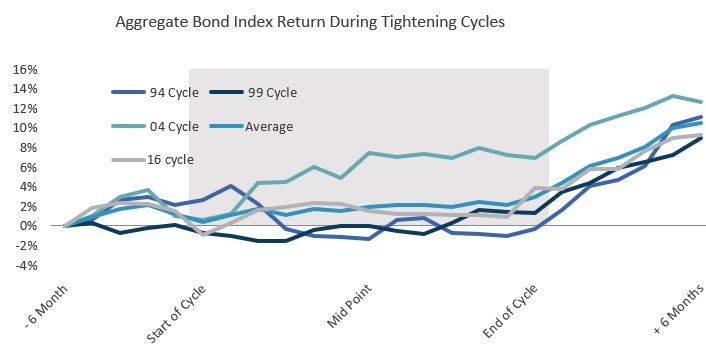

The Fed cycle doesn’t mean deep negative returns, and bonds rally into the end of the cycle. Over the near-term, carrying less interest rate risk makes sense; bonds typically have lower-than-average returns going into and during the early phase of a tightening cycle, but they have never had deeply negative returns. Further, the damage is followed consistently by a rally into the end of the cycle. So while the 60/40 allocation may be weighed down in the near-term, bonds become increasingly attractive as the backdrop becomes higher fixed income yields, slower growth, and a post-Fed cycle rally that favors duration.

BOTTOM LINE FOR INVESTORS

While no one solution is right for every investor, below are three strategies to keep fixed income in the mix.

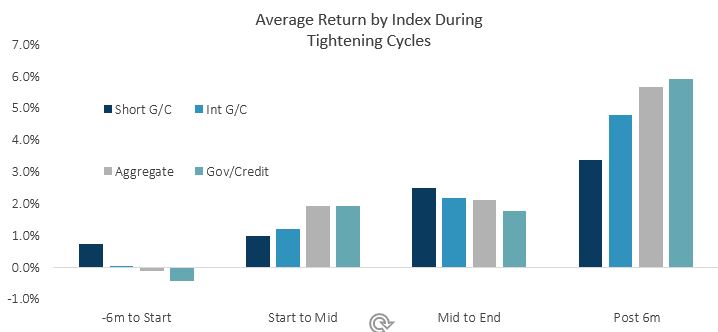

Ride it out in the intermediate term. For conservative investors, an actively managed intermediate gov/credit strategy has been a good place to ride out a tough fixed income market. Its duration profile has led to relatively limited downside in tightening cycles, especially with the ability to shorten duration and manage yield curve exposure to benefit from rising short-term yields. It also has enough duration to benefit from the post-cycle rally.

Shift to lower duration, then rotate back. For those who are more sensitive to downside risk, a short duration fixed income strategy makes sense. The short gov/credit index has provided positive returns in the last four tightening cycles and should consistently out-yield cash if actively managed. Since most fixed income damage is done very early, we believe a rotation out of short and back into intermediate or longer duration will make sense early in the tightening cycle (possibly mid-to-late 2022).

Shift a portion to Core Plus or MAI. For more aggressive and opportunistic fixed income investors, shifting a portion to a higher-yielding Core Plus or Multi Asset Income strategy makes sense. Core Plus will introduce lower interest rate-sensitive sectors and increase the yield and upside if equity market momentum continues, while not adding outright equity exposure. MAI will give investors an equity overweight, consistently higher yield than core fixed income and cash, and is managed to control overall volatility.