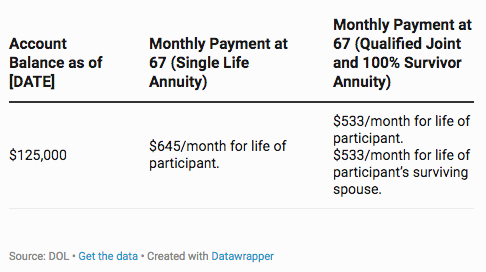

The theory that individuals might save more if they understood how their savings turn into income is about to be tested when a new DOL final interim rule comes into effect. The DOL is requiring ERISA defined contribution (EDC) EDC plans to show through illustrations how individual retirement portfolios translate into monthly income at retirement. Each participant in an EDC plan would receive a statement that shows the following type of information (example taken from DOL):

Transparency Can Nudge Savings

This illustration seems like a common-sense idea, yet surprisingly requires regulation.

Individuals have significant difficulty in translating their investment portfolio into lifetime income — the amount of income they would have on a monthly or annual basis for the rest of their life at retirement. Such difficulty is understandable given that such a translation requires complex calculations. Indeed, various retirement calculators at sophisticated firms help individuals determine how their retirement portfolios translate into lifetime income. Purchasing annuities also help individuals determine the fixed income value of their portfolios; and that is the tool being utilized in this rule. Accessing such computations outside of financial advice requires individuals to be proactive and to seek financial advice which they often do not do until they are close to retirement.

In addition to providing individuals with information outside of financial advice, these illustrations could provide them with the routine nudge to save more in order to meet their lifetime income goals. The disclosure required by the DOL would make clear that the income is not guaranteed unless the individual purchases the annuity, so the disclosure is simply helping them to translate what income they could have if they were to purchase an annuity with the savings in their portfolio. Indeed, the likely effect of this rule will be to boost annuity sales and commentators have predicted that such a boost will probably lead to an increase in savings. By allowing investors to know how much retirement income their EDC accounts could generate, the rule could encourage investors to convert their lump sums into annuitized income.

Expand Transparency To IRA Accounts

Why limit the DOL rule to employer-sponsored plans? Only about half of households have access to an employer-sponsored plan. Many individuals must save through an IRA, and individuals invested in IRAs could benefit from some of the regulations that are applied to employer-sponsored plans. Indeed, I have argued elsewhere that the QDIA requirement for employer-sponsored plans should be applied to IRAs in order to enhance saving.

Similarly, this final rule requiring lifetime income illustrations would also be highly relevant in an IRA. In fact, individuals could use a total lifetime income number — one that goes across their accounts and other sources of income, such as Social Security. Ideally, individuals would be able to pop into an app on their phone on a monthly basis and see how their earnings and savings translate into monthly income at retirement, and maybe receive nudges for things they could be doing to increase that number, e.g., decrease spending by $50 per month to have X more dollars in lifetime income. Such innovation is desperately needed in this market and rules like the DOL’s could be helpful because they will drive market participants to come up with ways to make estimates in an affordable and widely accessible way.

Adjust Disclosure For Different Asset Classes

With different asset classes in different accounts, individuals may benefit from several measures of expected lifetime income, not only what they would get if they annuitize. For instance, they could be provided the expected income, computed as a range, of their stock and bond portfolio if they do not annuitize, assuming a historic market return. Such an expected income range would be estimated at a certain statistical confidence level, e.g., 95%, with disclosures indicating that market scenarios could lead to higher or lower incomes than this range. Riskier asset classes, such as private equity, would likely have larger ranges than less volatile ones. A disclosure to an investor might look like the following:

I have advocated before that the IRA QDIA should consist of three pillars of investing: a fixed income portion, such as an annuity, a diversified stock and bond portfolio, and a higher risk venture or private equity asset-type portfolio. Of course, each of these pillars should have very different treatments in estimating lifetime income. While the fixed annuity can be easily predicted, the venture/PE one cannot and should have a wider range on its expected income value provided to individuals than the equity and bond portfolio. In this way, individuals will get a tangible representation of risk and return trade-offs, a concept that can be rather abstract to individual investors.

The DOL rule is cumbersome for plan sponsors and an opportunity for annuity sponsors, but it could be a lot more. It could be the start of something greater, an attempt to make individuals far more aware of how their financial decisions today predictably turn into their income for the rest of their lives at retirement.

This article originally appeared on Forbes.