(Index Fund Advisors) - How much can an extra set of objective eyes add to your financial well-being? For more than two decades, Vanguard — the pioneer in bringing index funds to Main Street investors — has been delving into such a question.

As we've written about in the past, the fund company's researchers have coined the term "Advisor Alpha." In so doing, Vanguard has developed a process to quantify how much working with an independent wealth manager can mean in terms of improving an individual's net total return.

More recently, Vanguard has built on its long-running Advisor Alpha series to study investors who get their advice through "robo" advisors. These wealth management platforms rely on computer software to pick funds, allocate portfolio assets, and in some cases, tax-loss harvest. Vanguard's researchers compared those results with expected returns of portfolios managed by human advisors.

Robos Lag Without a Human Hand

As part of such a study, Vanguard hired an independent research firm to conduct a "blind" survey of more than 1,500 investors who were working with a wealth manager. The firm's analysis also conducted their own in-depth interviews with investors and advisors from different firms. The first edition of the complete report ("Quantifying the investor's view on the value of human and robo-advice"), was released in early 2022. 1

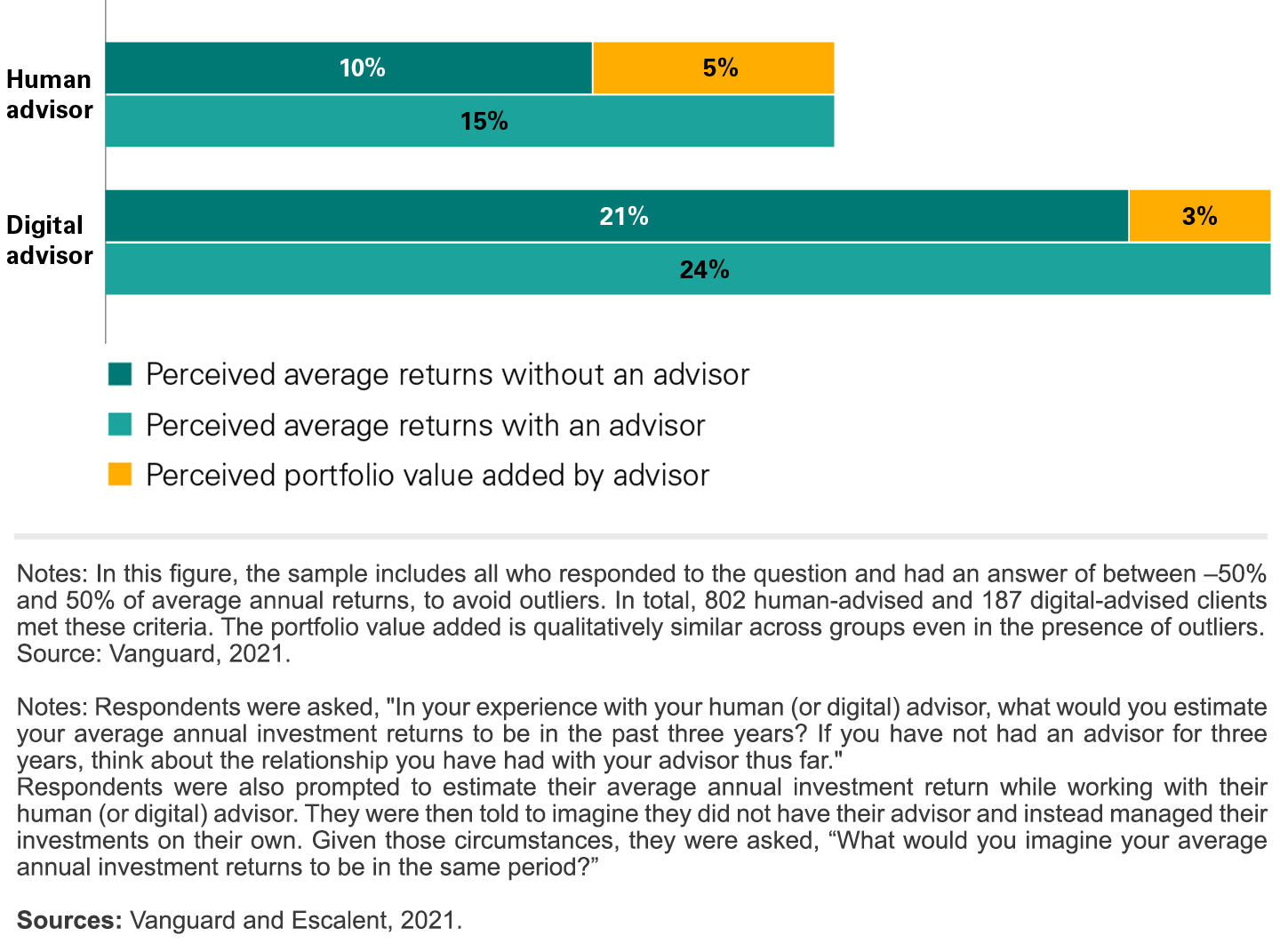

The Vanguard wealth management survey asked investors to estimate their annual portfolio returns achieved with whichever type of financial advice they used — i.e., human or computer. It then asked those polled to estimate what they thought their returns would be over a three-year period without the assistance of their advice service.

As you can see from the charts below, expectations varied by how much access people had to a human wealth manager. In summary, investors working with human advisors estimated their portfolios had returned an average of 15% per year. At the same time, these same investors figured they would've seen only a 10% return if they'd managed their investments alone. As a result, Vanguard pointed out the perceived "value-add" of using a human advisor was a net 5%.

By contrast, researchers found those using digital-only services reported a perceived average portfolio return of 24% a year. Meanwhile, robo-led investors surveyed estimated without a robo advisor such performance would've dropped to 21%. This implies a net 3% perceived value-add to yearly returns.

It's probably worth noting that earlier Vanguard Advisor Alpha research, which focused on human-only wealth management activities, estimated the value-add of a fiduciary-minded wealth advisor worth about 3% net in average annual portfolio returns.

By digging deeper into types of wealth management services, however, the picture of what a fiduciary minded advisor's clients can expect over time comes into focus. In separating the work of humans from purely computer-driven practices, Vanguard has identified more robotic — i.e., tech-driven — financial services at the lower-end of the expected returns spectrum.

Although such a contrast might seem to be rather minimal, consider the following illustration:

- If someone invested $100,000 in a hypothetical IFA Index Portfolio that produced an average annual return of 3%, they would've wound up at the end of 30 years (through 2021) with $242,726.25 in total.

- Using the same scenario but with a portfolio that returned an average annual 5%, this hypothetical investor would've ended up with $432,194.24.

So, an additional 2% in returns over time shouldn't be considered as insignificant. In this case, it would've amounted to $189,467.99 more — or, an extra 78.1% in dollars generated between a portfolio with a 3% average annual return and one that produced 5% a year.

Blending the Best of Tech and Human Interaction

This is an important distinction that sheds light on the proliferation in the U.S. of robo-type services. As Vanguard's researchers note:

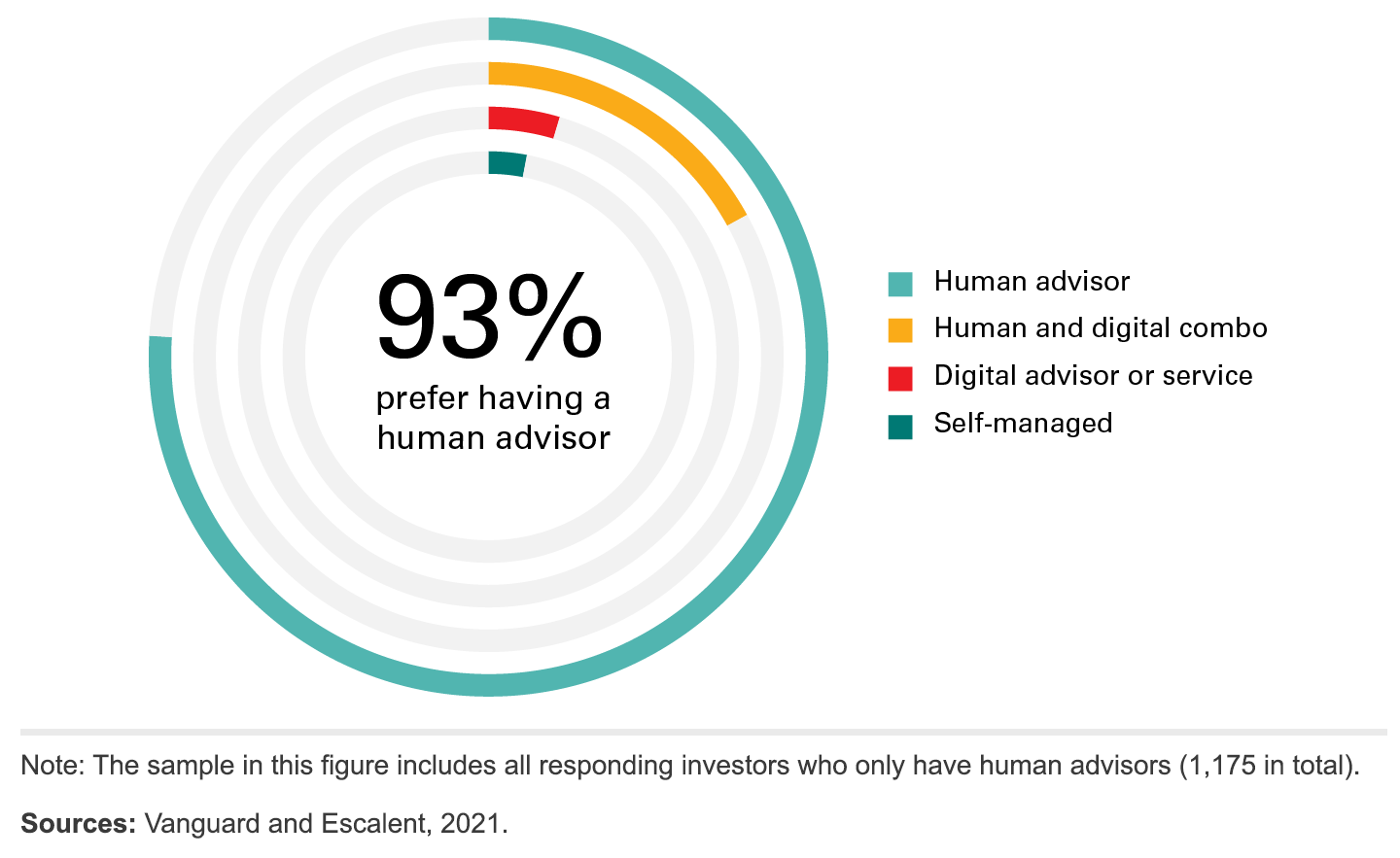

"While the advice landscape is indeed evolving with the breadth and depth of digital offerings becoming available, our research indicates investors maintain significant loyalty to human advisors."

Indeed, Vanguard found that 93% of investors surveyed who were working with a wealth advisor related they planned in the future to use a human-based advice service. (See graphic below.) Along these lines, such research emphasizes that areas like behavioral coaching, portfolio implementation, execution and asset location — services that can be tailored to individual circumstances by a human advisor — can be expected to raise the value of wealth management for many individual investors.

It's important to point out, however, Vanguard's research also found strong sentiment supporting use of advanced software and related technologies in handling certain aspects of wealth management. These included: Managing taxes and capital gains; diversifying investments; using scenario modeling to help answer specific financial goals and simplifying organization and portfolio management.

Interestingly, the Vanguard robo study asked investors who currently use digital-only adviser services about their future preferences. Some 88% said they'd be "willing" or "extremely willing" to work with a human advisor.

The key takeaway from such an analysis, according to Paulo Costa, a Vanguard behavioral economist: Investors want both in one place. In a piece summarizing such research, he observed:

"Our research finds that human-advised clients are, in fact, not likely to switch to digital advisors. Quite the opposite, 9 in 10 robo-advised clients are considering switching to a human advisor in the future. At the same time, clients believe that there is some room for automation of services in a practice." 2

This probably isn't a surprising development to our longtime clients. Mark Hebner founded IFA in 1999 with just such a concept in mind. In fact, IFA's website was created to blend the best of technology's advances with best practices in financial advice and portfolio management.

Besides offering hundreds of articles, videos, books and research papers through IFA.com, our wealth advisors can answer client questions in the comfort of their own living rooms through online chat and videoconferencing technologies. (In recent years, we've made the wealth of our educational materials and communications tools for viewing on Apple iOS and Android devices through development of the Index Fund Advisors App. It's available to download from both the Apple App Store and the Google Play Store for Android.)

Of course, at the heart of our wealth planning process is the IFA Risk Capacity Survey, which also can be found at IFA.com or via the IFA App. The RCS helps our advisors to determine the most risk-appropriate IFA Index Portfolio for each client. Much of the detailed analysis involved in creating a person's unique financial plan can also be done over a mobile device and/or laptop through use of eMoney and its rather comprehensive software suite of planning applications.

These days, a popular media term has been coined to characterize this meshing of robo and human advice planning services: The growth of the "hybrid" wealth advisor. While more robo platforms might be trying to adopt some sort of mix between humans and computers, IFA in many ways can be considered as one of wealth management's original hybrid advisors.

In fact, we've been providing the best of both worlds to investors for more than two decades. The ongoing Vanguard Advisor Alpha research series is just another sign that what Mark Hebner envisioned so many years ago is finally starting to be validated by many in the industry.

By Murray Coleman