As the world starts to re-open, most economists agree that a V-shaped recovery looks unlikely. There won’t be a return to “normal” for a while. However, the investment themes that will drive performance over the next decade are already emerging. Investors who are quick to adapt to the post-crisis landscape should have a market edge.

When Covid-19 struck, governments and central banks injected a massive stimulus to fortify derailed economies and dislocated markets. While those actions may have saved us from a global depression, our transformed world will have different pulses and priorities as a result. These shifts will have substantial investment implications.

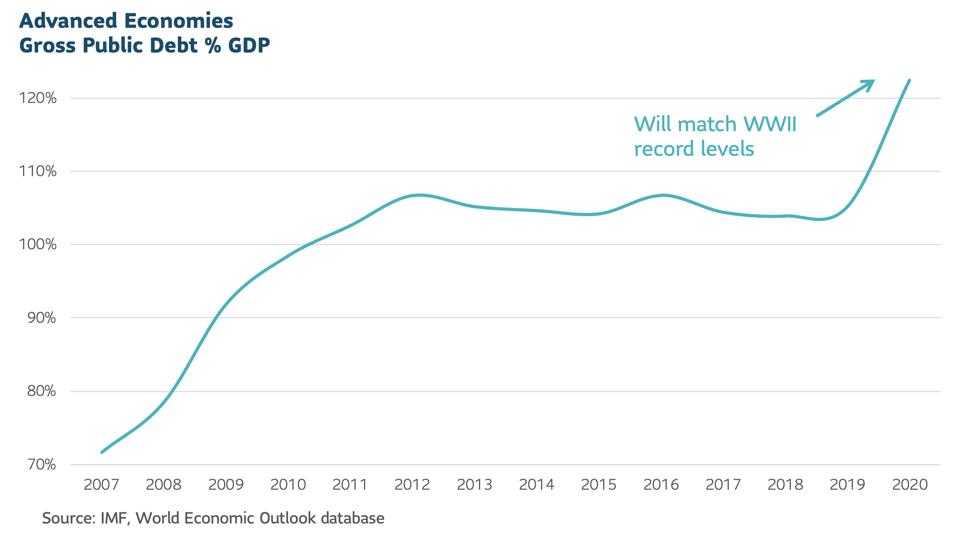

Record Government Debt

The overwhelming surge in government stimulus is pushing global debt to levels last seen at the end of World War II. The debt bill can be managed if growth picks up and rates stay low. That’s the easy way. Absent favorable growth and low rates, the tougher medicine is tax increases.

The International Monetary Fund estimates that in advanced economies, a 10% increase in the debt ratio cuts per capita GDP by 0.2%. Although this is not the end of the world, it is a drag as investment drops and productivity dips. Growth has historically exceeded borrowing costs. As long as that continues, debt levels should gradually shrink.

The U.S. expects to issue $4 trillion of debt this year. The Fed will purchase approximately two thirds and the balance by market participants. There should be ample demand from money market funds, foreign buyers, banks and other institutions that need to hold government debt for regulatory reasons. Interest rates could widen 10-20 basis points as the issuance hits the market but the Fed could easily expand their purchases to manage rate impacts.

Low Inflation

Global supply chains have been disrupted, but so too has demand. Any inflation spikes will be the result of how balanced the demand vs supply recovery is.

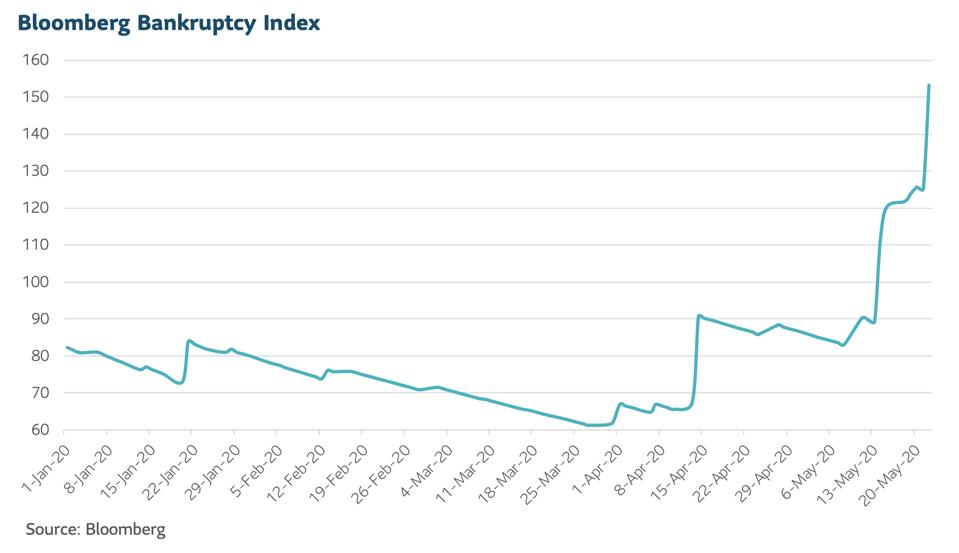

There could be excess demand if production is slow to reach capacity, but in a world of social distancing the service economy is unlikely to overshoot. Some small businesses will undoubtedly be under pressure and a jump in bankruptcies seems inevitable. The Bloomberg bankruptcy index is already seeing a tick up in May.

Recent data from the National Bureau of Economic Research suggests that approximately 40% of pandemic induced layoffs could be permanent. It will take time to retrain and reallocate that excess labor leaving some demand deficit. Precautionary savings also tend to rise after pandemics, as the risks of recurring infections keep consumers cautious.

Central banks across advanced economies have struggled over the last decade to pull inflation expectations up to target. The aftermath of this crisis is likely to be equally as challenging.

In a low growth and low rate world, the more innovative and technology-driven companies will trade at a premium. And income hungry investors will prize those sector leaders that generate reliable dividends.

Resilient Supply Chains

The pandemic reminded global companies of how vulnerable they may be to single suppliers. The extreme case of re-shoring all production seems unrealistic, particularly when overseas manufacturing also supports local business. But continued over-dependence on a dominant supplier seems foolhardy; especially as viruses or trade threats intensify.

With China as the hub of many supply networks, companies will push to diversify across alternative suppliers in different localities to make supply chains more resilient. Governments will encourage that move as well; the new EU commissioner is already urging Europe to do this to achieve strategic autonomy.

Supply chains can be broadly codified as those that are capital intensive (auto and electronics), the result of labor arbitrage (apparel and toys) or those related to national security (pharmaceuticals and technology). Capital intensive will be the hardest to relocate, national security the most urgent while labor arbitrage should be the easiest. There will be an immediate cost to any disruption.

Winner Takes All

Industry concentration has been accelerating for years. Using U.S. economic census data, the Economist found that two-thirds of almost 900 industries are more concentrated than in 2007. Across most sectors, the top four companies dominate. The current crisis is likely to accelerate this trend as smaller rivals struggle to adapt.

Retailers, for example, are vulnerable as the need for social distancing limits store traffic. But recent quarterly earnings from big-box retailers like Walmart WMT, Home Depot HD, Target TGT and Lowe’s showcase the power of their hybrid physical and online model. Q1 revenues year-over-year grew between 7% and 11%. Contrast that with the more apparel-concentrated Kohl’s KSS, where revenues dropped 30%.

These themes of scale, adaptability and technological advantages are playing out across other sectors as well. Combined with accommodative antitrust enforcement, U.S. sectors will continue to consolidate around best-in-class players.

Companies with strong balance sheets will grab market share over weaker competitors. Some destruction is typical in most recessions, but this unprecedented shock is amplifying uncertainty. Retail, airlines, leisure and live entertainment are all candidates for a makeover.

Digital Everything

Technology companies dominated the last decade and are likely to be a winner in the next as the current crisis is amplifying the technology advantage.

The post-crisis workforce will be more physically dispersed, relying on technology, virtual connection and cloud solutions to get the job done. Many companies will need to adapt to work seamlessly from any geographic location. The service economy will digitalize more, minimizing physical contact to protect customers.

Before the crisis, technology companies were drawing regulatory scrutiny triggering a heightened risk of breakup. Now they are more likely to be lauded as national champions as the U.S. seems more intent on grabbing technology leadership ahead of China.

The technology and data revolution will continue to transform business efficiency and consumer interactions. As the backbone of this progress, large technology companies are set to continue their preeminence. This should be another decade where growth stocks outperform value.

This article originally appeared on Forbes.