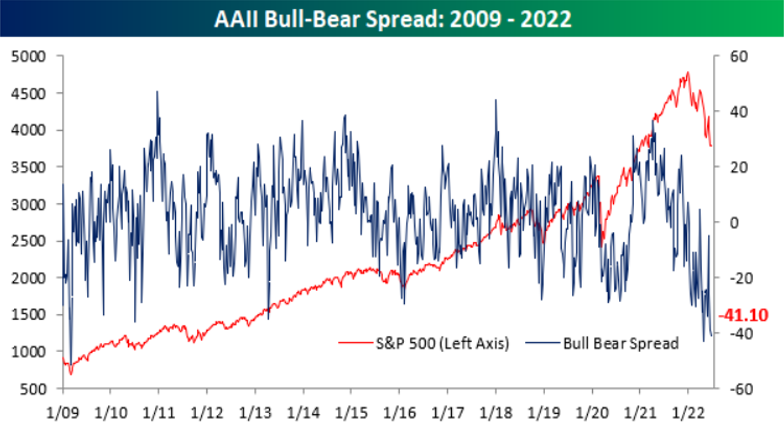

(Donoghue Forlines) Every month, our investment committee holds a meeting to discuss the most important issues driving the macroeconomy and financial markets. This month’s meeting was especially pertinent as it comes on the heels of a substantial decline in global equities. The S&P 500 has shed over 20% from its top, officially entering a bear market. Therefore, is now a good time to buy the dip? Warren Buffett, after all, advises investors to be “fearful when others are greedy, and greedy when others are fearful”, and right now US sentiment surveys show most market participants to be scared.

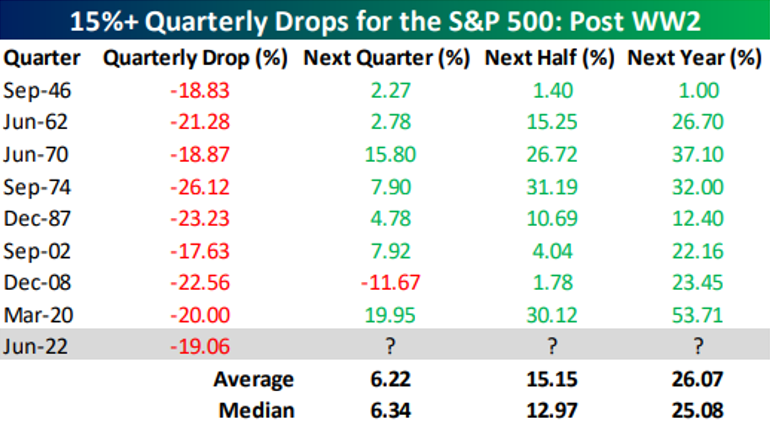

Of course, price affects sentiment and it’s been a quarter to forget for equities. As shown to the right, the S&P 500 is on pace to experience its 9th quarterly decline of 15%+ in the post-WW2 market era. Following the prior 8 quarterly drops of 15%+, the S&P averaged a gain of 6.22% the following quarter, a gain of 15.15% over the next two quarters, and a gain of 26% over the next year. Over both the next half year and year, the index was higher every single time.

However, a typical bear market drawdown for the S&P 500 is 34% and last 431 calendar days. Currently, the S&P 500 is in a 24% drawdown and 165 days since an all-time high. This would imply further downside, which our current technical analysis reiterates. The key issue that we are grappling with is whether the Fed can achieve a proverbial soft landing or whether the US and the rest of the global economy were spiraling towards recession (if it wasn’t already there).

After an ugly May CPI report, Wall Street strategists are tripping over themselves to upgrade the probability of a recession. This trend is also spilling over into Main Street. Google searches for “recession” are spiking, indicating that the wider public has also become increasingly worried about an economic downturn.

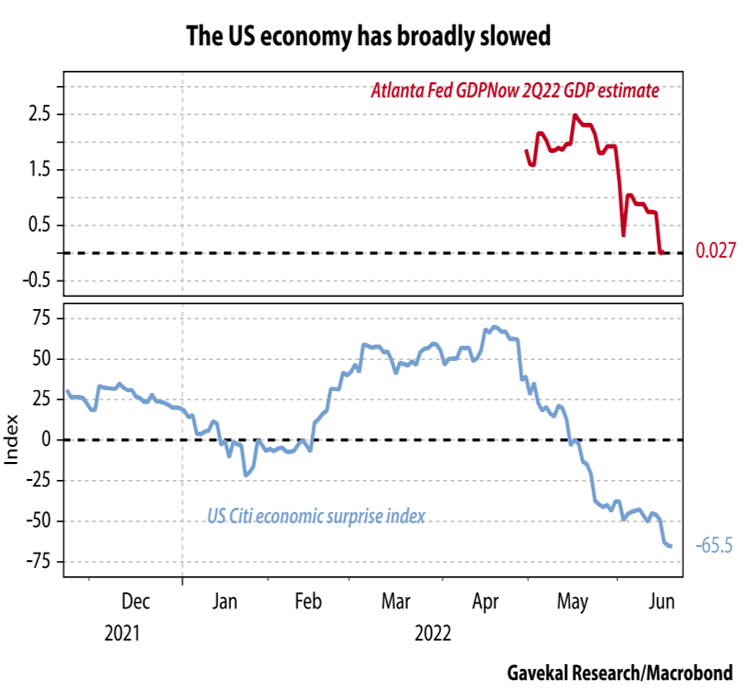

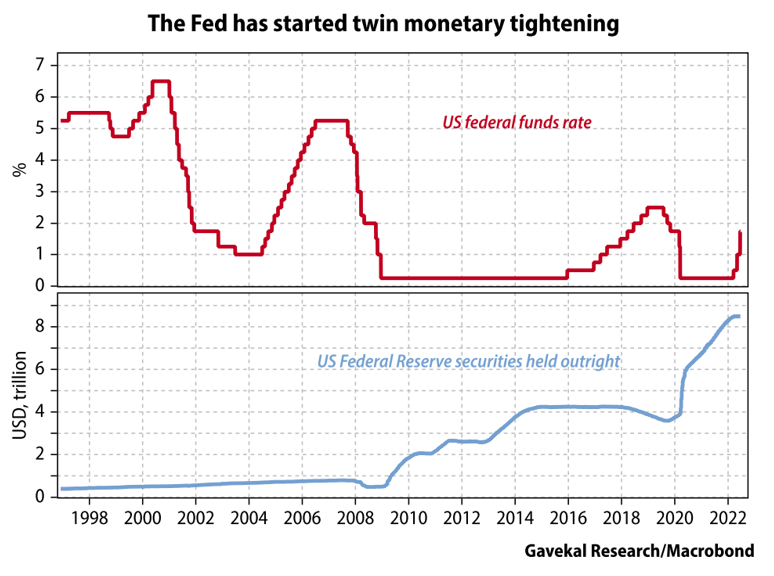

Price pressures have been more persistent than initially anticipated – eating into corporate profit margins and diminishing consumers’ purchasing power. Meanwhile, the Fed is tightening monetary policy aggressively which raises borrowing costs for households and firms. Foreign economic risks stemming from geopolitical tensions in Europe and China’s struggle with Covid-19 are only adding fuel to the fire.

Growth has slowed broadly, and financial conditions have tightened considerably during 2022. Typically, this would elicit a response from the Fed to ease policy. The caveat this time is elevated inflation. However, we believe the Fed will eventually have to pivot to focus on the slowing growth environment or face the possibility of making another policy error. We still believe inflation will peak soon and will be the catalyst for a pivot, and we’re already starting to see signs of this in the market, with core inflation sequentially lower the past two months and now commodities rolling over. At this point, we’re not comfortable drawing conclusion to when that will happen yet. Therefore, we will refrain from adding to risk assets until more clarity emerges about the path of growth and inflation.

Our positioning this year has been defensive in our fixed income allocations and we have made moves to de-risk our portfolios. We still believe we are not in a recession, and at most a shallow one that is happening right now. However, the market is experiencing a largely unprecedented liquidity squeeze from higher rates and tighter monetary policy. It is prudent not to ignore that risk and protect portfolios against capital destroying drawdowns.

Recent Portfolio Changes

There have been no changes to the portfolio holdings since March 10, 2022.