(John A Forlines III / Donoghue Forlines) Major stock indices crossed some key technical thresholds, and interest rates and commodities pulled back sharply as economic concerns really start to pile up ahead of a hawkish Federal Reserve. It’s rare you see the Fed tighten monetary policy into an economic backdrop that’s clearly weakening, but that’s where we stand. It’s hard to get too bullish about the prospects for the economy or the market from these levels, but as sentiment surveys and positioning clearly indicate, the negative view is as crowded as Times Square on New Year’s Eve. The markets can always see further over the horizon than any of us, which makes it hard to ignore the moves higher we’ve seen over the last month. We’re still not out of the woods but let’s evaluate where we stand and how were positioning around that.

Inflation

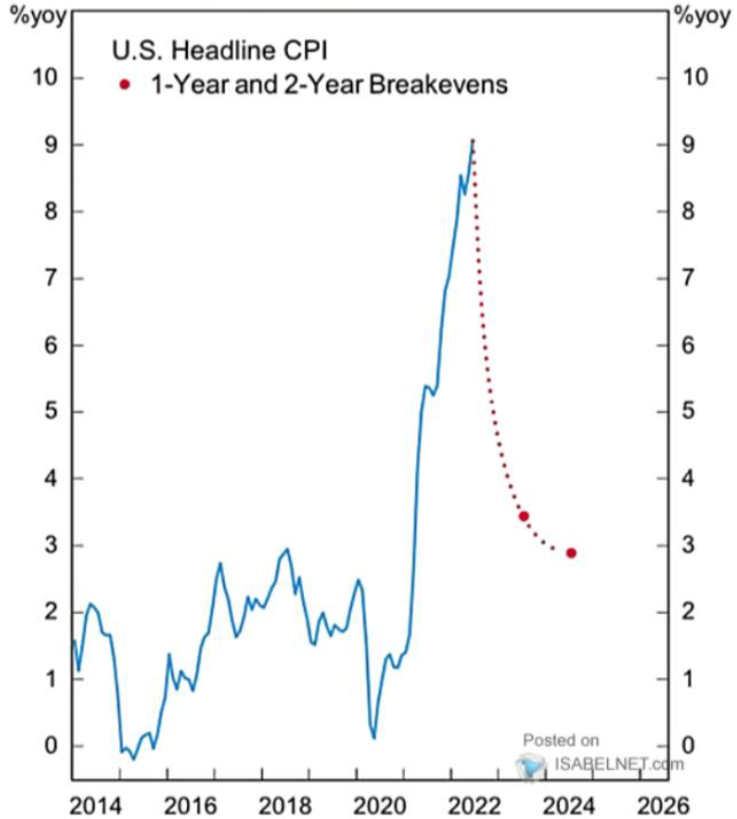

Market participants hoping for some relief on the inflation front were disappointed once again this month. The US headline CPI rose 1.32% month-over-month in June, above the consensus of 1.1%. Core inflation increased to 0.71%, surpassing consensus estimates of 0.5%.

The key question is how much of June’s report is “water under the bridge” and how much is a harbinger of things to come.

Chart 1

Since the CPI data for June was collected, oil prices have dropped to below $100/ bbl. Nationwide gasoline prices have fallen for four straight weeks, with the futures market pointing to further declines in the months ahead. Wage growth has slowed to about 4% from around 6.5% in the second half of last year. All this suggests that inflation may be peaking. (Chart 1)

The TIPS market certainly agrees. It is discounting a rapid decline in US inflation over the next few years. This week’s inflation report did little to change that fact.

Growth

Just about every macroeconomic metric has been showing weaker momentum lately, led by housing and manufacturing rolling over. It should come as little surprise that the Atlanta Fed GDPNow model is pointing to a contraction for the second straight quarter when GDP is released next week.

But like inflation, the key question is how much “water is under the bridge” and how much is a harbinger of things to come.

While growth metrics are losing momentum, key metrics are still holding up at absolute levels, specifically employment.

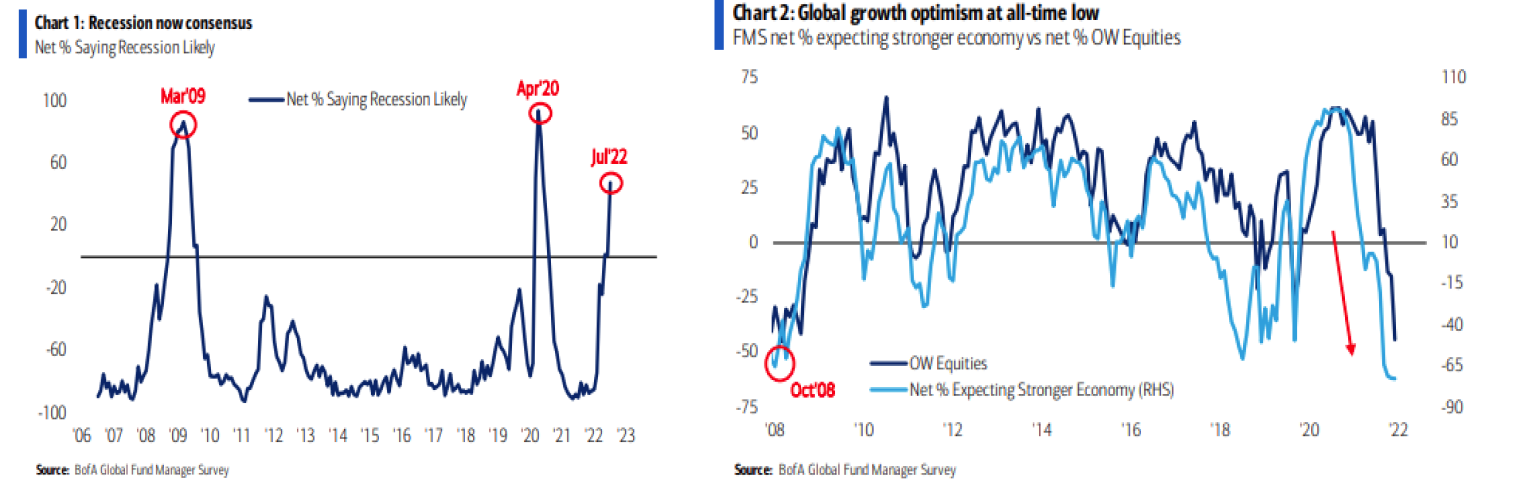

Many investors now see recession as baked into the cake. According to Bank of America, the majority of fund managers saw a recession as likely in this month’s survey. (Chart 2) Additionally, global growth optimism and equity positioning are at all-time lows. (Chart 3)

Chart 2, Chart 3

Technicals / Trends

It’s been an important last few weeks for market technicals as Bulls have made some key progress but aren’t out of the woods yet. The S&P 500 broke above its 50-DMA for the first time in 60 trading days (its longest streak since 2008), but is still firmly below its 200-DMA, failing to break through its long-term downtrend. (Chart 4) We will be monitoring these trends closely, as technicals help identify important market turning points.

Chart 4

Conclusions

Markets are at an inflection point. There’s a strong possibility we experience a shallow technical recession (2 quarters of negative real GDP growth), but much of that scenario is largely baked into prices. For us, the real question is are we going to experience a deep recession where unemployment significantly rises. Then asset prices could face much steeper drawdowns.

Right now, we are in the former camp, but are aggressively monitoring the latter. We aim to protect against capital destroying downside and believe the odds of that scenario have increased.

Stocks lack an immediate macro driver to move higher. We think that driver could come in the form of lower inflation prints starting as early as next month, which should allow the Fed to dial back hawkishness. But we want to position against rising risks of recession.

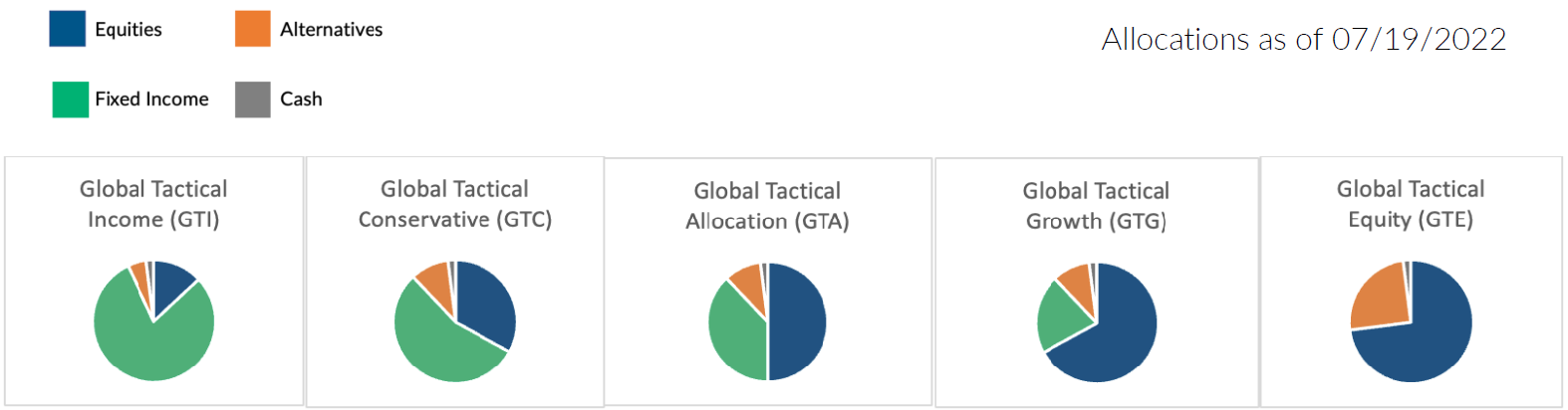

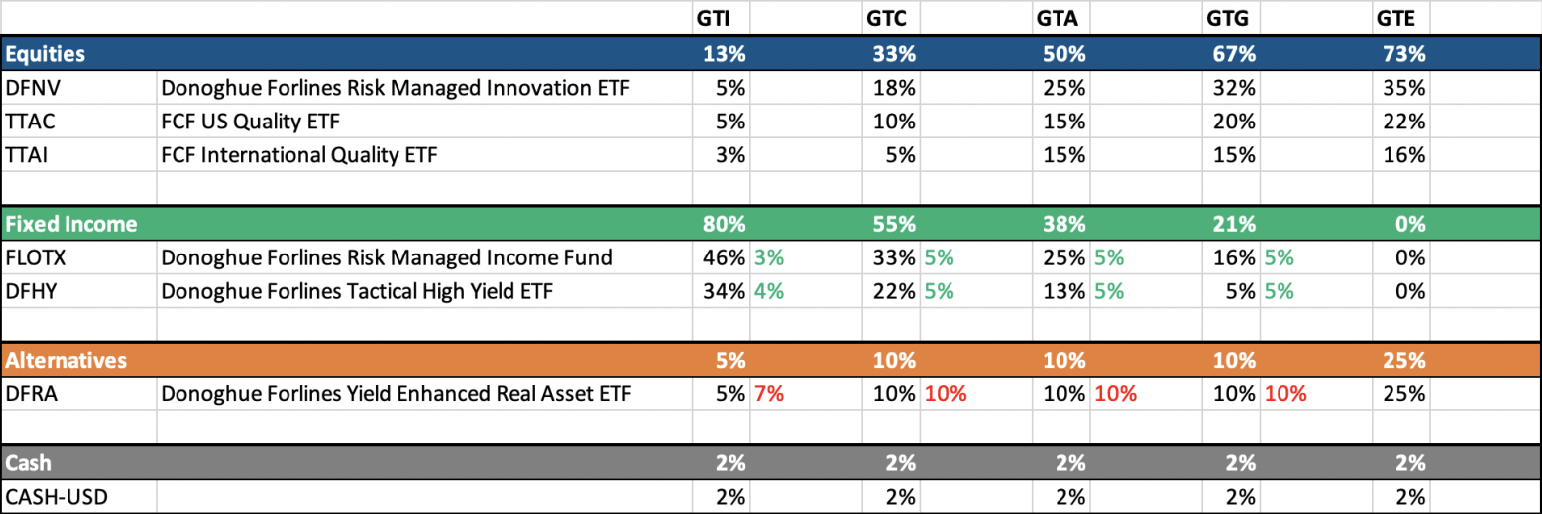

We have made some positioning changes to reflect this.

Recent Portfolio Changes

We have reduced our position in real assets, based off our view that inflation has peaked, and growth may also continue to retract. We have put this money towards defensive fixed income positioning. We continue to hold equities with an emphasis on free cash flow for a late cycle market with rising recession risks.