Dynamic is pleased to introduce a new Market Update segment, “Dynamic Bond Market Update,” where our fixed income specialist Bill Smith will discuss the latest impacts on the bond market and what’s expected moving forward. Intended for advisor use, a summary of the Bond Market Update will be distributed once a month to advisors via email with a link to the full report posted on the Dynamic Views blog.

By Bill Smith, Fixed Income Trader and Portfolio Manager

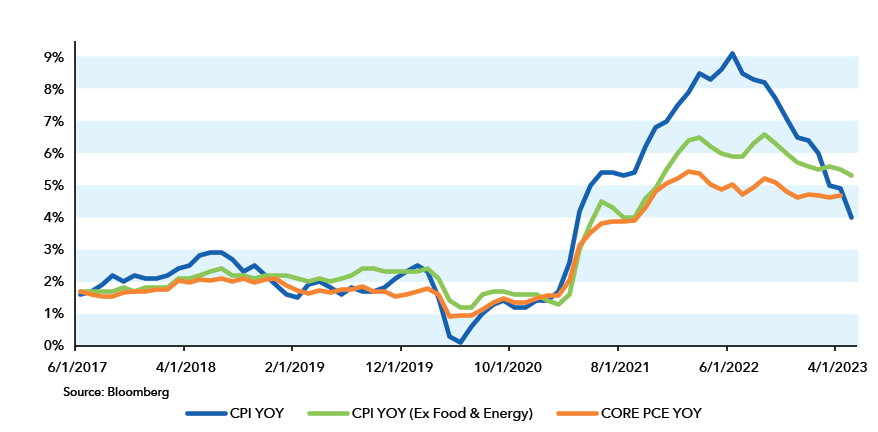

The most aggressive Federal Reserve (Fed) hiking cycle in decades has seen its first pause. The Bureau of Labor Statistics recent drop in year-over-year (YOY) Consumer Price Index (CPI) to 4.0% from 4.9%, coupled with a more muted decline in YOY Core CPI (5.3% from 5.5%), gave the Fed the opportunity to hold rates steady at its June 13-14 Federal Open Market Committee (FOMC) policy meeting.

This buys Fed policymakers time, albeit limited, to evaluate the cumulative effects of what is now a 15-month long, 500 basis point (bp) tightening campaign. Markets are quickly turning their attention to the July policy meeting, following a hawkish post meeting press conference where Fed Chair Jerome Powell reinforced the potential for further hikes in 2023.

A Call for Further Tightening

In this month’s FOMC policy statement, Powell noted a tight labor market and an inflation rate that remains above the Fed’s 2.0% target as reasons for potential further policy tightening. He also stated that “nearly all committee participants view it as likely that some further rate increases will be appropriate this year.” The latest Fed dot plot projections help to quantify “some,” with a majority of committee members calling for an additional 50 bp increase in the federal funds rate over the remaining course of 2023. While it seems likely this hawkish tone is partially being used to temper the dovish message a rate pause sends, market expectations for significant easing in 2023 have certainly receded.

The Beginning of the End

Regardless of additional rate hikes in 2023, or a prolonged pause as more data comes in, it seems increasingly likely that we are closer to the end of this hiking cycle than the beginning. Significant data backs the Fed’s pause, including inflation numbers that continue to decline. YOY CPI has rolled over and is currently less than half of the bureau’s 9.1% high-water mark set in June 2022, according to Bloomberg.

YOY Core CPI, while still elevated, is also down from a high of 6.6% set in September 2022. One of the Fed’s preferred measures of inflation, Core Personal Consumption Expenditures (PCE), has also retreated YOY from a high of 5.4% to 4.7%. (See the chart below, “Historic Changes in Inflation.”) Further declines in inflation would bolster the case for a tempered approach to future hikes.

Historic Changes in Inflation (CPI/PCE)

June 30, 1917 to May 31, 2023

Source: Bloomberg. As of 6/15/23. Past performance is no guarantee of future results.

Numerous leading economic indicators are also signaling the need for a cautious approach from the Fed. The YOY Conference Board Leading Economic Indicator (LEI) index, for instance, has been flashing warning signs since August 2022. From the 1960’s forward, every time this index drops below -1.0, a recession closely follows. April 2023 YOY LEI, the most recent release, came in at -8.0, according to Bloomberg.

Inverted yield curve indicators, historically solid bellwethers of slowing growth and potential recession, have also been flashing warning signs. As of June 14, the yield inversion on the 2-year vs. 10-year Treasury stands at -90 basis points, while the 3-month vs. 10-year Treasury inversion stands at -143 basis points. One of the Fed’s preferred yield curve indicators, the 3-month vs. 18-month forward spread, is also deeply inverted. A Bloomberg Economics recession model, based on this spread, pins the probability of a recession within 12 months at 91% as seen in the chart below:

Probability of U.S. Recession within 12 Months

3-Month vs. 18-Month Treasury Forward Spread

Source: Bloomberg. As of 6/15/23. Past performance is no guarantee of future results.

Combined, these forces will make it increasingly difficult for the Fed to justify large rate increases in 2023. That said, persistently sticky inflation, coupled with a tight labor market could continue to force the Fed’s hand.

Lock in Yields for Longer

While it’s impossible to predict the future path of interest rates, it may be time to start looking at duration for diversified fixed income portfolios. If we’re in the final innings of this rate hiking cycle, locking in yields for longer periods could prove prescient. If the Fed is forced to hike rates significantly more than forecasted, a scenario we find unlikely, duration can still add compelling yield to portfolios in this environment. As always, a prudent approach to fixed income investing calls for diversification across both credit and duration exposure.

As always, a prudent approach to fixed income investing calls for diversification across both credit and duration exposure.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.