Target-date funds are popular in 401(k) plans, but assume uniform goals and risks. Can 401(k) managed accounts offer greater personalization?

Customization is everywhere these days. We customize our workouts, our phones, our social media feeds, and even our fast-food hamburgers. One area where we may benefit even more from personalization is within our investment portfolios, particularly within our workplace savings accounts. Within these plans, participants have access to a list of core menu options that, under appropriate fiduciary oversight, cover a broad range of asset classes and investment styles. However, the average plan participant typically lacks investment knowledge to create an appropriate portfolio reflecting their personal financial situation.

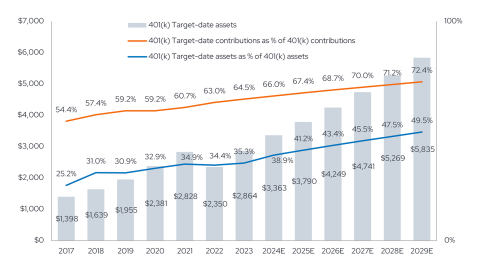

As a first step toward personalization, target-date funds (TDFs) have exploded in usage over the last decade. TDF assets account for 35% of all plan assets as of end of 2023, and TDF managers stated that 73% of assets come from plans’ Qualified Default Investment Alternatives (QDIAs).1 As the typical plan QDIA, TDF assets grow by default, but they offer only one level of customization for participants based solely on anticipated retirement year.

Personalization within workplace retirement accounts can be particularly impactful, as these accounts may become a sizable portion of net worth for the average participant over a lifetime. The Pew Research Center notes that retirement accounts accounted for 27% of total household wealth for households that own them in a 2022 report.2 Further, Vanguard found that the average account balance in plans administered by the company was $112,572.3 Retirement accounts can have a meaningful impact on investor success, but each of us travels our own unique journey and faces our own unique life events. The lack of detailed personalization in a TDF may be inadequate for some 401(k) plan participants as they age and develop more complex financial lives. 401(k) managed accounts may provide a more customizable retirement framework, though. Let’s compare TDFs and 401(k) managed accounts before examining how managed accounts may be utilized in 401(k) plans.

How target-date funds are used today

TDFs are typically offered in five- or ten-year increments and chosen by participants based on the vintage year closest to their planned retirement. Many TDF suites offer an additional retirement income-focused option for retirees. They group individuals into homogenous asset allocations based solely on the projected retirement date. While TDFs typically transition into more conservative allocations as time passes and retirements near, all TDF investors in each vintage receive the same investment adjustments. Shifts occur at the same magnitude and rate for that product’s shareholders, regardless of personal circumstances. The single mother of four children earning $300k a year who is 40 (with an early retirement planned) and the married 50-year-old couple with no kids and $75k in income hold identical portfolios if they solely invest in the same TDF. Would a financial advisor, who typically engages in detailed financial planning for their clients, give these same people identical recommendations?

A relatively new phenomenon within the TDF landscape is the concept of a personalized target date allocation. Within these constructs, basic investor information is used to blend multiple pre-existing TDF vintages to create a custom glidepath for an investor. The data points considered here are basic information stored by the recordkeeper. These typically include age, salary, deferral rate and employer contributions. Although this concept is yet to catch on, the service is a middle ground on the spectrum of participant personalization. However, even this service neglects other considerations like outside assets, early/late retirement preference and desired income replacement in retirement. While often relatively inexpensive and potentially better than the 401(k) portfolios investors may assemble themselves, the personalization options within TDFs are not particularly extensive.

The Great Financial Crisis revealed another issue with TDFs. Many suites had retirement-dated vintages positioned too aggressively and they underperformed badly during this major bear market. The large losses in TDFs even lead to a congressional hearing. The significant risk level may have been appropriate for some investors in these funds, but it was likely inappropriate for many others. In 2011, Professors Laurence Booth and Bin Chang wrote, “The bad news is that these [target-date] funds do not generally have the sort of asset allocation that one would expect of funds geared toward investors planning for their retirement. Moreover, the short-dated funds in particular did not seem to reallocate dynamically to lower risk securities as the equity market boomed and, as a result, were caught out in the bear market of 2008. At the most basic level, there does not seem to have been the disciplined investment approach we would expect based on the promotional material for target-date funds.”4 While lessons have been learned and target dates of today have evolved, this experience exemplifies another reason to consider a more customized alternative to TDFs, such as managed accounts.

The case for 401(k) managed accounts

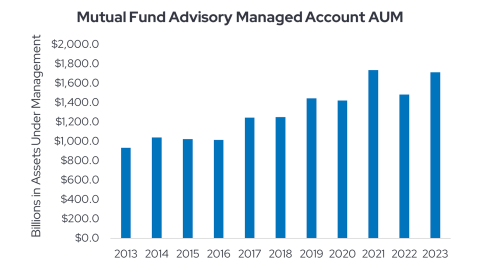

In short, these are portfolios supervised by an asset management firm that directs the asset allocations and specific investment selections for participants based on personalized data points such as target retirement age, other assets, and expected pension income, among a host of other data points that target dates do not consider.5 Managed accounts typically hold mutual funds or collective investment trusts (CITs) but may hold other vehicles like separate accounts or closed end funds as well. Investors are invested in a custom asset allocation that considers much more than just their age and projected retirement date to target their specific risk tolerances and retirement goals. In some cases, the managed account can even be integrated into the investor’s other holdings to provide complementary investment allocations. In essence, managed accounts are a way to bring the same type of personalized financial advice offered by traditional financial advisors to the retirement plan market in a scalable fashion. Managed accounts typically charge higher fees for these personalization services. However, for participants with complex financial situations, this type of service may provide valuable insights. In the retail wealth world, a corollary managed account concept exists as a method for creating customized portfolios. These accounts are becoming more common across the retail investment landscape.

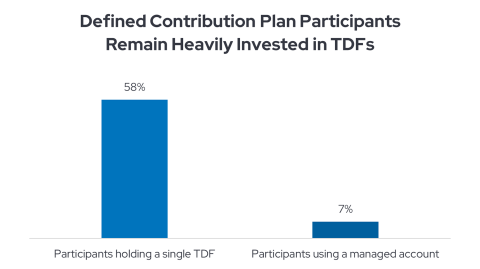

As more investors eschew one-size-fits-all retirement portfolios, though, managed accounts could see greater utilization within retirement as well. As seen below, the usage of managed accounts today is dwarfed by their TDF counterparts. One impediment for their uptake has been availability. 401(k) plan administrators and sponsors must first make these services available to plan participants.

Benefits of 401(k) managed accounts for retirement planning

Do investors truly value greater customization in their workplace retirement accounts, though? According to a 2024 Franklin Templeton Voice of the American Workplace Survey,6 the answer is a resounding yes. Over 80% of respondents were supportive of the personalization within their retirement plan.

84% of workers said, “I would be interested in a more personalized 401(k) investment option (i.e., personalized portfolio-using factors such as age and income) tailored to my unique financial situation.”7

82% of workers stated, “I would like my employer to offer personalized employee benefits (i.e., customized benefits that meet my individual needs, whether financial or work-life balance, etc.).”7

In many cases, the extra expense of the managed account may not be justifiable for younger investors with a more straightforward financial picture. However, as investors age, other elements enter the picture, like a spouse and their retirement savings, kids and their education/marriage, other savings goals, etc. It is at this point that the case may become stronger for managed accounts that can consider these additional factors and complex situations. As retirement approaches, it is critical that 401(k) participants do not over or under-save for their goals. It is equally important for these investors to receive proper risk management for their portfolios. The customizable aspects of managed 401(k) accounts may thus be more appropriate or helpful for investors closer to retirement and those in the decumulation phase of life.

One size does not fit all for retirement planning

TDFs have helped many Americans save and invest for their retirement years using structured, professionally managed strategies. These funds, however, cannot offer complex customization to 401(k) plan participants. For greater portfolio personalization, managed accounts may be an appropriate solution for 401(k) plan participants. These accounts could be especially attractive to participants with more complicated financial lives. Managed accounts can even make investors feel more comfortable about their retirement planning. According to Cerulli Associates, “Participants enrolled in a defined contribution (DC) managed account program are nearly three times as likely to state they are “very confident” in their retirement investment strategy: 47% of DC managed account users reported feeling very confident in their retirement investment strategy.”8 This peace of mind is intertwined with the greater personalization that can be delivered through a managed account. Sometimes, one size does not fit all when it comes to retirement planning.

For more information on Envestnet | PMC, please visit www.investpmc.com