(Jerry Wagner, Flexible Plan) Decisions.

We have to make them every day on a whole range of matters.

While most decisions seem to revolve around choosing between alternatives, another category of decisions tends to be more critical in the scheme of things.

The first type of decision is tactical. It often is reactive. It may rest in logic, but feelings are usually at the heart of it: “This just feels right.” “I like the look of this one.” “I’m feeling bad, and this makes me feel better.”

The other category of decisions is strategic. Strategic decisions are more likely the result of thinking about the issue. Develop a plan, implement it, and evaluate its effectiveness as the results become available.

We adopt a plan, but, at some level, we are also already considering ending it.

As president and five-star general Dwight D. Eisenhower said, “In preparing for battle I have always found that plans are useless, but planning is indispensable.”

If you’re planning effectively, you’ll always be open to changing your plans.

So when should we change our plans?

We all have cell phones, mobile plans, and streaming or cable services these days. When do we terminate one and start a different one?

Generally, if you ask someone that question, you usually get the answer, “When it stops working.”

How do we know if something stops working?

If you think of your cell phone, there are many logical signs. You may need a new phone if the screen is cracked, the camera takes dark or blurry photos, the battery is dying, the phone won’t update, or storage space is running out.

These are all good, logical, easily discernable signs that a cell phone doesn’t work or, more particularly, that it no longer satisfies your needs.

When considering changes to your portfolio, the same decision considerations come to bear, but I would submit that it is much harder to determine whether a portfolio is working.

As with other decisions, there are tactical and strategic elements at play.

The temptation to make a tactical change

When the market keeps falling, day after day, some traditional investors say they follow a “buy-and-hold” approach. They talk about the advantages of portfolio diversification as a risk-management tool. But when the losses mount up, sooner or later, even the most ardent passive investor can conclude, “Enough is enough.” Usually, that means moving from an aggressive or growth investment to a conservative, defensive approach.

Of course, this is precisely the emotional reaction that can be of concern in making a tactical decision. And studies show that this is often the wrong time to abandon equities. In the 2008 decline, the bottom in the stock market rout occurred on the date of the greatest amount of mutual fund exchanges out of stock market funds.

And then there is the added problem that a decision to sell also creates the need for another later tactical decision—when to buy. Again, emotions can significantly influence this decision.

When should you buy back into the equity funds after selling out of fear of more significant losses? It isn’t easy to pull the trigger to buy after such an experience. Many investors have taken years, missing massive gains in the recovery, before they find that they can stomach going back into the equity waters again after a significant stock market decline.

Is it time for a strategic change?

In the first decade of this century, the experience of going through two 50%-plus declines in the stock market caused many investors to believe that there had to be a better way. They turned to more active asset managers like Flexible Plan Investments (FPI). We take a dynamic risk-management approach that quantitatively determines when portfolio changes should be made and implements those changes automatically.

Deciding to have your investments managed by a dynamic risk manager is a strategic decision based on experience and market history. It is a recognition that you want to turn away from emotional decision-making and the constant pressure to do something and turn instead toward quantitatively derived, tactical management by a professional, third-party asset manager.

That does not mean that you will become immune to feeling the need to make a tactical change when losses occur. It is natural to have these urges. But in this case, it is probably best to stick to the plan. Sticking to the plan is more straightforward, and the impulse to change is more easily overcome. We provide investors and their advisers with several tools to determine the wisdom of acting on such impulses.

How we help you “stick to the plan”

When an investor sees losses in their FPI account, they should talk to their advisor about them. A quick check of the current assets held in their portfolio may show that their strategies are already in the defensive position into which they want to retreat, including a greater allocation to cash or even to inverse fund positions.

Importantly, actively managed investment strategies not only include sell methodologies based on historically successful processes, but they can also be programmed to buy back into the equity market without jumping over any emotional hurdles.

Investors that abandon the strategies lose the ability to move effortlessly into a defensive position and painlessly back into equities when history suggests that the time is ripe with opportunity. An investor taking that approach is likely trying to “market time” the tactical manager and bring emotions back into the decision-making process. When paying an adviser to make the tactical decisions, it is better to stick with the original strategic plan.

How do you know if your portfolio still meets your needs?

If tactical decision-making is not helpful for an investor using a third-party, dynamic risk manager, when is the appropriate time to make a change? How do you know if your strategy doesn’t work or, more particularly, that it no longer satisfies your needs?

First, if you are considering a change, it’s important to clearly define your needs. The trauma of going through market declines can substantially change someone’s views on investing and what investments are suitable for them.

At times like these, a good starting point is to begin a review of your account by completing a new suitability questionnaire. Perhaps the stock market was making daily new highs when you first completed the questionnaire, and your answers reflected your view of the market environment at that time.

Completing the questionnaire again can tell you whether you now have a more conservative risk tolerance. If so, you might want to tone down the aggressiveness of your portfolio.

In the final analysis, what is most important is that investors and their advisers assess a portfolio’s performance over the long term and through full market cycles. Is it still on track to meet their personalized investment objectives, despite a possible short- or intermediate-term period of relatively poorer performance due to unfavorable market conditions?

How do you know if a strategy isn’t working?

For many years, I struggled with how to answer that question quantitatively.

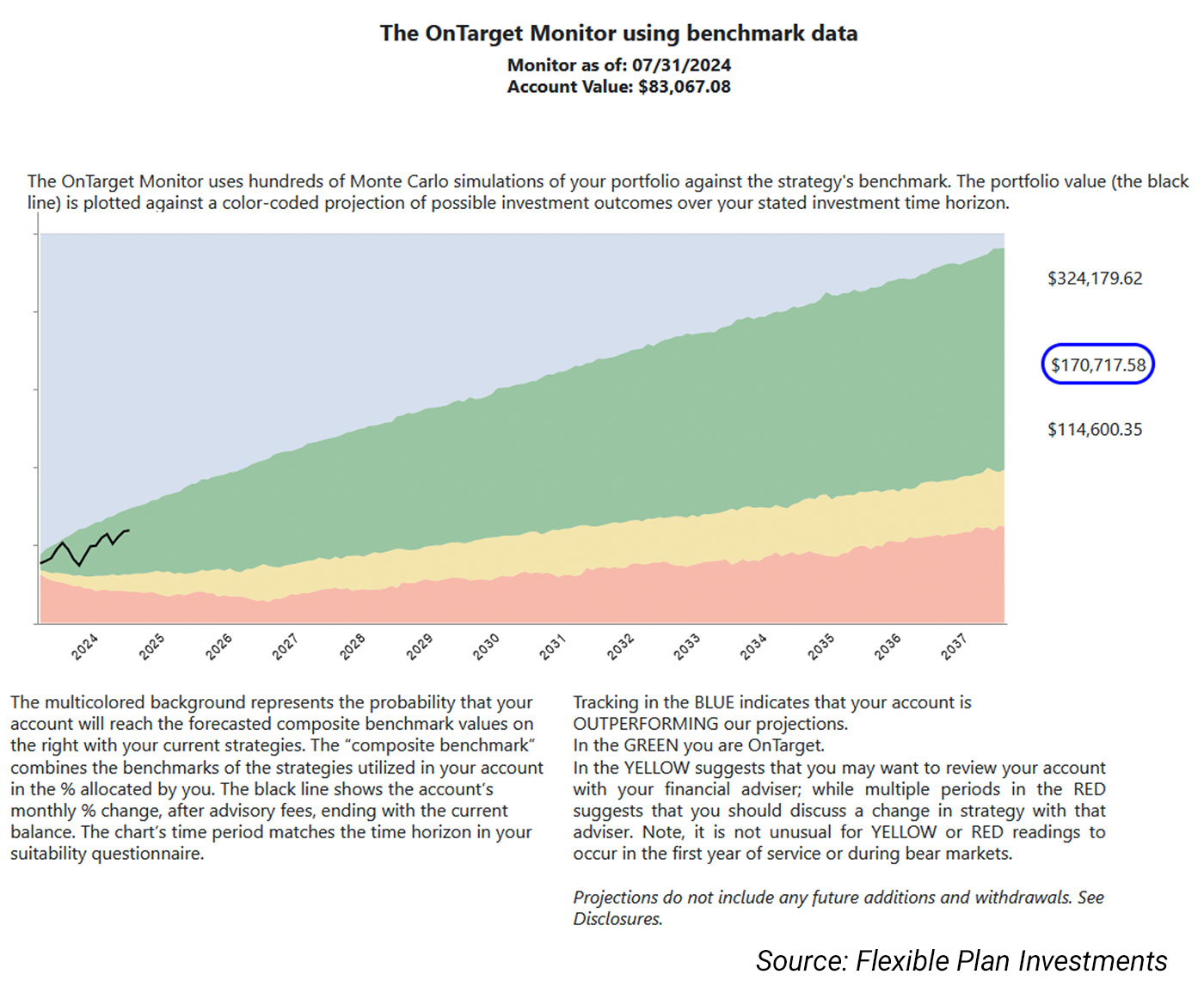

Then in 2007, we introduced our OnTarget Monitor, which allowed us to model the likely performance of our strategies and portfolios over a chosen time horizon. The OnTarget Monitor made a personal, custom benchmark possible for every one of our investor clients.

Once we had the personal benchmark, it was easy to match that up against actual performance as we progressed through the indicated time period.

You can view that comparison when you log in to your account on the OnTarget Investing website (an example is shown below). A quarterly comparison is also shown on your OnTarget statement from FPI. Identical reports are available to your financial adviser on their personalized My Business Analyzer tool.

As you can see, the OnTarget Monitor is color coded. If performance (indicated by the solid black line) falls into the red zone, some strategies may not be working and your portfolio may need a change. However, as we have always noted, when you are in the middle of a bear market and everything is falling in value, being “in the red” may simply reflect the health of the underlying financial markets.

In any event, if your account is in the red, you should discuss it with your financial adviser. We cannot change your allocation decisions unless you and your adviser submit a strategy change.

Of course, if your account is in any of the other color zones, no action needs to be immediately considered. You can stick with the plan.

In the end, it’s usually best to stay the course

Napoleon Hill, the author of the mega-bestseller “Think and Grow Rich,” once said, “Within every adversity lies the seed of an equal or greater benefit.” Changing your investment strategy may open your portfolio up to new opportunities when the market environment changes.

But be careful to ensure that your portfolio fully reflects your suitability questionnaire responses and that the strategy you change is actually no longer working. After all, some seeds may take a little longer to grow than we’d like. And the decision to stay the course and let FPI continue to manage the account with its existing strategies may be the best decision of all.