(Forbes) Goldman Sachs (NYSE: GS) is a leading global financial services firm with offices in over 30 countries. The company offers investment banking, securities trading, lending and investment management services to hedge funds, financial institutional, government and high-net worth individual (HNIs) clients. In Goldman’s earnings release recently, the bank reported total revenues of $8.3 billion for Q3 2019 – 4% less than the year-ago period. This was mainly driven by 15% y-o-y decline in Investment Banking fees and a 17% reduction in Investing & Lending revenues, partially offset by a 6% increase in Institutional Client Services. While the bank has reported an average annual revenue growth of 9% over the last three years, total revenues are expected to decline by 5% y-o-y in 2019 – a decrease of $1.6 billion.

Trefis details the key components of Goldman Sachs’ Revenues in an interactive dashboard, along with our forecast for the next three years. In 2019, Goldman Sachs’ Institutional Client Services is expected to contribute roughly $12.6 billion (36%) to its Total Revenue estimate of $34.95 billion, which is 6% less than the 2018 figure of $13.5 billion. You can make changes to our forecast for individual revenue streams in the dashboard to arrive at your own forecast for revenues. Additionally, you can see more Trefis data for financial companies here.

What to expect from Goldman Sachs’ Revenues?

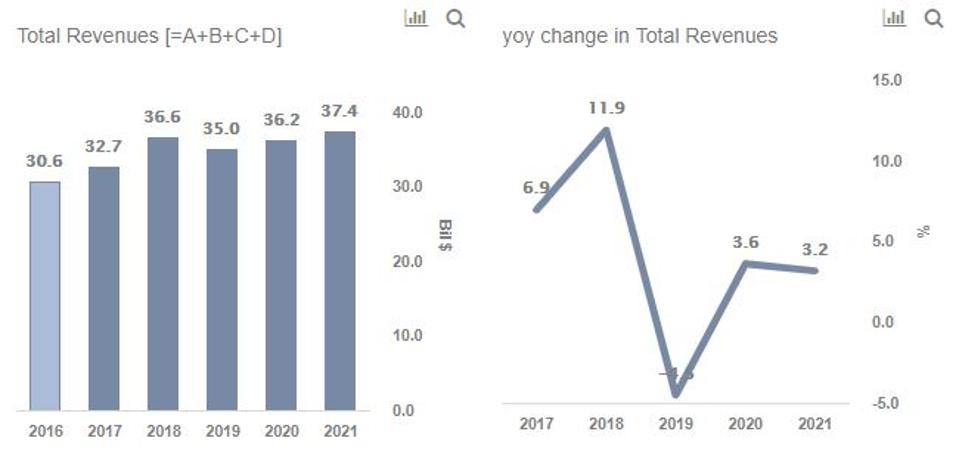

- Total revenues have increased at an average annual rate of 9% over the last three years, from $30.6 billion in 2016 to $36.6 billion in 2018. However, it is expected to drop by 5% y-o-y in 2019 – a decrease of $1.6 billion.

- Thereafter, Goldman Sachs’ revenues are expected to grow at an average annual rate of 3% and cross $37.4 billion by 2021.

- Goldman’s revenues are expected to increase from $36.6 billion in 2018 to $37.4 billion by 2021, mainly driven by growth in Investing & Lending division.

[A] Investment Banking revenues are expected to drop 7% in 2019.

- This division offers Mergers & Acquisitions (M&A) advisory and Equity Underwriting & Debt Origination services across sectors such as energy and power, industrials, healthcare, materials, technology etc.

- Although the segment revenues have grown 25% over the last three years –from $6.3 billion in 2016 to $7.9 billion in 2018, we expect it to decrease by 7% y-o-y in 2019 to $7.3 billion.

- The decline can be attributed to a 15% slump in equity underwriting & debt origination revenues due to negative market conditions and lower activity in the underwriting space, partially offset by 2% growth in M&A advisory revenues.

- Thereafter, we expect market conditions to improve in subsequent years and enable investment banking revenues to cross $8.1 billion by 2021.

[B] Institutional Client Services revenues are expected to decline by 6% from $13.5 billion in 2018 to $12.6 billion in 2019

- It represents Goldman’s securities trading operations which include FICC (Fixed Income, Currency & Commodity) Trading and Equity Trading.

- This segment has contributed more than 36% of total revenues over the last 3 years and is the largest segment.

- Further, revenues have shown high volatility over the last three years due to fluctuating market conditions.

- As a result of this dependence, the recent slump in bond yields and lower consumer activity level is expected to reduce trading revenues by 6% in 2019.

- Thereafter, the segment revenues are expected to grow at an average annual rate of 3% and cross $13.5 billion by 2021– which is at the same level as 2018.

[C] Investment Management has grown 21% over the last three years – from $5.8 billion in 2016 to $7.0 billion in 2018.

- This division represents Goldman’s asset management arm, which provide private individuals with a full range of mutual fund and alternative investment products, and institutional clients with a fully integrated asset management offering.

- The segment revenues are expected to reduce from $7 billion in 2018 to $6.8 billion by 2021 due to secular industry changes.

[D] Although Investing & Lending revenues have grown 2x – from $4.1 billion in 2016 to $8.3 billion in 2018, we expect the growth to slow down in coming years.

- It represents investing and relationship-lending activities across asset classes – including debt and equity securities, and real estate.

- We expect the segment revenues to be around $8.3 billion in 2019, which is at the same level as the previous year.

Our interactive dashboard for Goldman Sachs’ details what is driving changes in revenues of Goldman Sachs’ Investment Management and Investing & Lending segments.

Trefis estimates Goldman Sachs’ stock (shows cash and valuation analysis) to have a fair value of $229, which is roughly 10% higher than the current market price.