(The Motley Fool) - One year ago, deposit outflows became a real problem for banks, and a few failed because of it. One financial company that struggled with falling deposits is Charles Schwab (NYSE: SCHW).

That's because rising interest rates have made it more attractive for investors to move their money into higher-yielding alternatives. Investors learned more about Schwab's deposit situation during its first-quarter earnings call. Here's the latest.

Low-cost deposits have been crucial for Charles Schwab

Charles Schwab provides customers with various financial services, including banking, brokerage, financial planning, and wealth management. The company has historically performed well for investors, thanks to its limited credit exposure and cost-efficient business models.

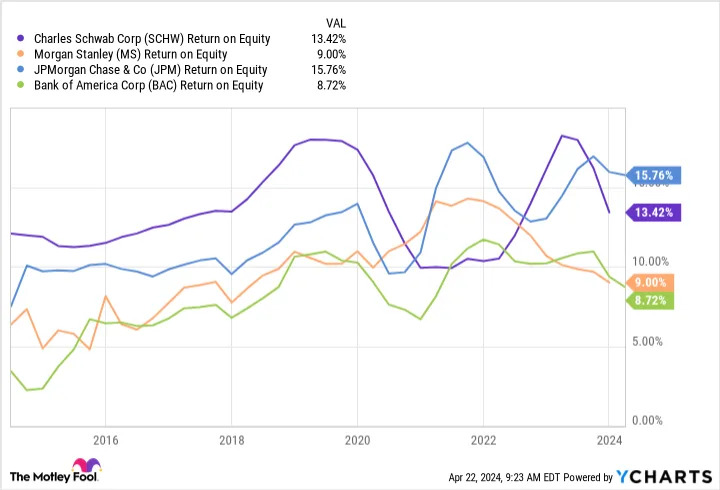

Over the past decade, Schwab's average return on equity is 13.5%, outpacing banks and other financial institutions, JPMorgan Chase (12.2%), Morgan Stanley (9.6%), and Bank of America (8.2%).

One reason for Schwab's solid long-term performance is its reliance on low-cost deposits. While this has worked well for the company over the past decade, it has also caused challenges during times of rising interest rates.

Schwab relies on deposits, most of which are in savings accounts that clients haven't yet invested. Customers shift their funds into high-yield savings accounts or other low-risk assets with appealing yields when interest rates begin rising. As a result, Schwab's balance sheet shrinks along with a big chunk of those low-cost deposits it relies on. The company calls this phenomenon "client cash sorting."

Rising interest rates led to a drastic decline in customer deposits at Schwab

In 2017, Schwab felt the impact of rising interest rates held low by the Federal Reserve for several years following the Great Recession. Rates were cut amid the COVID-19 pandemic. However, inflation began to rear its ugly head, and in March 2022, the Federal Reserve raised interest rates again and proceeded to increase them at the fastest pace in over four decades.

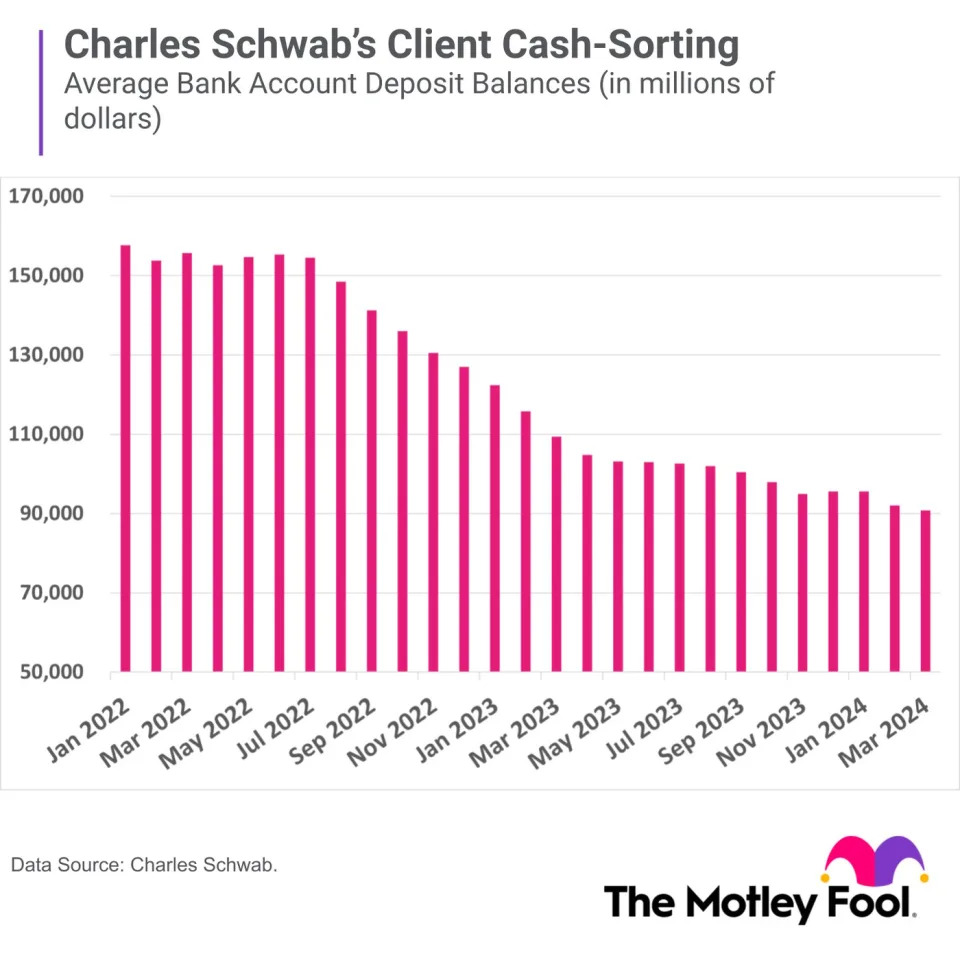

Schwab felt the worst of it from August 2022 through April 2023, when its bank account deposit balances plummeted by nearly $50 billion, or 32%. In other words, clients pulled funds from their bank accounts at Schwab at a pace of $5.6 billion per month to take advantage of higher-interest-earning assets.

The company has been helped by the Federal Reserve's pause on interest rate hikes. Its last interest rate increase was during its July 2023 meeting. With interest rates moderating, Schwab hasn't faced the same surge in outflows. However, deposits continue to bleed out, falling at a pace of $1.2 billion per month since June 2023. In the first quarter, Schwab's deposits fell by $4.7 billion, showing that the company continues to deal with client cash-sorting, albeit at a much slower rate.

A bar chart shows Charles Schwab's average monthly bank account deposit balances over the past two years.

Investors will want to keep an eye on inflation and interest rates

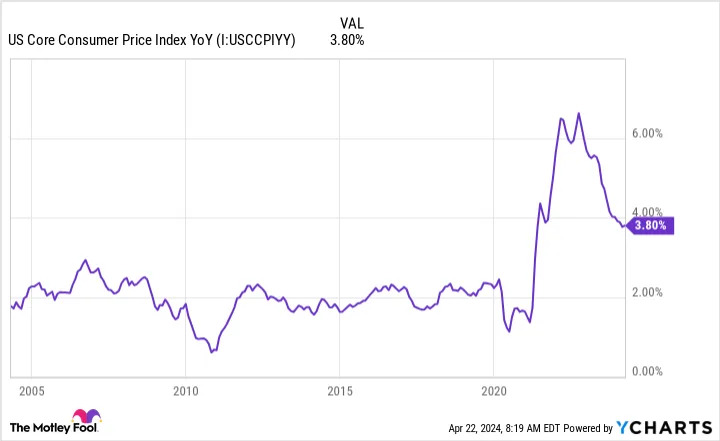

Charles Schwab continues to manage outflows, and one risk is that inflation remains stubbornly high, which could push back interest rate cuts further into the future. Over the past few months, the pace of inflation moderated. After falling for several months, the year-over-year change in the core consumer price index (CPI) has hovered around 3.8% to 3.9% -- above the Federal Reserve's 2% inflation target.

As a result, the expectation for interest rate cuts in 2024 has fallen dramatically. Earlier this year, markets were pricing in up to six interest rate cuts. However, after higher-than-expected inflation readings, markets expect just one rate cut for the rest of the year, per CME FedWatch Tool.

Is it a buy?

Schwab will likely continue to face deposit outflows amid a higher-interest-rate environment, so investors will want to continue monitoring this for changes. However, the company has done a good job riding out the situation, and the worst may be behind it.

During last year's regional banking crisis, Schwab alleviated these pressures by tapping into available lending facilities. The company paid down some of its higher-cost debt in the first quarter and improved its net interest margin to 2%. As it continues paying down this debt, it hopes to boost its net interest margin to 3% by the end of the year -- making Charles Schwab an appealing investment today.

Should you invest $1,000 in Charles Schwab right now?

Before you buy stock in Charles Schwab, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Charles Schwab wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $506,291!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

By Courtney Carlsen, The Motley Fool

*Stock Advisor returns as of April 22, 2024

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Charles Schwab. The Motley Fool recommends the following options: short June 2024 $65 puts on Charles Schwab. The Motley Fool has a disclosure policy.

Has Charles Schwab Solved Its Deposit Outflow Problems? was originally published by The Motley Fool