The Federal Reserve’s latest data show that household wealth dropped by $6.5 trillion from the end of 2019 to March 2020 as the coronavirus pandemic started to take its toll. All of this loss came from a sharp drop in stock prices and happened before average Americans saw unemployment soar to levels not seen since the Great Depression. Taking other data on how average Americans have been doing since March 2020 suggest that the real pain to household wealth has only begun.

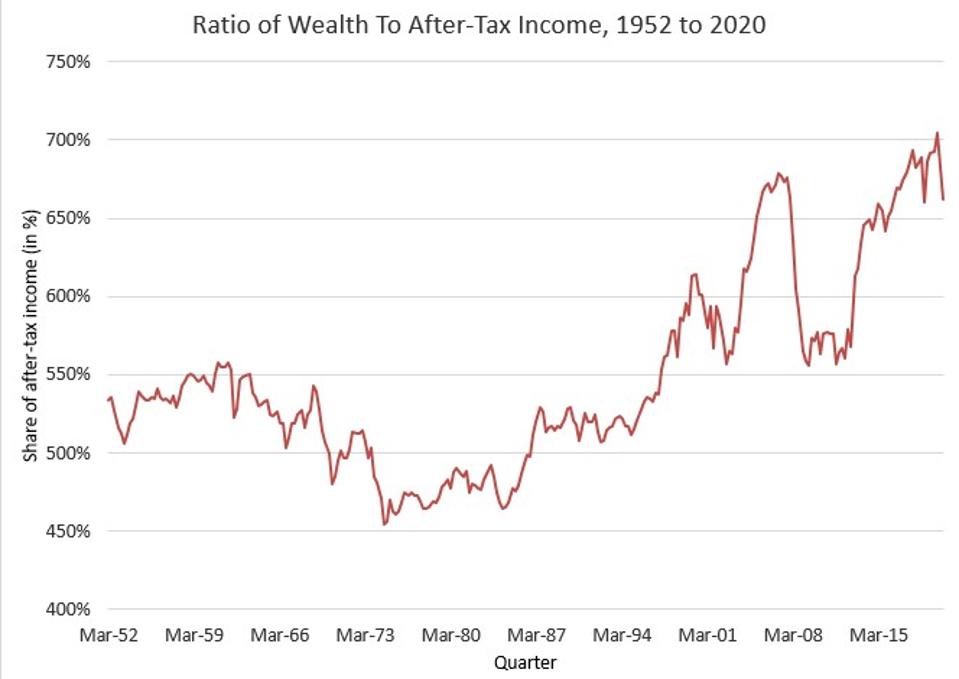

Household wealth went into freefall at the start of the year as Wall Street took a nosedive amid uncertainty over the economic impact of the novel coronavirus. Over the first three months of this year, households experienced a wealth loss of $6.5 trillion. All of it (and then some) came from a $6.9 trillion drop in financial assets, offset by gains in home equity at the same time. As a result of the loss in stock market value, total household wealth had dropped to 662.0% of after-tax income by the end of March, its lowest level since March 2016 (see figure below). But this decline in wealth was heavily concentrated among those who owned stocks.

And stock ownership is very unevenly distributed among households. According to the Federal Reserve’s Distributional Financial Accounts, the wealthiest 10% of households owned 78.9% of all stocks and mutual funds in the country. In contrast, the bottom half of all households owned 0.8% of all stocks and mutual funds at that time. The initial hit to household wealth hurt mostly those at the very top.

But the stock market does not capture the economic pain that many households feel in their finances in the ongoing downturn. On the contrary, the stock market quickly recovered much of its losses since March, while the recession took hold, unemployment skyrocketed and financial insecurity became more widespread.

The Federal Reserve, for instance, conducted a survey in April of households’ financial security. At that point, 39% of those living in households with income of less than $40,000 reported a job loss in March, when the recession just started to get going. The economic pain has become only more widespread since then.

For most households, a job loss can quickly spill into economic trouble since they have few financial resources to fall back on. Only 46% of those with a job loss or reduced hours could come up with $400 in an emergency in March 2020. But even among those who had not suffered a job loss yet, 32% could not come up with $400 in an emergency at that point. Many households were ill prepared for a financial emergency before the crisis. The recession’s widespread economic impact on jobs and incomes left a large number of American families exposed to a high risks of massive financial security.

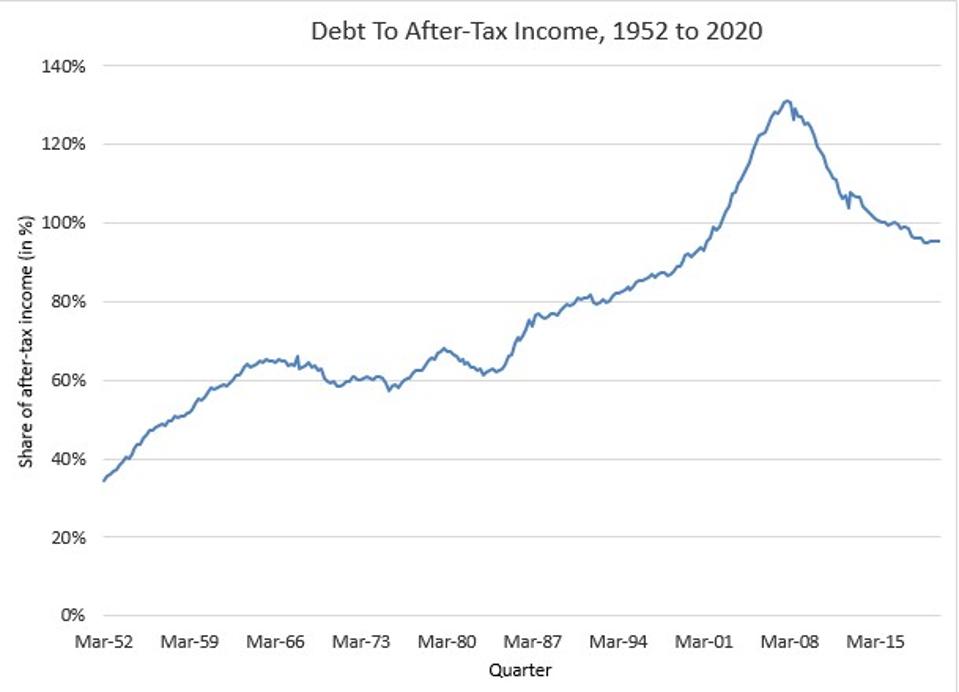

The rapid rise in financial insecurity among many households also occurs among widespread indebtedness. On average, household debt equaled a still high 99.4% of after-tax income in March 2020 (see figure below). Debt levels had in fact fallen since the Great Recession in large part because many households either default on their mortgages or because they couldn’t get a mortgage to buy a house. At the same time, though, non-revolving consumer credit – mainly car and student loans – rose to $3.1 trillion at the end of 2019, which equaled a record high of 18.6% of after-tax income then, before dropping slightly to 18.4% of after-tax income by March 2020. Before the recession hit, households borrowed where they could as they faced rising costs for education and other key items that outpaced incomes. As the recession lingers, many households will again turn to debt to pay for key things such as their children’s education and a new car to get to work.

One additional key risk for many families’ finances, aside from having to go even deeper into debt, is the potential loss of their house if they can no longer pay their mortgage. Estimates based on weekly U.S. Census data, for instance, show that about 12% of mortgagees did not pay their mortgage last month or deferred payment in May 2020. And about one-in-six households say that they have no or slight confidence in paying their mortgage next month or that they will defer it. About one-in-five households either currently have trouble or expect future trouble paying their mortgage. As many homeowners struggle to pay their mortgage, they could eventually face default and foreclosure, setting off a downward spiral in house prices that could decimate the value of people’s most important asset, their house.

The massive losses in people’s stock portfolios early during the coronavirus pandemic did not reflect the experience of the average American family. Worse, while stock portfolios quickly recovered since March this year, the rest of the economy is still in a major recession. Widespread and ongoing job and income losses could once again decimated wealth and savings of low-income and middle-income households, as they did after the Great Recession. Household debt, especially costly non-mortgage debt could grow to new record highs, while many could experience a drop in their house values. The decline in middle-class wealth has only gotten started.

This article originally appeared on Forbes.