(Trustnet) - Investors are placing a greater need on investment security as a result of the post-pandemic stock market rise and paltry yields from bonds.

According to Steve Kenny, commercial director at Square Mile Investment Consulting & Research, one of the most common questions asked by clients is how they are to protect their cash.

The answer is not clear. Yields from bonds remain near historic lows as central banks pumped cash into the system to keep economies afloat during the pandemic and have yet to withdraw this support. This has kept interest rates low and forced savers to look to riskier assets for their returns, which has pushed stock markets to expensive levels.

“People started buying infrastructure for diversification, but that is correlated to equities, so you are basically buying equity risk,” said Kenny.

There has also been a “resurgence of interest” in the targeted absolute return sector, something that was popular in the past but lost its appeal as many funds struggled to make positive returns consistently.

“Independent financial advisers (IFAs) have had a torrid time with absolute return funds. Some would say that 95% of the sector is unfit for purpose and is full of portfolios masquerading as equity based funds,” he said.

However, he noted that there were “a few nuggets in there” and suggested people with a shorter time horizon should look to build a basket of “three or four funds where there are different types of diversification that bundled together provide true differentiation”.

This approach would be particularly appealing to someone in, or nearing, retirement. Those in their 50s or older have accrued a significant proportion of their wealth, he said, and therefore would be more willing to sacrifice stock market returns for some protection.

Tom Archer, investment research analyst at Square Mile, said the JPM Global Macro Opportunities was a good option for people looking to protect their capital through absolute return funds.

Since it launched in February 2013, the portfolio has made 80.4%, or more than 7% per year, but, crucially, is easier to understand than some of its peers.

“Although most global macro funds contain complicated amalgams of investments spanning all the major asset classes, this fund’s exposures are concentrated in equity markets,” he said.

“Returns can be more volatile than others in the peer group, but we have high conviction that the fund can continue not only to deliver to its objectives but also protect investors’ capital to a substantial extent in times of market turmoil.”

A compliment to this slightly more aggressive fund would be the Blackrock European Absolute Alpha portfolio.

Total return of funds over 5yrs

Source: FE Analytics

Managers Stephanie Bothwell and FE fundinfo Alpha Manager Stefan Gries believe consistent, absolute returns, coupled with low volatility, can be generated through a portfolio with low net market exposure and in which the main driver of those returns is stock selection.

“As such, the fund combines both long and short investments in European stock markets,” Archer said.

Since launch in April 2009, the fund has delivered consistent mid-single digit absolute returns and has had only one losing calendar year (2016).

“In the first quarter of 2020, when European equity markets were down by 22%, the fund was up 4%. We are confident that the fund can continue to deliver steady absolute returns and will also preserve investors’ capital to a very high degree in market downturns,” he said.

However, absolute return funds are not the best way for those with a long-term horizon. Indeed, while the firm is using these funds as a hedge currently, Kenny said that it was “probably not” a long-term solution.

“You can argue we are using it as a tactical play at the moment because fixed income is not the place to be. Is it a longer-term allocation? Probably not. But how long we will use it I cannot tell you. It is working now and it will stay in the portfolios until we think it will no longer do so,” he said.

For younger investors under 50, or those that are willing to take a much longer view, he said that smaller companies were the best way to diversify away from the traditional market-leading stocks.

Although market minnows tend to bear the brunt of the stock market falls during downturns, they often recover quicker, a phenomenon that Columbia Threadneedle manager James Thorne outlined last week.

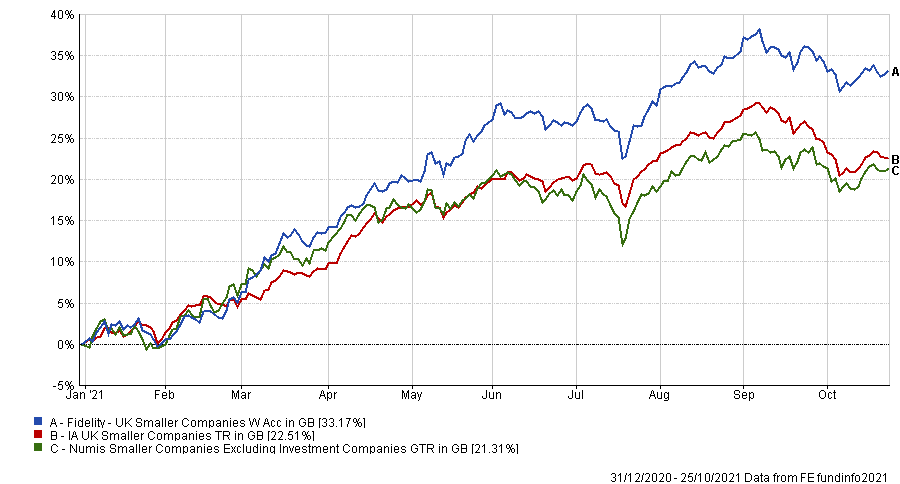

John Monaghan, head of research at Square Mile, said one option for younger investors was the Fidelity UK Smaller Companies fund.

“The performance of the UK Smaller Companies sector is typically very volatile, however the approach behind this fund, which focuses on downside risk and therefore protecting capital when markets are challenging, has proven to be very successful since launch,” he said.

Manager Jonathan Winton takes a contrarian stance, buying unloved companies in the hope they can rebound. This year it has been a particularly fruitful strategy: the fund is the second-best performer in the IA UK Smaller Companies sector, returning more than 50%.

Total return of fund vs sector and benchmark over YTD

Source: FE Analytics

“There will be times when this style is out of favour, but over the longer-term the fund should provide investors with impressive returns,” said Monaghan.

By Jonathan Jones

Editor, Trustnet

October 27, 2021