Kylie Jenner sits at a dark-wood dining table at her mother's home in Calabasas, California, flicking through display options for a forthcoming pop-up shop.

The youngest member of the Kardashian-Jenner industrial complex needs to decide how to showcase products by her Kylie Cosmetics makeup company.

She taps her black iPhone X with a silver glittery nail and turns the screen around to show a coterie of employees a vending machine.

"You guys, imagine this, but all in lip kits," says Jenner, dressed in a black blazer and matching black patent Louboutins with bright red soles.

"I think it needs to be a clear vending machine where you see all the colors."

What her half-sister Kim Kardashian West did for booty, Jenner has done for full lips. Like Kardashian West, she has leveraged her assets to gain both fame and money. But while her sister is best-known for the former, Jenner has proved adept at the latter. In historic fashion.

Just 20 when this story publishes and an extremely young mother, Jenner runs one of the hottest makeup companies ever.

Kylie Cosmetics launched two years ago with a $29 "lip kit" consisting of a matching set of lipstick and lip liner, and has sold more than $630 million worth of makeup since, including an estimated $330 million in 2017.

Even using a conservative multiple, and applying our standard 20% discount, Forbes values her company, which has since added other cosmetics like eye shadow and concealer, at nearly $800 million. Jenner owns 100% of it.

Add to that the millions she's earned from TV programs and endorsing products like Puma shoes and PacSun clothing, and $60 million in estimated after-tax dividends she's taken from her company, and she's conservatively worth $900 million, which along with her age makes her the youngest person on the fourth annual ranking of America's Richest Self-Made Women.

But she's not just making history as a woman.

Another year of growth will make her the youngest self-made billionaire ever, male or female, trumping Mark Zuckerberg, who became a billionaire at age 23.

Ultimately their fortunes all derive from the same place. "Social media is an amazing platform," Jenner says. "I have such easy access to my fans and my customers."

That and a large dose of tastemaking are pretty much her entire business, an invention of the Instagram age. Hewlett and Packard immortalized the garage–Jenner has her kitchen table.

Her near-billion-dollar empire consists of just seven full-time and five part-time employees. Manufacturing and packaging?

Outsourced to Seed Beauty, a private-label producer in nearby Oxnard, California. Sales and fulfillment?

Outsourced to the online outlet Shopify. Finance and PR? Her shrewd mother, Kris, handles the actual business stuff, in exchange for the 10% management cut she takes from all her children. As ultralight startups go, Jenner's operation is essentially air. And because of those minuscule overhead and marketing costs, the profits are outsize and go right into Jenner's pocket.

Basically, all Jenner does to make all that money is leverage her social media following. Almost hourly, she takes to Instagram and Snapchat, pouting for selfies with captions about which Kylie Cosmetics shades she's wearing, takes videos of forthcoming products and announces new launches.

It sounds inane until you realize that she has over 110 million followers on Instagram and millions more on Snapchat, and many of them are young women and girls–an audience at once massive and targeted, at least if you're selling lip products.

And that's before the 16.4 million who follow her company directly, or the 25.6 million who follow her on Twitter, or the occasional social media assists from her siblings and friends.

It's not that much different from the early days of Donald Trump's presidential campaign, when his strategy basically consisted of calling in to TV shows, tweeting provocatively and holding an occasional rally.

Products of reality television, both Trump and Jenner understood how fame can be leveraged–that they are as much brands as people and that fame is just another word for free marketing.

While this has always been somewhat true–t's the very nature of a celebrity endorsement–social media has weaponized fame to the point that a real estate mogul can be president and a 20-year-old from a family "famous for being famous" can approach billionaire status by monetizing that to the extreme.

Given its perpetually young consumer base, the $532 billion beauty industry has always been inordinately driven by influencers and role models. As with fast fashion in clothing, Generation Z consumers have been eschewing lethargic makeup brands like L'Oréal, Estée Lauder and Coty in favor of quick-to-market products that they learn about via social media.

A former aesthetician for women like Cindy Crawford and Naomi Campbell, Anastasia Soare started selling eyebrow pigments and pencils through her Anastasia Beverly Hills in 2000.

The line exploded when it reportedly joined Instagram in 2013 and began sending influencers free makeup to publicize the brand. Now with 17 million followers and products sold in 3,000-plus stores, Soare, 60, debuts on the self-made women's list with an estimated $1 billion.

Instagram also helped Huda Kattan, 34, make our list for the first time this year, with an estimated net worth of $550 million.

A makeup artist turned digital influencer, with 26 million Instagram followers, she started Huda Beauty in 2013 after three years of blogging about cosmetics.

In December the company sold a minority stake to private equity firm TSG Consumer Partners; its recent $1 billion valuation translates into five times retail sales.

Jenner's massive and massively loyal following, however, puts her in a class of her own.

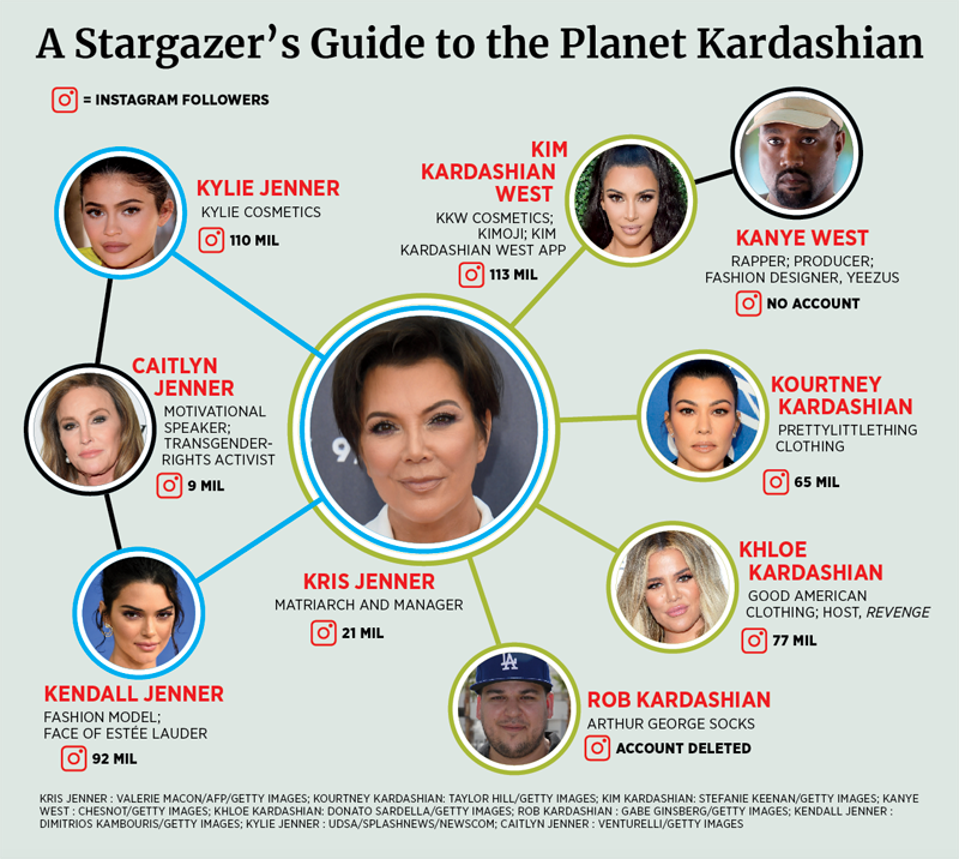

The youngest daughter of Kris and Caitlyn Jenner, sibling of supermodel Kendall Jenner and half-sister of Kim, Kourtney, Khloe and Rob Kardashian, Kylie Jenner grew up under a microscope.

The family's Keeping Up With the Kardashians first aired when she was just 10 years old, beaming her onto television screens in more than 160 countries.

Steered by their mother, Kris, each scion had a moneymaking scheme, from mobile gaming (Kim) to modeling (Kendall) and even socks (Rob), but the teenage Jenner felt adrift.

"I struggled for a minute with finding something to do on my own," Jenner says. With her mother's guidance, she started making seven figures as a model, notching endorsement deals with British retailer Topshop and Sinful Colors nail polish, among others.

Unsurprisingly for a child who grew up on camera, Jenner has always been precocious–especially in her appearance.

"Ever since I was in sixth grade, I would wear purple eye shadow," Jenner says. "I turned to makeup to help me feel more confident."

She learned about makeup by watching YouTube videos and scrutinizing the professionals painting her face for TV appearances and photo shoots. Jenner, who claims she was insecure about her lips, developed the habit of applying liner beyond her lips' natural perimeter to create the illusion of bigger lips.

In August 2014, at age 17, she presciently trademarked the phrase "Kylie Lip Kits ... for the perfect pout," two years before going out on her own.

As with sister Kim's sex-tape fame, Kylie Cosmetics got started by capitalizing on a scandal.

By 2014, Jenner's appearance became tabloid fodder as the size of her lips ballooned. On social media, teenagers popularized the "Kylie Jenner Lip Challenge," a viral fad in which they inserted their lips into a shot glass and then sucked out the air. In May 2015, she admitted to having temporary lip fillers–and with Kris Jenner dusting off her Kim Kardashian playbook, she almost immediately cashed in on it. "I said, 'I'm ready to put up my own money. I don't want to do it with anyone else,' " Jenner recalls.

She used some $250,000 of her earnings from modeling gigs to pay an outside company to produce the first 15,000 lip kits.

An intuitive marketer like most of her family, she spent months teasing the kits on Instagram, then announced the launch via social media just a day before they went on sale–November 30, 2015.

The kits sold out in less than a minute.

Resellers started offering the $29 product on eBay for up to $1,000. "Before I even refreshed the page, everything was sold out," Jenner says.

This is where Mom comes in again.

As with all the Kardashian-Jenners' ventures, Kris Jenner tends to drive the big moves.

Sensing that this could be an ongoing business, not just a one-time stunt, she brought in e-commerce platform Shopify, run by billionaire Canadian entrepreneur Tobi Lutke, that December.

Kylie Lip Kits relaunched as Kylie Cosmetics on Shopify in February 2016, this time stocked with 500,000 lip kits in six shades. "You could watch the buildup happen on the store as [the launch time] approached," says Loren Padelford, who runs the high-volume Shopify Plus.

"To watch the internet focus down on one website was crazy."

The numbers kept getting bigger.

In November 2016 her holiday collection snagged nearly $19 million worth of orders in the 24 hours after it launched.

By the end of 2016 Jenner's company was selling 50-odd products, with revenue of $307 million–for a company less than a year old.

"No other influencer has ever gotten to the volume or had the rabid fans and consistency that Kylie has had for the last two and a half years," adds Padelford, whose Shopify Plus also powers the online stores of Drake, Justin Bieber–and Kardashian West.

Jenner began experimenting with brick-and-mortar retail, with a limited Topshop run and pop-ups in New York, Los Angeles and San Francisco that saw lines stretch for blocks (her first pop-up, in December 2016 at the Westfield Topanga mall near Los Angeles, attracted 25,000 customers in 14 days).

But at the end of the day, why bother?

To use Shopify's platform, Jenner pays an estimated $480,000 annually, plus 0.15% of sales–pennies compared with the cost of doing that volume at physical retail.

The manufacturing works similarly. Kris Jenner found siblings John and Laura Nelson, inheritors of Spatz Laboratories, which has long produced private-label cosmetics out of its 80,000-square-foot facility in Oxnard and an outpost in Nanjing, China.

That's where all of Kylie's products are now formulated and made. Its parent company, Seed Beauty, also handles everything else, from packaging to shipping fulfillment. Altogether they employ more than 500 people just to work on Kylie Cosmetics.

But it's more than scale. Jenner wisely defers to the Nelsons' know-how rather than develop and test new formulas, a process that can take up to six months. That allows Jenner to introduce new products for her trend-driven fan base within weeks of conjuring them.

It's a huge win for Spatz, which Forbes estimates got paid $180 million in 2017 for products and services, or roughly 55% of total sales.

But the deal also ultimately allows Jenner to be a mogul while sitting at home, posting pictures and pondering new looks.

Back at Kylie Cosmetics world headquarters for the day–looking out at her mom's swimming pool while sipping an iced tea–Jenner prepares to hop into her black Bentley Bentayga to pick up her 5-month-old daughter. "Maybe one day [I'll] pass this on to Stormi, if she's into it," says Jenner, who envisions working on Kylie Cosmetics "forever."

Such a worldview is more in line with a naïve 20-year-old than a near-billionaire mogul.

It seems far-fetched to think the brand, whose customers are mostly women ages 18 to 34, will last that long, much less independently.

Especially with a business tied to the fickle world of personal fame. Stars fall out of public favor or lose interest.

And others see the gravy train and jump in. Capitalizing on her front-row view, Kardashian West founded her own line, KKW Beauty, in June 2017 and has already nabbed an estimated $100 million in revenue. Rihanna followed in September with Fenty Beauty, which focuses on color-inclusive shades, in partnership with LVMH division Kendo.

"All of them could change their minds," Shannon Coyne, an equity research analyst at BMO Capital Markets, says of the influx of celebrity makeup entrepreneurs. "Kylie seems to want to create this beauty empire, but anything can happen, and she's so young."

Kylie Cosmetics' growth is already starting to taper off: After leaping to $307 million in 2016, revenue grew just 7% in 2017, despite the addition of 30 new products.

Forbes estimates lip-kit revenue dipped 35% from approximately $153 million in 2016 to $99 million in 2017. Still, Kris Jenner says revenue is up "considerably" in the first six months of 2018 compared with the same period last year–a claim that Forbes couldn't verify.

While Jenner dismisses the idea of selling out, her calculating mother–who got paid an estimated $17 million by her daughter in the past year–can do the math. "It's always something that we're willing to explore," she says.

FORBES

FORBES

Would someone buy it? "It could easily be an instant game-changing acquisition for any company on the hunt for a winning brand with a younger customer," says Tara Simon, senior vice president of merchandising at cosmetics giant Ulta.

But celebrity lines cannot command valuations anywhere near the six times revenue that other beauty brands demand because of the volatility of relying on one name to sell a product.

Kylie Cosmetics could certainly sell for half that, or three times sales, which is where Forbes places its valuation.

"They're not looking to be sustainable brands," said Mintel's Sarah Jindal, referring to Kylie Cosmetics and KKW Beauty. "In a couple of years it wouldn't surprise me if she was on to something else. When you are leveraging your name, you can turn it into anything you want to sell."

When you can make such quick cash, who needs a big exit?

Kylie Cosmetics has already generated an estimated $230 million in net profit. And sometime later this year, its owner will likely take a title that Bill Gates and Mark Zuckerberg once held–youngest-ever self-made billionaire, redefining in the process the very nature of "self-made." It's quite a world we live in.