“The best time to plant a tree was twenty years ago. The second-best time is now.” This ancient Chinese proverb makes perfect sense. When it comes right down to basic principles, however, I think it makes even better sense when thinking about preparing for inheritance. Inheritance is something that falls in the category of “death and taxes”. We will likely all get to experience dealing with inheritance, either as one who is the beneficiary of the inheritance, as one who is the provider, and for many of us, both. If you are dealing with an inheritance, you potentially have the double impact of working through a loss, while also navigating the probate system. This probate process becomes even more complex due to the variance of the nuances from locality to locality. The basic system is the same. However, how that system is administered depends on the location in which you are experiencing it. Dealing with loss almost never changes.

Thanks to the Tax Cuts and Jobs Act, signed into law in 2017, the exemption for federal estate taxes was doubled and indexed to inflation. There are also no federal taxes on inherited assets, such as stocks, providing heirs an advantage when they inherit an appreciated asset. However, according to the Tax Foundation, an independent tax policy non-profit, as of 2020, seventeen states and the District of Columbia may tax your inheritance, your estate or both.

Early in 2020, we at Warren Financial helped a client through the process of dealing with a significant inheritance including many shares her father had accumulated through a long career with his company, Norfolk Southern (NSC), multiple insurance policies and an annuity. The estate was to be divided between our client and her sister. The stock was easily divided between the two, with each receiving 2,700 shares. The stock had been purchased by her father over a 40-year career. Given the challenges to the transportation sector due to COVID-19, our client wanted to reduce her concentration in this one holding and re-deploy the capital into other holdings, specifically the ‘stay at home’ plays of big-tech such as Amazon (AMZN, Invesco QQQ Trust (QQQ) and Zoom Video Communications (ZM). Thankfully, because the cost for each share could be ‘stepped up’ to the market price as of the day they were inherited, the capital gains tax on the liquidated shares was minimized. If the latest Biden tax increase proposal goes through Congress, this type of step-up in cost basis on death could be eliminated which would cost everyone inheriting anything of value to pay significantly more tax.

In a conversation I had with someone who recently went through the process twice as executor of two estates at nearly the same time, he shared that while he recognized that the probate court system is congested, he was surprised at how little help they would provide. As he said, the most vexing thing about the estate and probate process was experiencing the people who work in the court system. Court employees were adamant that they were not lawyers and would not provide basic guidance and information about the process, the forms, and the status of the estate as it worked its way through the court system. Our client also had a related challenge where he didn’t have a full understanding of what was involved in the estate.

For him, it came down to learning to ask for legal information (which is allowable) versus legal advice (which is not). As he learned – the ‘court part’ (e.g., standing in front of a judge) – was fine. It was the ‘preparing’ part that caused so much anxiety. Every estate, no matter how similar, is unique. The locality that will probate the estate is likely unique as well. His advice was to do as much as you can in advance. Don’t leave anything to chance or interpretation by the benefactors. Family members generally always get along well – until they don’t.

Another person I spoke with shared similar observations. When her mother passed away, she was left as the executrix of a complex estate – homes in multiple states, as well as investment assets. While she was successful in navigating probate in various jurisdictions, her number one piece of advice would be to contact an attorney sooner. She was able to complete all the forms and documents herself before hiring an attorney which was helpful for her to really understand what the estate included. However, during a challenging time such as this with a lot of added stress, it was a good idea to seek out help. In fact, pulling together a team of help to work through legal, tax and financial considerations is a great option. The emphasis is on “team” versus a group of advisors. Each offers domain expertise, but bringing them together to collectively address what can be an overly complex process will be well worth it. Additionally, for any team to have optimal results, there should be someone running point. With the most regular and consistent exposure to a client’s life, your financial advisor could make the best choice to lead your team of experts.

In addition to settling the estates finances and legalities, multiple people with whom I spoke also had the task of emptying their parents’ home after they passed. In some respects, although complex, the financial and legal issues were a bit easier than considering personal effects. A repeated bit of advice was to go through documents now to purge unneeded files rather than leave it to your heirs to sort through. And speaking of sorting through, while you may have a warm spot in your heart for trinkets and mementos, your heirs might not. If they don’t want that set of crystal wine glasses today, they likely won’t want it after you’re gone. Do everyone a favor and donate today what you could force someone to decide about in the future.

If you have someone in your life who may require additional assistance and care after your passing, a trust may be required. The trust document will define who the trust is designed to protect and provide for, the trustee that will administer the trust, and other details that will be necessary. A client’s father recently passed away leaving a widow and two adult children – one was my client, the other was her sister who will need some help for care and support. The trust document detailed what the adult child will receive and when. There was one critical detail that was omitted: how to manage the assets to ensure the individual doesn’t run out of money when she most needs it. While it is important to safeguard the trust assets to prevent loss, it’s also important to understand the implications of the selected investment strategy. Too aggressive and the trust could run short. Too conservative and you could have the same result. At a minimum, it’s important that the trust assets keep up with inflation and sufficient funds are allocated for likely needed medical care as the trustee ages.

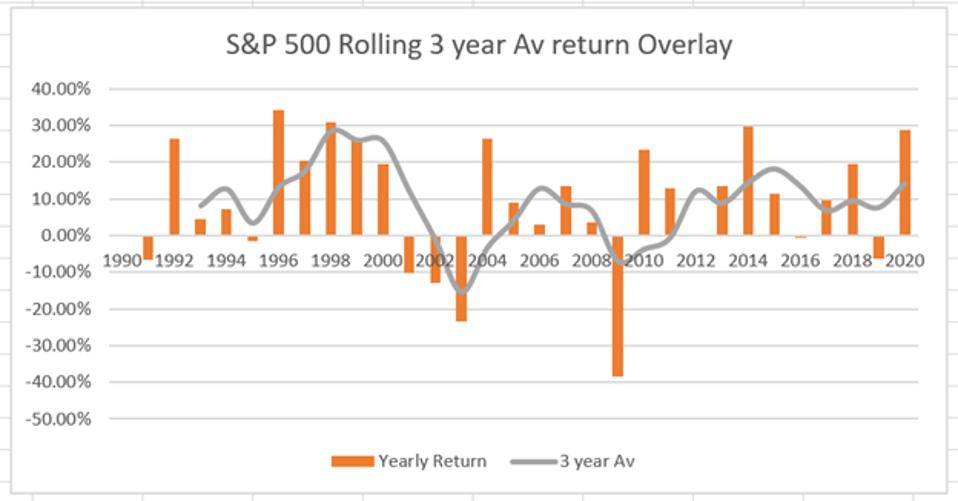

What we suggested was a layered approach – a years’ worth of cash, two years’ worth in a money market fund that earns some interest, albeit small. The balance would be invested in equities, such as S&P500 index (SPY) SPY 0.0%, PayPa PYPL +0.8%l (PYPL), TradeDesk (TTD), Restoration Hardware (RH), Microsoft (MSFT MSFT 0.0%), WorkDa WDAY +0.7%y (WDAY), Lennar LEN -0.6%(LEN), Facebook (FB FB -0.3%), Taiwan Semi (TSM), and others. Note that building a portfolio is more than just picking great companies, it is critical to size each stock purchase appropriately. This strategy was to ensure that there would be sufficient cash at all times, while taking advantage of three-year averages of market returns to provide for replacement of the cash used. Why three years? The market has historically nearly always provided positive returns with very few exceptions (see graph).

S&P 500 Rolling 3 Year Average Return Overlay

WARREN FINANCIALWarren Buffett said it best when he stated that “someone is sitting in the shade today because someone planted a tree a long time ago.” In our business, we are given the privilege of helping our clients ‘plant trees’ (building wealth, in other words), but we also get to provide value as we help them prepare for the time when they pass on their ‘forest’ (their estates) to those that follow. You likely have thought many times that you need to get your affairs in order. But speaking about end-of-life issues can be a little daunting and easy to put off until sometime in the future. To help motivate you to not delay this important conversation, I’d encourage you to think forward about the person (or persons) who will be sitting in the shade you successfully and graciously generated for them. That might be just the encouragement you need to sit down and create the plan needed.

Creating a plan for an estate, or to help someone who you may one day be inheriting an estate from, consider these five things that you can do today that will ensure a less stressful future for your heirs and peace of mind for you:

1. Write your will. More importantly, include the specific details regarding what you want done with your estate, and the assets you want to give to someone special. While you’re at it, include an advance medical directive and descriptions and explanations of final arrangements so that if needed, your family will be able to provide for your wishes exactly as you intended. Create or review your will every few years to make sure that it is accurate and still represents your intensions.

2. Gather copies of all pertinent documents (such as the will, insurance policies, bank and investment account identification, including websites, documentation that describes what is held where, passwords, etc.), creating an encyclopedia of the legal and informational documents that will be needed to settle your estate. It would be helpful to digitize this so that it is easier to store and protect. Give a copy to your financial advisor. And then tell someone where it is stored.

3. Create a contact list of the many people that are currently working with you, names, addresses (street and email), phone numbers, their firm name and relationship to your estate. This will be needed when your executor is going through the process of closing out your estate.

4. Establish trusts as needed to care for dependents and others noted in your will that will need your help after your passing. You’re likely already working with a wealth advisor. Engage their help in designing a plan to ensure an appropriate degree of risk. A properly risk mitigated portfolio will enable the trust to fund the care for the trustee as long as needed.

5. Pull together a team to help you through this time. Probate is challenging enough, don’t try to navigate the entire process alone.

As Nelson Henderson once wrote: “the true meaning of life is to plant trees, under whose shade you do not expect to sit.” Here’s to a life well lived, full of success for you and your heirs and plenty of shade for all.

This article originally appeared on Forbes.