(Forbes)

OBSERVATIONS FROM THE FINTECH SNARK TANK

A Knowledge@Wharton article titled Why Partnerships Are the Future for Fintech asserts:

“As the finance industry grapples with what the next generation of banks and payment systems will look like, it’s clear that partnerships are a linchpin for riding the wave of change successfully.”

The article backs up this claim with the following points:

- According to Denise Leonhard of Paypal, “[Nobody] is going to be able to do it alone. To get to the next evolution of payments, it’s going to be really partnership driven. Established firms offer fintechs a level of scale they wouldn’t be able to access otherwise. [Fintechs] may have a great unique solution, but they can’t actually scale, and you need scale to drive forward.”

- Leonhard’s sentiment is supported from the other side of the aisle. According to the head of mortgage for Plaid, “There is a lot we can gain from partnering with financial institutions. Banks have scale, they have brand alignment.”

- According to a 2016 study by Wharton professor Serguei Netessine, “the majority of Global 500 companies have a variety of ways of partnering with startups.” The article states “that engagement took the shape of M&A, investment funds, spin-offs, accelerators and incubators, events, support services, startup programs and offering co-working spaces–or a combination of several of these.”

Partnerships are Not the Future of Fintech

“Bank/fintech partnerships are crucial to the future of banking” has become a widely accepted meme in the industry.

In a recent study from Finextra, 81% of bank executives surveyed said that collaborating with partners was the best strategy to achieve digital transformation.

They’re going to be disappointed.

The vast majority of banks are not well suited to partnerships:

- Larger institutions may have the resources to identify, vet, and enter into partnerships, but their size and organizational complexity makes operationalizing and scaling partnerships difficult.

- Smaller institutions typically don’t have the resources or skills needed to identify, vet, and enter into any meaningful number of relationships. Operationalizing partnerships often requires integration into core apps which can be a challenge for smaller institutions.

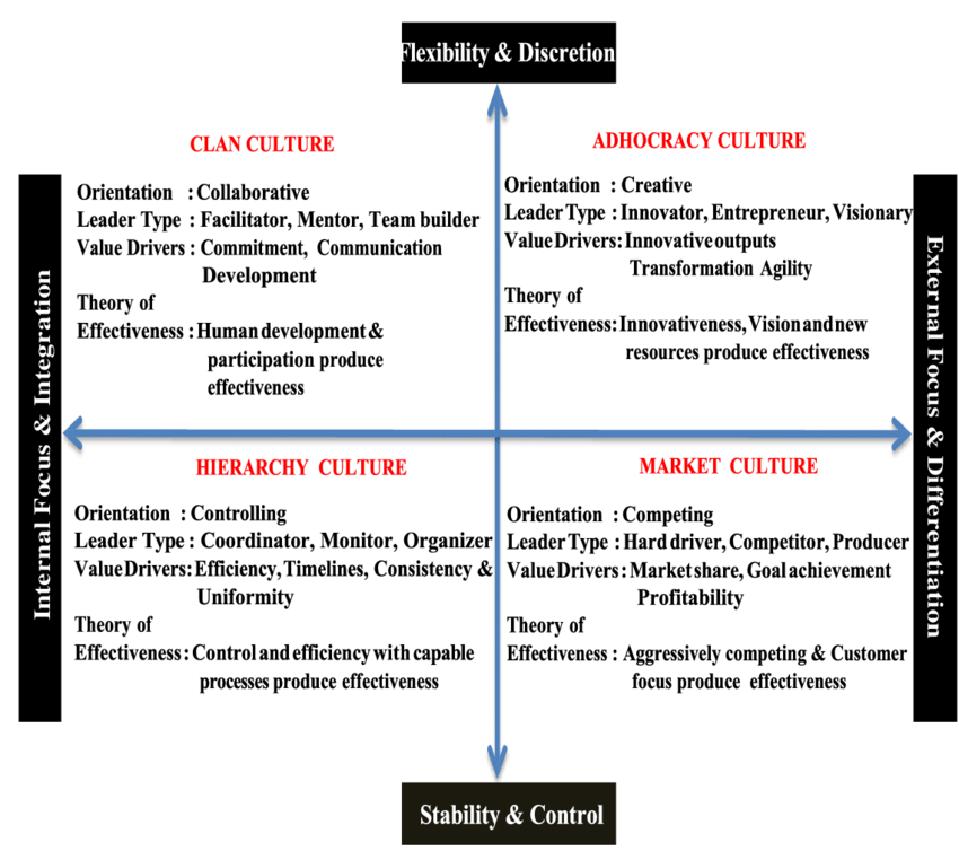

Then there’s the issue of corporate culture which, in many banks, is not conducive to partnering with outside entities. The Competing Values Framework developed by Cameron and Quinn helps explain why–some cultures are more control-oriented than collaborative.

Partnerships Are No Piece of Cake from the Fintech Perspective

Brett King, CEO of fintech Moven told me, “The biggest barrier to bank/fintech partnerships is banks’ procurement departments. They treat us like small IBMs and hammer us with performance and risk clauses that would kill us if we let them.”

Echoing that sentiment was Philippe Gelis, CEO of fintech Kantox, who wrote, “Inside banks, there is also no single decision maker. You need to convince multiple stakeholders that the partnership makes sense, that it will create significant extra value for both parties, and that the risk of cannibalization is low. Once that’s done, you then need to convince their compliance department, IT team and legal.”

What does this all add up to? According to Dr. Louise Beaumont from Publicis.Sapient:

“For banks, partnerships won’t generate the quantum leap they need to move beyond a decades-old, product-centric mentality to deliver next-generation financial services that consumers deserve. At best, they may gain a workable solution that squats awkwardly in the existing infrastructure and brand. At worst, banks will fail to deliver any noticeable difference to customers beyond a flurry of press releases.”

Industry Participants Will Be Connected, But Not in the Form of Partnerships

This isn’t to say that banking industry participants (e.g., institutions, fintechs, and vendors) won’t be highly interconnected–they will be. But one-to-one partnerships won’t be the predominant form of connection. The most prevalent ways to connect will be:

- Platforms. Amazon is a platform. There are over five million marketplace sellers across all Amazon marketplaces (more than one million new to Amazon in 2019 alone). They’re hardly “partners” with Amazon. According to a Forbes article titled Digital Platforms Are Eating Banking, there five types of digital platforms taking over the banking world: 1) Megabank API toolkits; 2) Marketplace platforms; 3) Analytics platforms; 4) Business banking platforms; and 5) Core integration platforms. Platforms provide a plug-and-play capability that enables participants to interact, transact, and integrate without partnership or one-to-one contractual arrangements.

- Open banking. Consulting firm EY defined open banking as: "Online banking and financial services enabled through consumers' ability to offer third-party providers access to their personal bank account data and payment initiation." This type of connection enables the sharing of data between parties without a contractual agreement (i.e., partnership) or transactional capability (like a platform provides).

- [Banking]-as-a-service. The term BaaS is often used interchangeably with open banking, but I’m using the term here to describe what fintechs like Harvest (wealth management-as-a-service) or StreetShares (lending-as-a-service) provide to banks. These arrangements are somewhere between a partnership and a traditional vendor relationship. The BaaS fintech provides a “service” to the financial institution–in these examples by offering a product or service to the market–but with non-traditional service level agreements and support requirements.

- Alliances and consortia. Partnering with each other may be a better starting path to partnering with fintechs. Examples include Alloy Labs Alliance, a shared innovation lab and accelerator, and CU Ledger, a credit union service organization focused on distributed ledger technology.

The End of a Meme

There’s a predictable pattern to management fads and memes. They gain in popularity over a two-year period, go quiet for about a year, then in year four the failure stories come out and the meme dies out (see reengineering, knowledge management, dot coms, big data, etc.).

The “Bank/fintech partnerships are crucial to the future of banking” meme is in year three.

Granted, there are banks that have entered into successful partnerships with fintechs–Radius Bank in Boston and nbkc bank in Kansas City come to mind. They’ve made strategic commitments to making fintech partnering a competency of their organization. They’re the exception, however.

In Advice to Fintech Firms: How to Partner with Banks, Graham Seel writes, “Without shared vision, values, and goals, there can be no partnership.”

Spot on. I would add “shared risk” to that list of partnership criteria.

Using this list of criteria, many bank/fintech “partnerships” fail the test.