The value investing space is dying, but value catalyst investing is alive and thriving, and it’s in this space that ideas can be found to help beat the index in 2020.

The Edge (which sources under-performing companies for activist involvement, Special Situations and Spinoffs) predicts the market will become volatile this year.

Many funds have thrown in the towel, and that is a good sign. When scores of people get out of the space, smarter people start looking at getting in. The Edge fishes in a niche part of the market for interesting ideas where few people do and to remain positive on the returns.

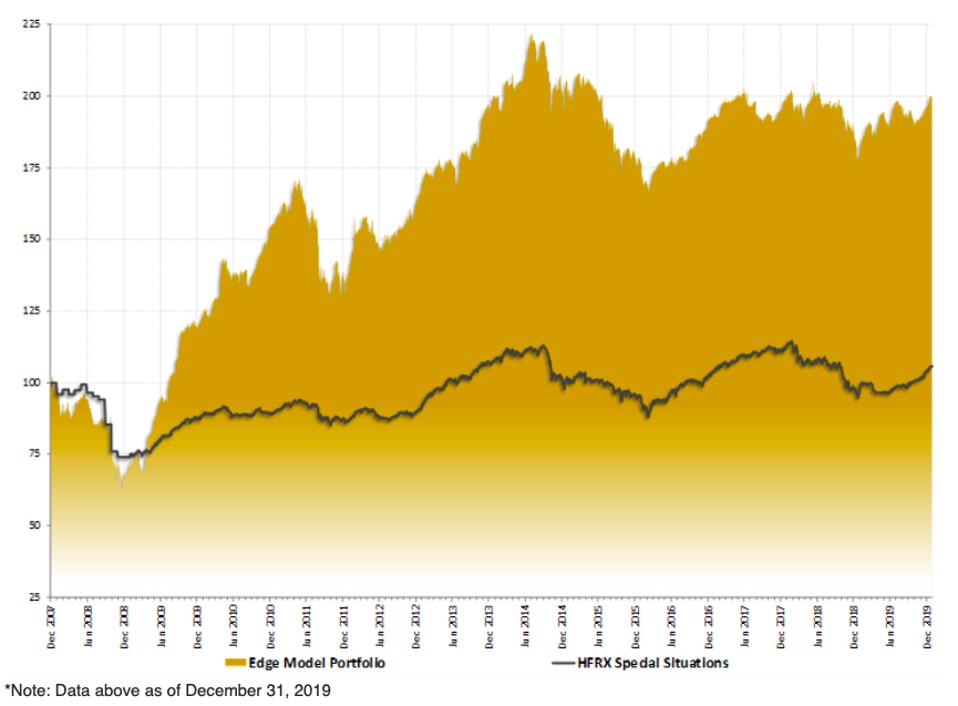

The Edge believes in relativity and benchmarks its performance using a variety of indices. As of December 31, 2019, the Spinoff portfolio (ESR) finished the year +20% whereas the Special Situations portfolio (ESS) closed the year at +12%.

On a combined basis since its inception, The Edge's Model Portfolios have outperformed the HFRX Special Situations Index by +89%. That performance can be seen in the chart below.

Today In: Money

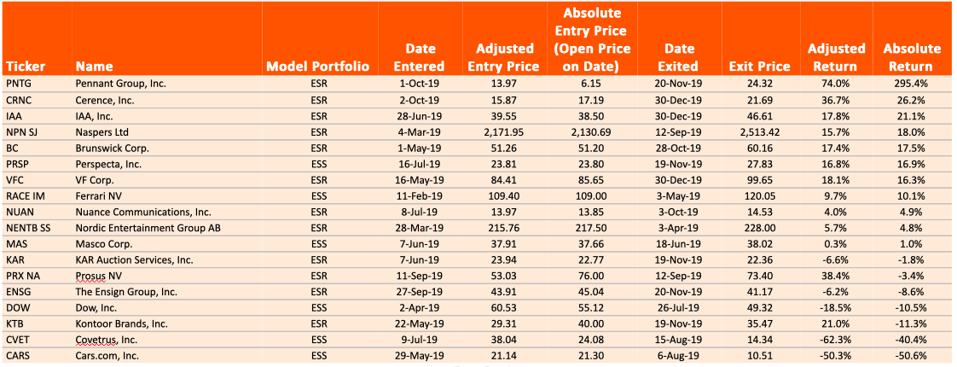

Model Portfolio Names Entered & Exited in 2019

High Conviction names triumphed with Naspers Ltd. (NPN SJ), Perspecta, Inc. (PRSP), Ferrari NV (RACE), and IAA, Inc. (IAA) all realizing returns quickly.

Current Model Portfolio Names Entered in 2019

The Edge tries to keep the Model Portfolio turning over with the best ideas and don’t try to run things beyond their valuation. These names are regularly replaced with newer top ideas. Madison Square Garden (MSG) and the Spinoff of their entertainment business is one to watch, according to The Edge.

Attendees of The Edge’s November conference had a real treat and first look at a new idea presented by activist investor Macellum Capital: Bed Bath & Beyond (BBBY).

Arconic (ARNC) was another real winner, as the insider incentives were key for The Edge, and the fact the world hated the company because of the Grenfell Tower fire appealed to Osman’s contrarian side.

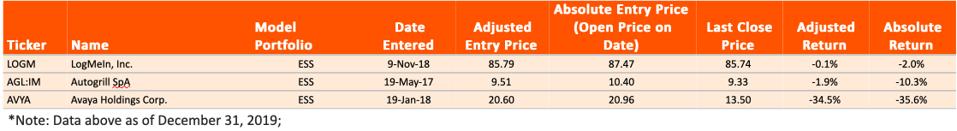

Current Model Portfolio Names Entered Pre-2019

The Edge’s longer-term holdings like software company LogMeIn, Inc. (LOGM) has just been approached for takeover, while holding company Avaya Holdings, Inc. (AVYA) seems to be headed for an exit. The Edge called AVYA correctly out of bankruptcy but were wrong on the equity for now.

Lastly, The Edge anticipated airport and roadway concessions company Autogrill SpA (AGL IM) would look to expand its international exposure and acquire Elior’s concessions business that had been on the block when they transitioned from a Spin to a sale, but that catalyst has yet to play through.

Non-Actioned Idea Flow & Original Recommendations in 2019

In the table below are the remaining names published on during 2019 with their respective original recommendations from The Edge, as well as their relative returns.

CAG (Dec 27, 2019): Since The Edge highlighted an insider buying shares on the open market in July 2019, ConAgra Brands, Inc. (CAG) demonstrated the successful integration of the Pinnacle Foods assets and returned +28% in a strong earnings beat [on December 19]. On the back of this rally, The Edge recommended investors to book profits, considering the management had drafted a strategic shift moving forward that may limit the pace for future growth.

DHR (Dec 30, 2019): With its exchange offer of Envista Holdings Corp. (NVST) complete and limited catalysts ahead, The Edge recommended investors to book profits in Danaher Corp. (DHR) at the end of the year. The stock originally entered the Model Portfolio in July 2018 on the announcement of a Spinoff, which then transitioned into the IPO (and later exchange offer) of NVST, and the stock provided returns of +47% since entry.

This article originally appeared on Forbes.