Paul Arnold leads Morningstar Investment Management's ESG initiative. His insight is always welcome.

Environmental, social and governance (ESG) investing is still new to many investors, and the jargon abounds. Further confusing things, ESG terms are used differently within the industry, making it hard at times to know whether a portfolio is offering what you think it is. In a 2017 survey of institutional investors (like pension funds), 56% of those adopting ESG investing said there was a lack of clarity over ESG terminology within their organization.

ESG investing also employs different strategies. Some focus on how ESG risks may affect investments, while others invest directly in ESG change (like solar power technology or green bonds).

Meanwhile, individuals who seek ESG portfolios tend to focus on values. A 2019 Morgan Stanley survey of 800 individual investors found that 84% wanted their investments to fit their values, which are unique to each person. Some want to avoid investing in anything contrary to their values, while others want to support change in one or more areas. Those areas range from climate change to diversity to faith-based values.

Given the vast array of potential client values on one hand and growing library of ESG investments on the other, it’s important that financial advisors come to a mutual understanding of their clients’ motivations for ESG investing, matching specific values with appropriate investment options. The first step is an in-depth conversation with the client to understand their needs.

The Match

The next step is careful due diligence on ESG investment portfolios available to your client. An advisor should know each portfolio thoroughly to be able to discuss how it would address the client’s values. While many investors may not notice minor differences between standard multi-asset portfolios, ESG investors who learn their portfolio isn’t aligned to their values will likely become concerned.

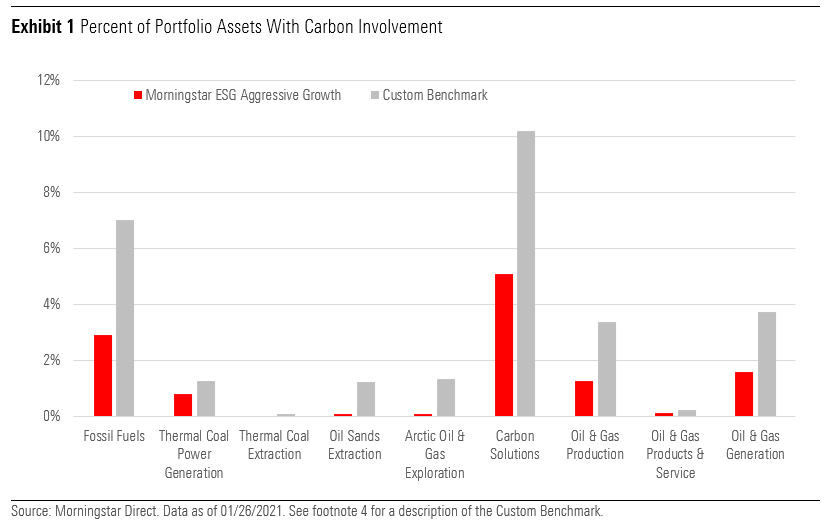

To illustrate differences between portfolios, we’ve compared exposures of the Morningstar ESG Aggressive Growth portfolio to those of its composite benchmark, represented by four non-ESG-focused ETFs. We would expect managers of other ESG portfolios would provide similar information to investors.

We used Morningstar involvement data to tease out ESG value differences between the two portfolios. “Involvement” refers to any part of a company involved in that issue. So, carbon involvement includes companies whose businesses touch on each of the issues in Exhibit 1.

We can see that the Morningstar ESG Aggressive Growth portfolio has substantially less carbon involvement than the benchmark in areas like Fossil Fuel, Carbon Solutions, or Oil & Gas Production, while having minimal involvement in areas like Thermal Coal Extraction, Oil Sands Extraction, Arctic Oil & Gas Exploration. Emissions for portfolio companies are substantially lower, too.

Note that our portfolio does not target reduction or elimination of any specific factors—carbon or otherwise—and that we wouldn’t say that it removes exposure to any of the factors on the chart. Our approach is designed to balance sustainable goals with an investor’s financial goals, rather than provide a highly sustainable portfolio at all costs.

Again, that distinction may be of great importance to one client, while another would prefer the balance we’ve sought to build into our ESG Asset Allocation series.

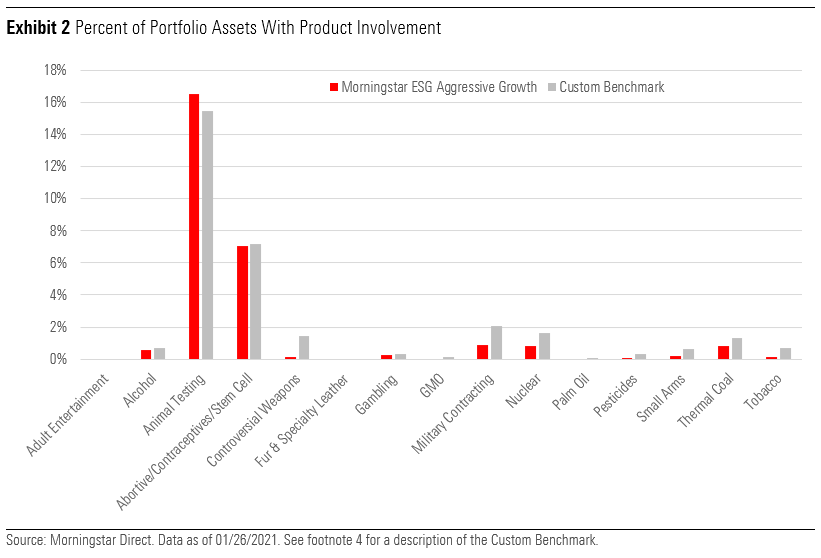

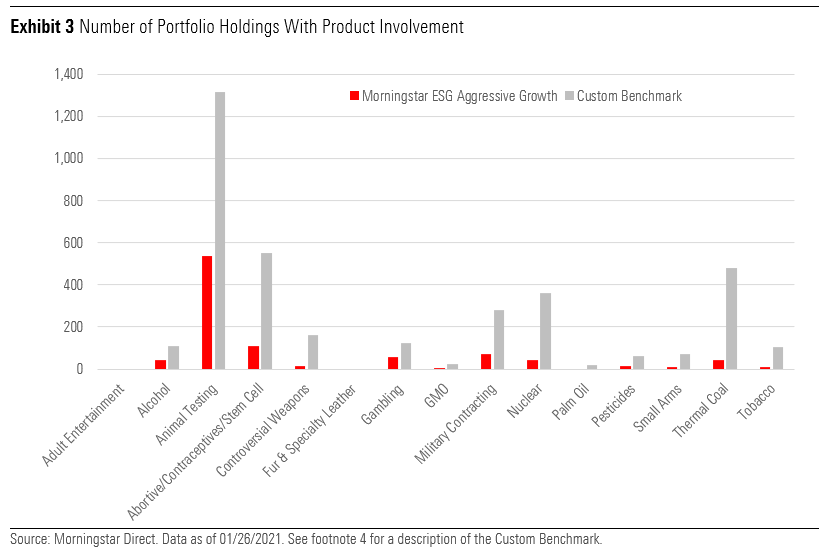

Next, let’s look at product involvement data, where we see a similar pattern as for carbon involvement—the Morningstar ESG Aggressive Growth portfolio lowers but does not eliminate exposure to the products listed.

The two graphs above display this data in two ways. Exhibit 2 shows the percent of holdings involved in each issue. Note that if any part of a company is involved, the entire company’s assets are included, such that a large company’s involvement more powerfully raises the involvement percentage than a smaller company would. Exhibit 3 shows the number of holdings with involvement; this approach treats each investment equally.

Like with carbon involvement, this portfolio beats its benchmark in offering investors a more ESG-friendly set of investments. However, it (and its benchmark) might not be right for the investor looking to screen out companies involved in various activities.

The Recommendation

Your clients come to you for your investment expertise. But some clients might have a lot more knowledge in ESG than they have with investing, or they might know an awful lot about one area within ESG.

A safe recommendation needs to be well-informed, and it helps if your portfolio uses a range of ESG strategies to appeal to a wide variety of clients. Still, not every ESG portfolio will appeal to every investor. It’s important for advisors to make an appropriate match and be willing to be flexible to find a portfolio that has a stronger commitment to certain ESG factors, or to maintaining returns as close to a non-ESG portfolio as possible.