(Ricky Williamson, Morningstar Investment Management) Pick a measure, any measure, and you can make the case that U.S. equities are overpriced. The P/E, the cyclically adjusted P/E (or 10-year P/E), and market capitalization/GDP ratios are all near or above all-time highs.

In our own valuation work, we see few major markets that are attractively priced. It's not just U.S. equities, but U.S. bonds and others have—since March 2020—moved from being in many cases attractively priced to being overpriced. This raises the question of what to invest in when attractive valuations and conviction have diminished.

The Case for Flexibility

Taking a flexible approach to asset allocation may help investors reach their financial goals through any market environment by dialing risk up or down in response to market prices. Pricing is a key part of flexibility because higher prices often indicate higher risk to investors as they can lead to lower returns, while lower prices can mean lower risk and higher potential returns.1

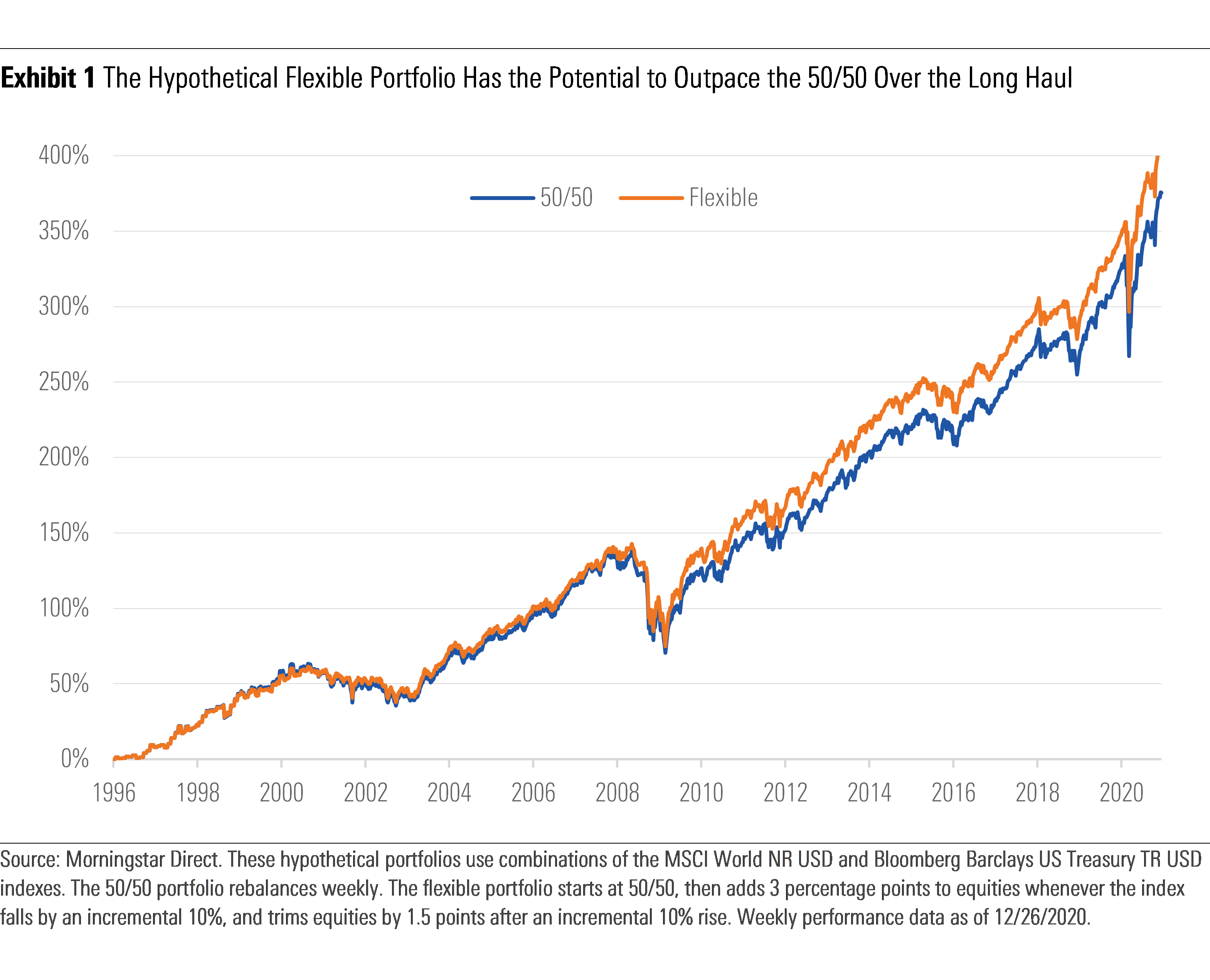

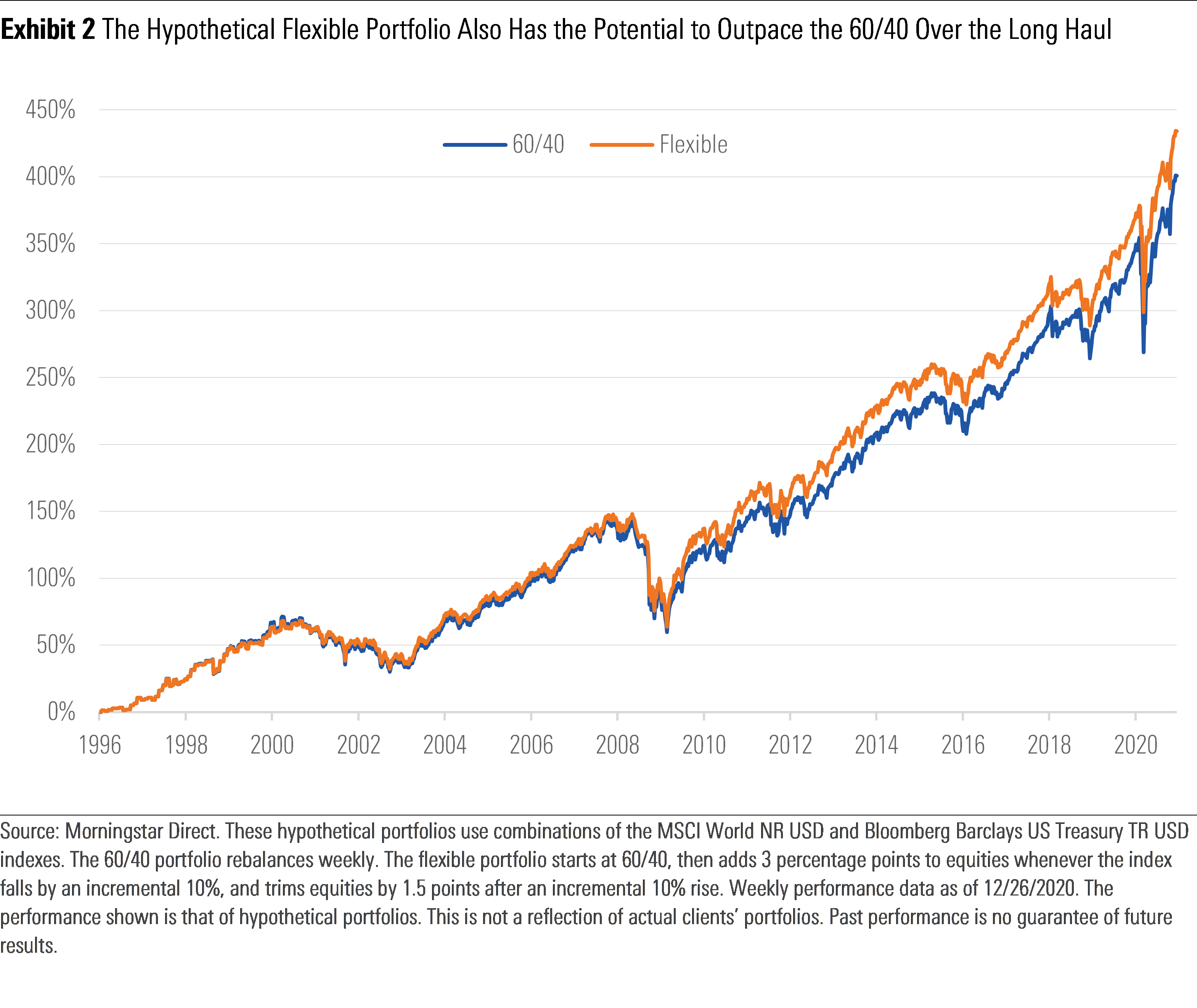

We performed a simple data study that illustrates how a hypothetical flexible portfolio might respond to market prices—as prices climb longer, they are more likely to become overpriced; conversely, after a major decline they are more likely to be attractively priced. We then compared this flexible portfolio over time to a hypothetical static portfolio of 50% global stocks/50% U.S. Treasuries2. The flexible portfolio also starts at a 50/50 allocation but then adds 3 percentage points to equities whenever stocks fall by an incremental 10%, and trims equities by 1.5 points after an incremental 10% rise. We then repeated the exercise using the more common 60/40 portfolio allocation.

Why would the flexible portfolio add more stocks after a decline than it would increase them after an increase? This asymmetric approach was designed to reflect the long-run performance of markets. Historically, stocks have generated positive returns (about 8% annualized) over long periods, while experiencing drawdowns (or major losses) only occasionally. The long-run growth of stocks appears to be driven by fundamentals—that is, growth in earnings and payouts, like dividends and share buybacks. Thus, our simple model seeks to reduce stock exposure during growth periods about half as fast as we increase it during drawdowns.

Looking at the results of this test, we suggest there are three ways flexible or dynamic portfolios can help investors.

1. Preparing for Performance

Looking at exhibits 1 and 2, the most obvious takeaway might appear to be the fact that the flexible portfolios outperformed the static portfolios over time. Long-term performance matters—that growth helps investors reach their long-term goals.

How could a portfolio that is underweight equity keep pace, even as stocks rallied? The reason is that the flexible portfolios had less equity before market sell-offs and had their highest equity holdings as the market began to recover. Therefore, they limited the downside and participated more in the upside. Given the nature of compounding returns, the flexible portfolios kept up with the static portfolios despite being underweight equities on average over the test period because it was able to take advantage of growth at key times.

Importantly, this study limited the investment options to global equities and Treasuries. A truly flexible strategy in the real world would hope to provide additional excess return through intra-equity and intra-bond positioning.

2. Helping Investors Focus on the Long Term

The hypothetical flexible portfolios do not require clairvoyance or knowledge of future stock returns. They simply add risk as markets go down with no clarity as to when the “bottom” might occur. This is in contrast to the static portfolios, which rebalance to 50/50 or 60/40 every week.

Although the flexible portfolios didn't "call" the market bottom, they were prepared for it. That can be harder for us humans, though. When markets plummet, it can be painful as we watch our balances shrink ever smaller. Similarly, when markets rocket upward, we tend to feel bulletproof, even though history teaches us that all rallies eventually end—many tragically.

This may be one behavioral drawback of a flexible portfolio in the real world—it will reduce allocations to stocks and risk at times when investors feel the most ready to take on risk. That can hamper returns in the short run. And, at times, these periods of stocks moving ever higher can be extended, giving the investor feelings of fear of missing out. This, too, can be a danger, as an investor may be tempted to sell out of flexible strategy to dive fully into the market rally, only to be caught holding more risk when markets retreat.

So, flexible portfolios aren't fix-alls for behavioral missteps. But because they tend to reduce equities after major price rises, they experienced lower maximum drawdowns during the test period. Protecting on the downside not only helps future returns, but it also can lead to better investor behavior—making it less likely a client exits the market at the worst time, which is at or near the bottom.

3. Reducing Risk

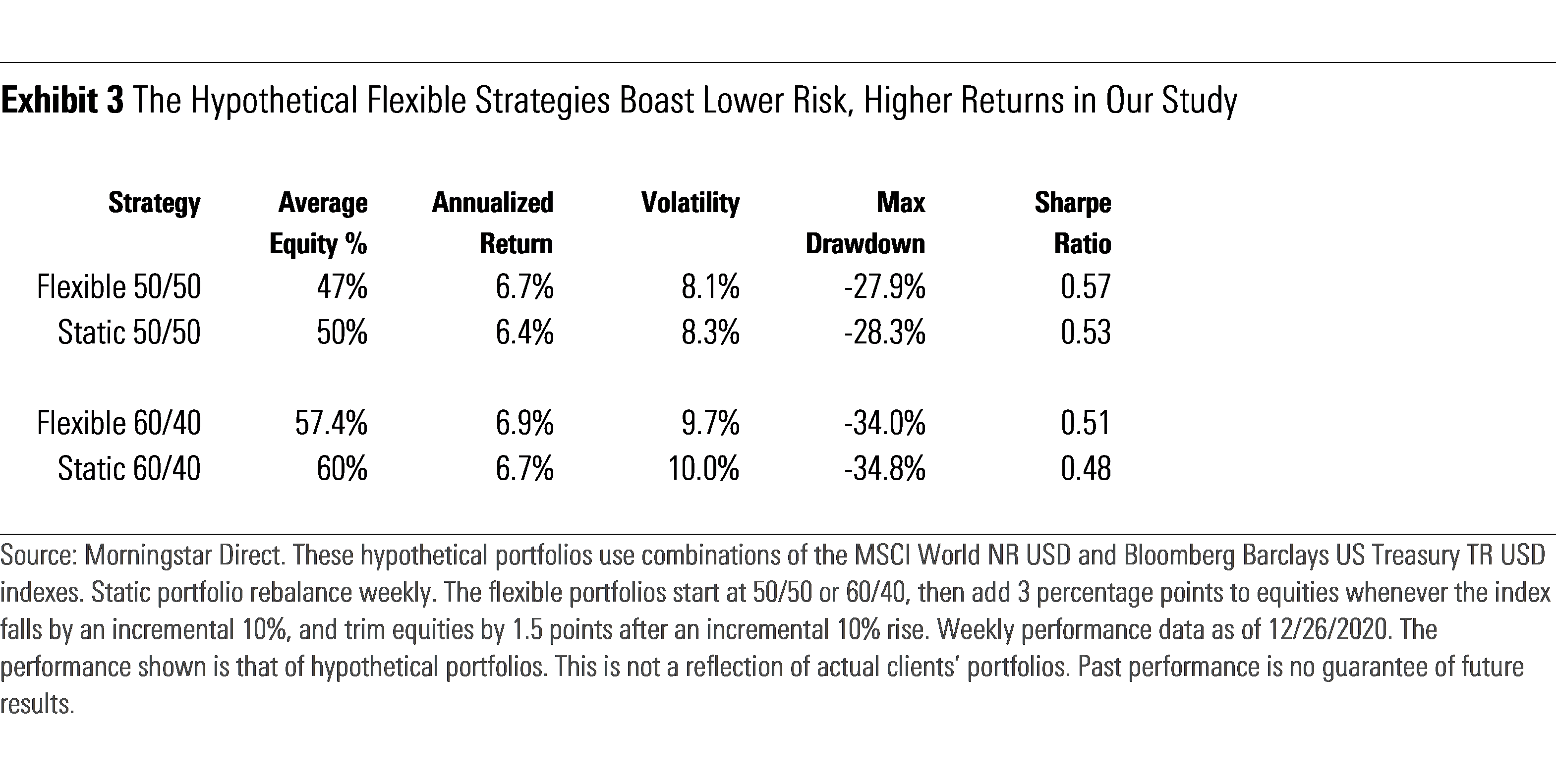

As important as competitive total returns may be, the hypothetical flexible portfolios boasted better risk metrics, delivering a smoother ride and better risk-adjusted returns.

Exhibit 3 shows the details here. While outperforming, the flexible portfolios held a lower equity allocation over the period. Not only that, but they lost less on the downside and reduced volatility. The result was higher Sharpe ratios—a measure of portfolio efficiency—for the flexible portfolios. Note that the flexible strategy that started at 50% equity kept pace with the static portfolio that held steady at 60% equity.

The Same Principles Apply to Income Strategies

Income-producing assets (fixed income, dividend-yielding stocks, etc.) cycle through periods of being cheap and expensive just like broad equity markets. And being caught overexposed in a period where they move from expensive to cheap can not only lead to large capital losses, but it can also harm an investors’ ability to take advantage of higher yielding opportunities after prices have fallen.

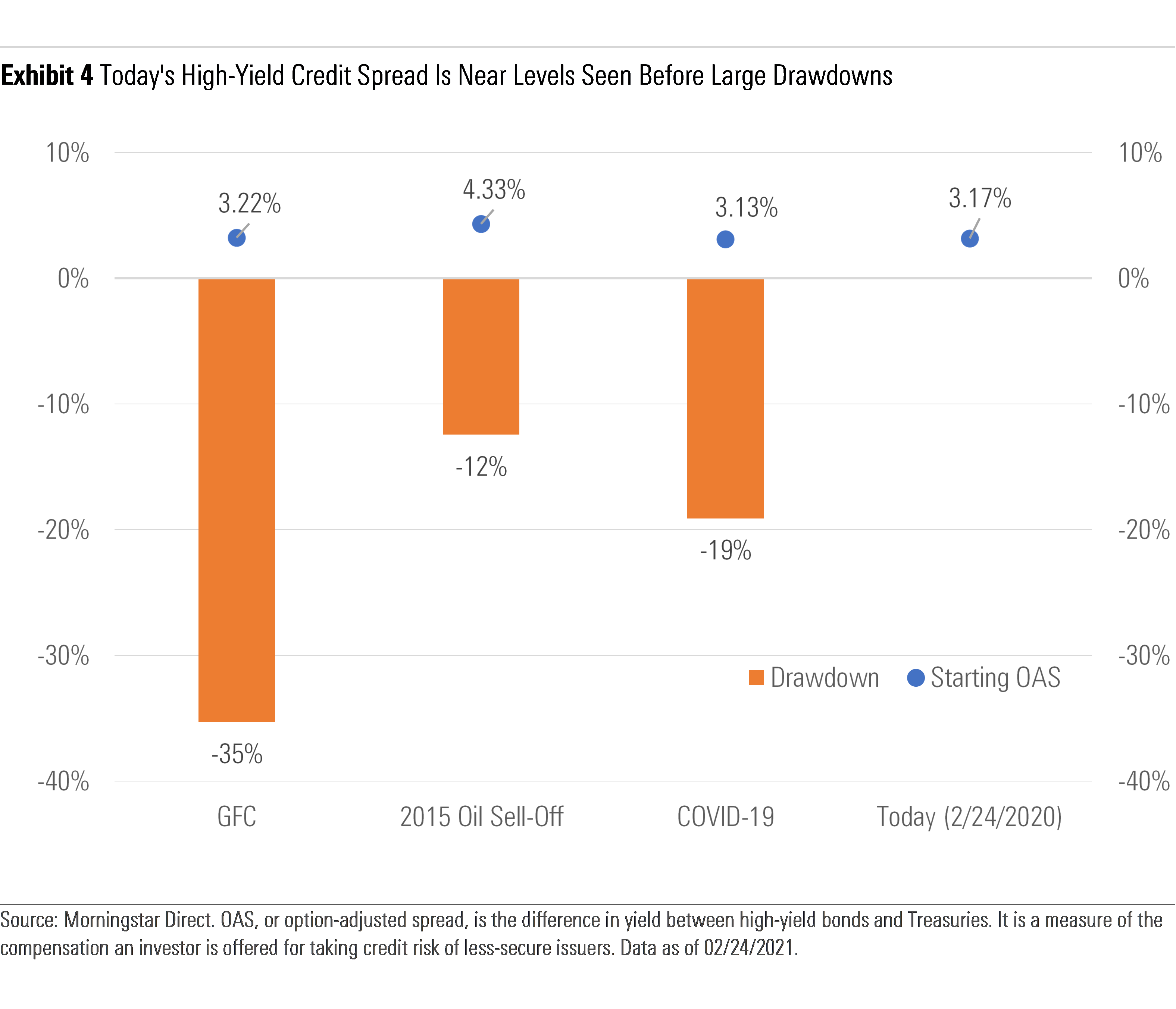

In an environment where yields are low and credit spreads are tight (like today), it can be tempting to reach for yield and allocate capital to the highest yielding asset classes (which is often a place like corporate high-yield bonds). But investing in an asset class like high yield in an expensive market is a dangerous game, and investors can experience losses similar to equities in market sell-offs.

When credit spreads tighten, prospective returns become asymmetric to the downside. It’s a double-whammy in that investors—compared to an environment of lower prices and wider spreads—must accept lower relative yields while taking on even more risk. Sure, yields might still beat Treasuries, but if the market turns, that yield offers very little protection and you can experience significant capital losses.

A Willingness to Be Contrarian

All of this gets at flexibility, but we might also think of it as a willingness to be contrarian—to go in a different direction than the masses based on your conviction. Warren Buffett has famously described this as being “greedy when others are fearful, and … fearful when others are greedy.” That, coupled with a long-term mindset, may keep an investor focused on long-term goals, which in turn could help in reaching them.

[1] Valuation-based risk might be illustrated by a ticket scalper during the pandemic. Imagine you buy and resell tickets to events that may or may not take place due to transmission levels at the time of the event. There are two events six months away, both with $100 ticket prices. You can buy tickets (to resell to others) for one event at $50, while the other event's tickets are selling for $130. Which presents a higher risk to you, and which a better opportunity?

[2] Global stocks are represented by the MSCI World NR USD index, while Treasures are represented by the Bloomberg Barclays US Treasury TR USD index.

Disclosures Opinions expressed are as of the current date; such opinions are subject to change without notice. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved. This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. Past performance does not guarantee future results. Morningstar® Managed PortfoliosSM are offered by the entities within Morningstar’s Investment Management group, which includes subsidiaries of Morningstar, Inc. that are authorized in the appropriate jurisdiction to provide consulting or advisory services in North America, Europe, Asia, Australia, and Africa. In the United States, Morningstar Managed Portfolios are offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC, both registered investment advisers, as part of various advisory services offered on a discretionary or non-discretionary basis. Portfolio construction and on-going monitoring and maintenance of the portfolios within the program is provided on Morningstar Investment Services behalf by Morningstar Investment Management LLC. Morningstar Managed Portfolios offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment adviser or investment adviser representative. Investing in international securities involve additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Morningstar Investment Management cannot guarantee its accuracy, completeness or reliability.