(Morningstar) Charts and themes that tell the current story in markets and investing.

Everybody’s Talking About AI

When one mania ends, another begins.

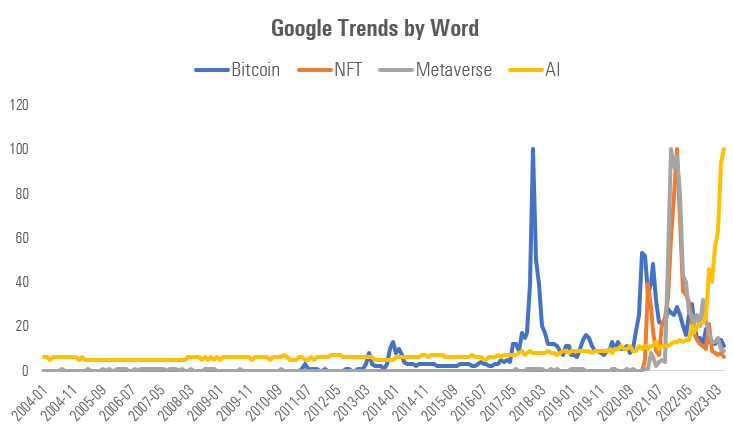

The excitement around Artificial Intelligence (AI) is building. Google searches of “AI” have followed the same pattern as previous mega trends, including Bitcoin, NFTs, and the Metaverse.

Exhibit 1

Source: Google Trends

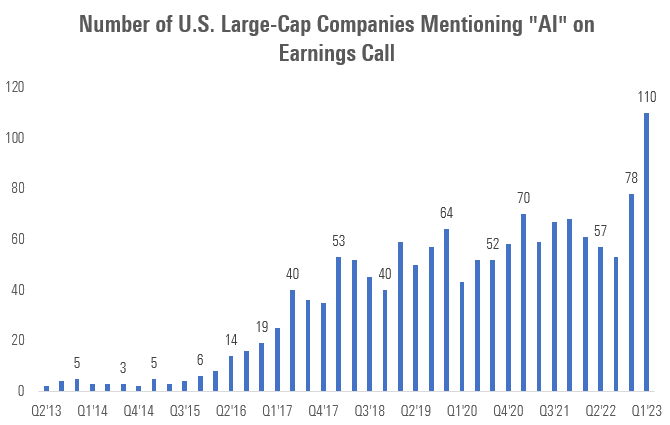

The exuberance for the topic can be observed in companies as well. More than 100 large U.S. companies mentioned AI on earnings calls during the most recent quarter, nearly double from the period a year ago.

Exhibit 2

Source: Earnings Call Transcripts

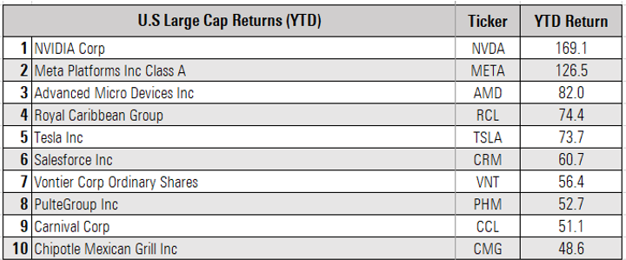

NVIDIA—a prominent company in the AI race—is the top performing stock among U.S. large caps in 2023, up 169%.

Exhibit 3

Source: Morningstar. For illustrative and educational purposes only. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment.

NVIDIA added nearly $300 billion in market capitalization after its most recent earnings report. For perspective, $300 billion in market capitalization is larger than all but 20 companies in the U.S.

And it was added in a single day.

Needless to say, there’s plenty of optimism. The CEO of OKTA—a workplace security software vendor—mentioned on a recent earnings call:

“AI is getting a lot of hype, and I still think it’s underhyped.”

But optimism can lead to overvaluation at times.

The “dean of valuation,” New York University finance professor Aswath Damodaran recently mentioned that, “you’re pushing the absolute limit of what sustainable value is” in reference to NVIDIA’s meteoric rise this year.

The future of AI is up for debate, but it’s something worth paying attention to at the very least.

Debt Ceiling in the Rearview Mirror

The debt ceiling is now behind us. The House of Representatives passed a deal lifting the debt ceiling, narrowly ahead of the “X-date,” the point in time where the government would have run out of money.

The negotiations were a mainstream story, but the markets never broke much of a sweat—judging by the lack of volatility.

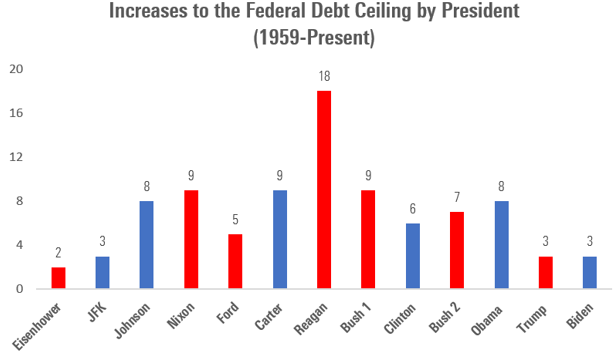

This was the 90th time the debt ceiling has been lifted since 1959.

Exhibit 4

Source: Morningstar

Markets were aware of this history and likely confident that a resolution was going to happen before the X-date.

Under the terms of the deal, there will be no ceiling until Jan. 1, 2025, at which point we could go through the same process again. But that’s a problem for another day. Investors can now turn their attention elsewhere, particularly to what the Fed may be up to next.

Market Turns Its Attention to the Fed

Since March 2022, the market has digested 10 Federal Reserve rate hikes. The federal-funds rate now sits at 5.00%–5.25%, its highest level since September 2007.

U.S. inflation currently sits at 4.9%, meaning the fed-funds rate is now slightly above headline inflation. This is relevant because the previous eight Fed hiking cycles saw it continue rate increases until the fed-funds rate was above the Consumer Price Index (CPI).

We’ve now reached that point.

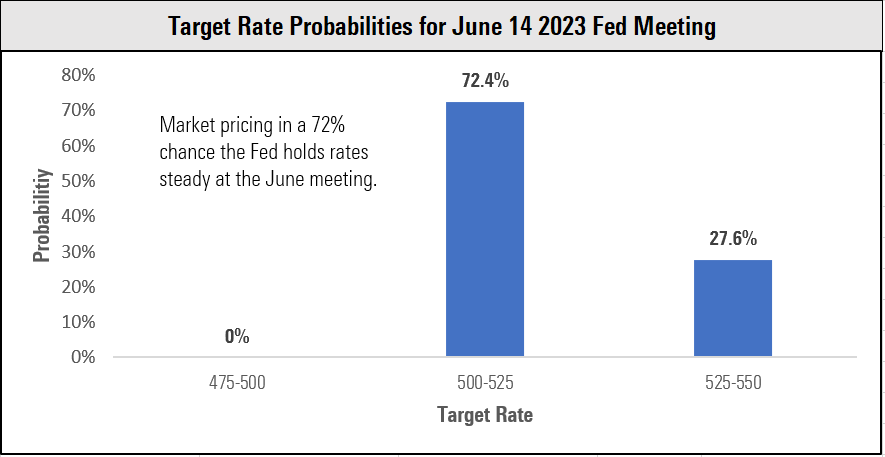

Using futures market data, the market is pricing in a 72% chance the Fed keeps rates unchanged at its June meeting.

Exhibit 5

Source: Chicago Mercantile Exchange. Data as of June 9, 2023.

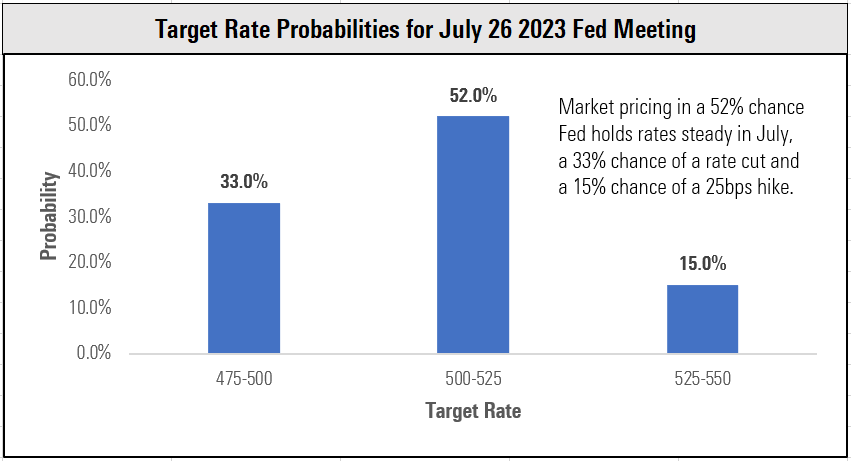

Looking ahead to the July meeting, markets think it’s more likely the Fed cuts rates 25 basis points (33% chance) than raise them 25 basis points (15% chance).

Exhibit 6

Source: Chicago Mercantile Exchange. Data as of June 9, 2023.

The numbers above can change dramatically based on new economic data, but for now, those are the market’s expectations.

Problems in Commercial Real Estate

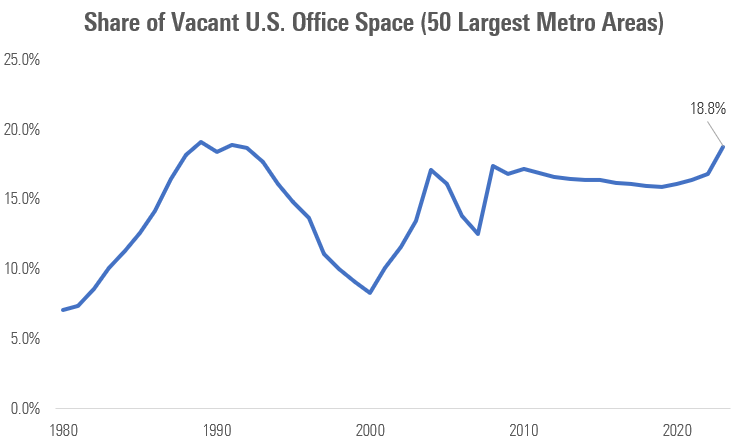

U.S. office vacancy rates are at their highest levels since the savings and loan crisis in the 1980s and early 1990s.

Exhibit 7

Source: REIS Office Vacancy Rate. Annual: 1980-2023.

The Fed released its annual Financial Stability Report in May. Highlighting risks to the market, the Fed called out commercial real estate (CRE), mentioning:

“A correction in property values could be sizable and therefore lead to credit losses by holders of CRE debt.”

Problems in commercial real estate, primarily office space, are quite clear. Work from home has had an immeasurable impact on the future of commercial office space.

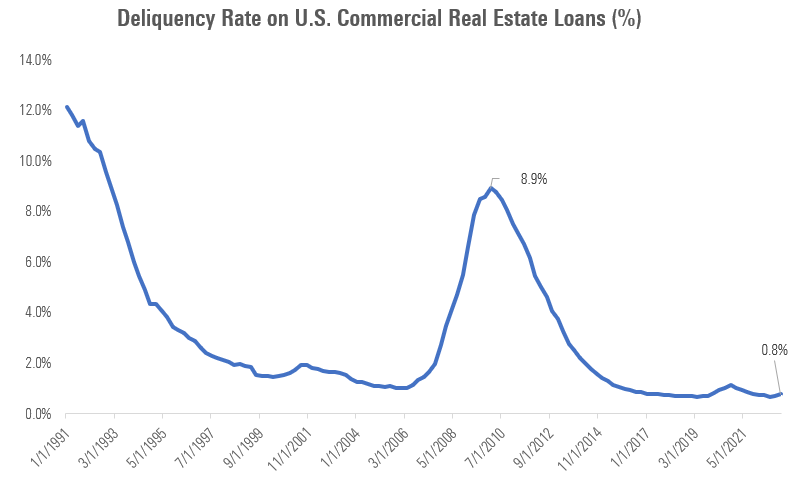

Perhaps surprisingly, delinquency rates have yet to rise on commercial real estate loans, still remaining near all-time lows.

Exhibit 8

Source: FRED

But it’s possible a default cycle might be getting started.

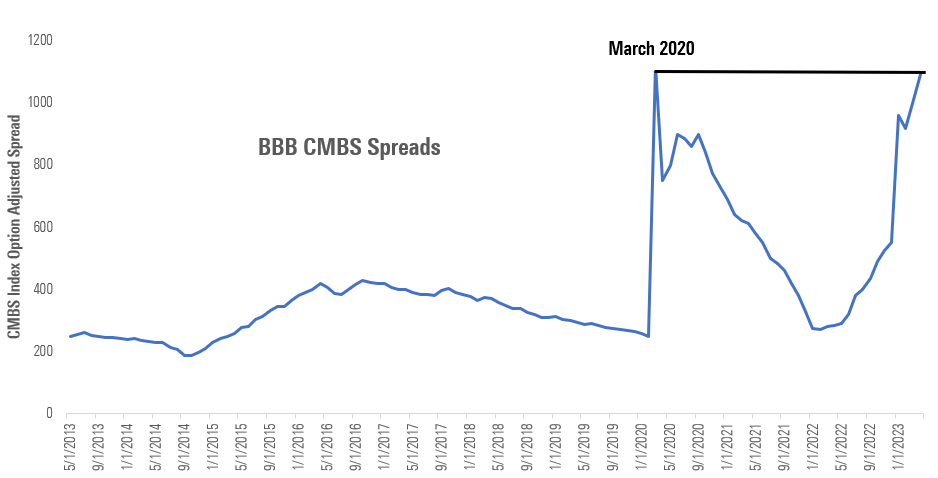

Spreads on commercial mortgage-backed securities (CMBS) are at their widest levels in over a decade, signaling the market could be worried about a wave of defaults.

Exhibit 9

Source: Intercontinental Exchange, Bank of America

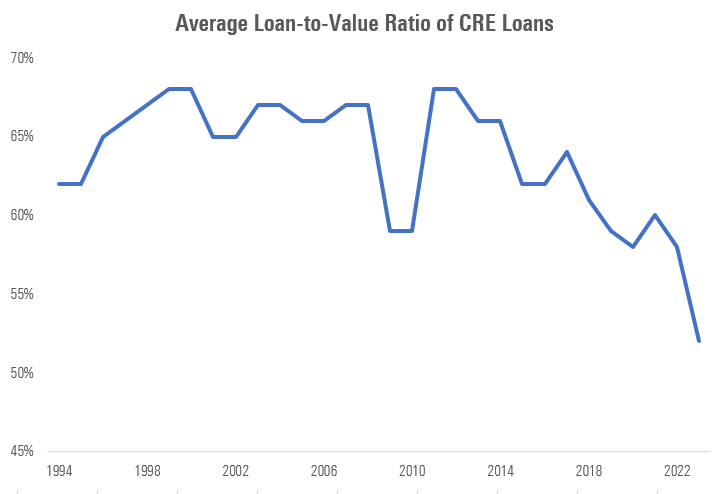

Banks appear to be losing their appetite for this line of business. The ratio of money that banks are lending compared to the property value dropped to a 30-year low in commercial mortgages this spring.

Exhibit 10

Source: Ares Management, Federal Reserve

PNC—one of the largest U.S. banks—held an analyst day recently and one of the topics was around lines of business (or sectors) they're pulling lending away from.

PNC’s CEO stated:

“We’re not going to add to office exposure. There’s actually a lot of office deals we’d like to do, but the headlines of ‘Hey, your office exposure went up!’ isn’t worth it, which is kind of the unfortunate truth about banking.”

Those comments might imply perceptions could be worse than reality. And reality is already quite bad.

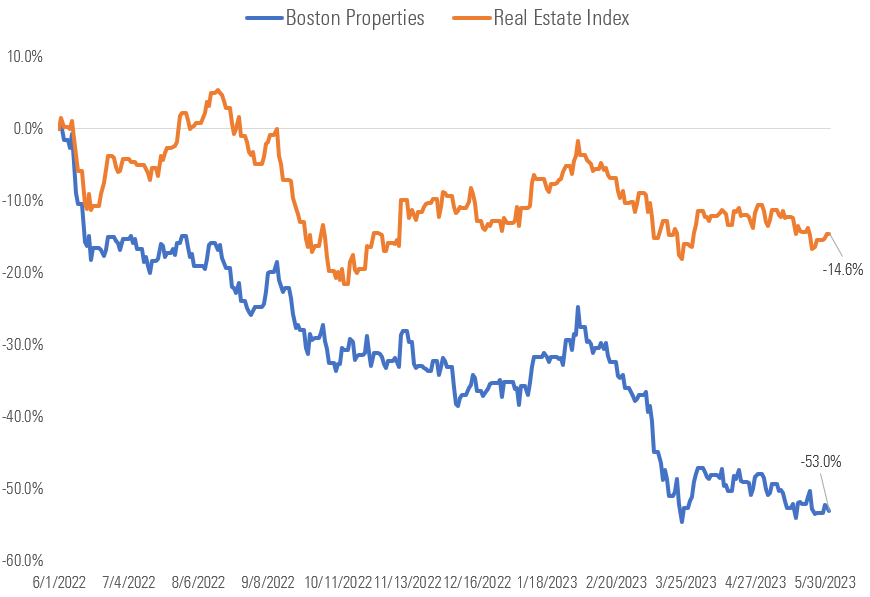

Boston Properties—the largest publicly traded U.S. office REIT—stock price is down 55% over the past year, a significantly larger drawdown compared to a diversified real estate index.

Exhibit 11

Source: Morningstar. For illustrative and education purposes only.

Per data from Barron’s, Boston Properties stock trades for 9.5 times forward funds from operations (a popular valuation metric for real estate), versus a five-year average of nearly 22 times.

In short, a large amount of bad news is already reflected in prices. This is possibly why PNC’s CEO mentioned deals would otherwise be attractive if not for the negative sentiment.

One interesting item to note: Some large real estate investors have been diversifying away from office space for years.

Steve Schwarzman—founder of Blackstone, one of the largest global real estate investors—pointed this out recently, mentioning his firm has been decreasing its office exposure for nearly a decade.

Blackstone’s $585 billion real estate portfolio today “consist[s] of less than 2%” office space, compared with more than 60% a decade ago.

And while office space and adjacent retail relying on foot traffic from offices have been winning the attention war, there’s areas of commercial real estate that continue to hold steady. This includes areas like industrial warehouses that support e-commerce, experiential retail, and multifamily housing to name a few.

Going forward, some areas of commercial real estate will likely outperform, and some areas will likely underperform, the same as it ever was.

Supply Chains

Gene Seroka—executive director of the Port of Los Angeles—summarized the supply chain problem in the summer of 2021 as “10 lanes of traffic being stuffed into five.”

Luckily, time heals all wounds. In the two years since Seroka’s quote, supply chains have been working through a period of self-correction.

According to large retailers, supply chains are normalizing—a key point many of them have highlighted throughout earnings season.

Walmart Inc—the largest global retailer—mentioned its supply chain is in the best shape it’s been since pre-pandemic.

Dollar General also recently commented that restocking times at distribution centers are the best they’ve been in nearly two years.

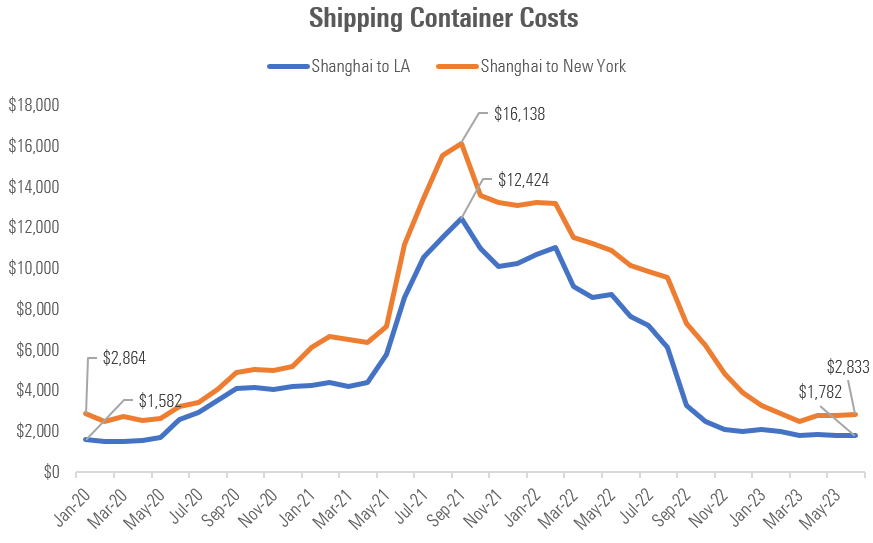

One reason? Shipping costs have reverted to pre-pandemic levels. In September 2021, it cost more than $16,000 to ship a container from Shanghai to New York. Today, it costs roughly $2,800, down more than 80% from peak.

Exhibit 12

Source: Drewry World Container Index