(Marta Norton, Morningstar) The growth of portfolio blending is of particular interest to us. At its heart, this is really a story of diversification and personalization.

Morningstar's investment team attempt to meet the broad range of investor preferences and needs with a wide array of strategy offerings, but the reality of financial planning is that one size does not always fit all. Frequently it is using the available investment universe, then blending appropriately, which really can determine investment success. We think this is a wonderful advancement that has really cemented its way into modern portfolio thinking in line with goals-based financial planning.

In many respects, this is a "more is more" approach. By adding more ingredients, we are hoping to deliver better results. For example, complementing a multi-asset exchange traded fund (ETF) strategy with an active equity separately managed account (SMA) can greatly enhance the likelihood of an investor achieving success–if done correctly and for the right reasons. The benefits will depend on the client in question, but may include tax management, a better suited stock and bond mix, higher likelihood of goal attainment, or behavioral advantage. For example, client risk aversion during inevitable setbacks may be controlled (comforted by the differentiated results that are aligned to their goals) and thereby overcome panicked selling. This is at the core of great investing.

How Would you Best Describe a Great Portfolio Blending Framework? What are the Risks?

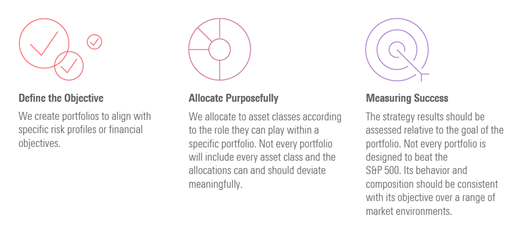

This three-step approach is perhaps simplistic, but it is hard to argue or beat. It captures the key inputs that will determine if a blended approach is appropriate. By having a plan, understanding the role of each component, and delivering differentiated results, you're well on your way to a successful portfolio combination.

In this sense, portfolio blending can be a beautiful thing. However, we can equally flip this framework and consider the other side of the coin--when to beware the blender.

1. No plan / no specific need.

2. When each strategy within the blend doesn't play a distinct role in portfolio.

3. When you haven’t created differentiated results.

There are two key challenges to look out for here:

- Diversification is only worthwhile up to a certain point. There is no point diversifying an already diversified portfolio if it won't play a specific role or create differentiated results, especially after fees. Anyone with an active interest in the kitchen will know that adding too much seasoning or spices can ruin a good meal. Or said simply, overdiversification can be a bad thing.

- Unnecessary costs are a sign of poor portfolio blending. Like all things in life, we want to derive value from what we pay for, so be careful overpaying for things that don't serve a specific need. For the cooks among us, this might be akin to adding caviar and truffle to a wagyu steak instead of salt and pepper. Portfolio combinations that don't work often apply when adding positively correlated assets that are expensive and carry the same risk factors. If you're not improving the expected portfolio outcome, beware the blender.

The Heart of Good Blending is Personalization

The concept of portfolio blending is really a portfolio personalization opportunity. Not everyone should have X percentage in cash, Y percentage in bonds, Z percentage in equities. They should have an appropriate blend that matches their stage of life and desired outcomes. It is about choosing the right ingredients from the shelf and allocating appropriately. The same recipe construction applies to the more than 70 US strategies we run at Morningstar Investment Management. Combining them is both art and science, but if you use our suggested framework for portfolio blending, you're well on your way to investor success.

A few actionable examples include, but are not limited to, 1) combining a multi-asset solution with an active stock basket, 2) combining active and passive to keep costs low while accessing a greater opportunity set, or 3) combining income-focused and total return portfolios for retirement bucketing. It starts with your goals and life stage, but ends with a portfolio blend you can take comfort in.

This is an area of tremendous opportunity in the financial planning space and we're delighted to help investors in the pursuit of their goals.