(Morningstar Investment Management) One of the growing narratives from the war in Ukraine is the idea of secondary-effect risks. This includes the well-publicized effect on commodity prices, but it has evolved into a growing chain of challenges. Prominently, several respected voices have noted that we now have the pre-conditions for a global recession and real pressure on household incomes across the globe.

Many of the questions voiced thus far are along the lines of:

- Could the spike in commodities cause the global economy to slow or enter a recession?

- If inflation gets out of hand, how aggressively will the central banks act?

- How severe could the market downturn get if we see a combination of a recession and rising rates?

- At what point does it become a buying opportunity?

For investors asking the first three questions, the logic is presumably that if economic growth is at risk, you might consider selling growth assets. However, for investors with long-term goals, we think this approach may be strengthened by embracing the fourth question—using an approach that is a) risk aware, b) intentional, c) contrarian, and d) aligned to your goals.

Portfolio Response: Readiness and Robustness

As long-term investors, we need to remain humble and not overestimate our ability to predict the outcome of seismic macro-events. We have no advantage over other investors in predicting the course of the conflict, in the same way we had no advantage in creating a roadmap of COVID-19 in 2020.

What we can do, however, is thoroughly assess the investment landscape and look for investment opportunities. As patient, long-term investors operating in a market influenced by fear and greed, we understand that excess returns could become available when the price of an asset diverges significantly from a reasonable assessment of fair value.

This time is indeed different, but the way we are responding is similar—with a principled approach that is opportunistic and robust. The caveat is, given the level of uncertainty, that we would like to see a wide gap between current prices relative to their fair values when we make meaningful changes.

Does an Economic Downturn Impact Markets?

As we contemplate investment decisions—or any financial decisions, for that matter—it can be tempting to predict where the economy or earnings cycle is heading. That is, in theory, we could pick when (or which part of) the market is about to weaken and seek shelter until it reaches a cyclical low. The challenge, of course, is that this approach is notoriously difficult to do because you need to predict the future twice—once to get out of risky assets at the right time and again to re-enter them at the bottom of the cycle.

Even the market has difficulty pricing in such signals. For example, in mid-2018 the global bond markets started pricing in a deteriorating economy while global equity markets were pricing in a further expansion. Then it suddenly reversed in late-2018, as equity markets priced in a decline while bond markets did the opposite.

So, what does that mean in a multi-asset portfolio context? To us, it means a few things. First, a key when dealing with fears of a recession is to distinguish between true risk (a negative knock to corporate fundamentals) and negative sentiment (investors repricing their expectations).

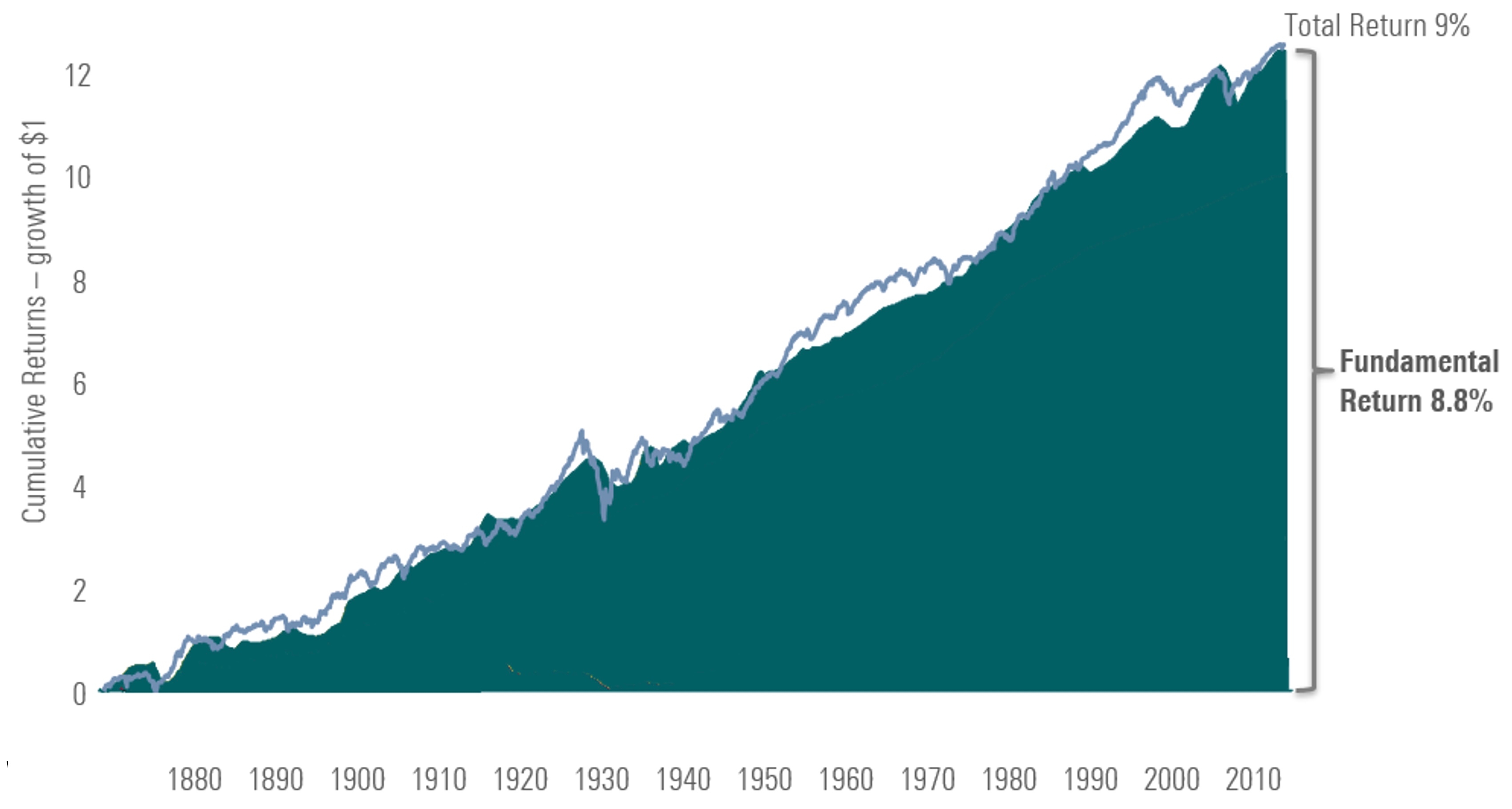

Exhibit 1: For more than 100 years, prices have oscillated around the fundamental return.

Source: Morningstar Investment Management calculation, U.S. stocks are represented by the S&P 500 and its predecessors. Time frame: 1870-2015. For Illustrative purposes only.

At an individual level, falling real wages hurt. This means that wages are rising by less than inflation, so your net savings are dented, potentially impacting your financial goal progression. At a portfolio level, this also might be an issue, with defensive assets earning less than the inflation rate. This results in a reduction in your real purchasing power, which can also hamper goal attainment.

There are no easy answers to this challenge in an environment such as today’s, but one approach is to focus on real outcomes after inflation. At a portfolio level, this means holding assets that may protect you against a spike in inflation, which is something we take seriously as a portfolio robustness measure.

Adding Value in a Downturn

Putting aside the eroding challenges of inflation, we believe investors can benefit by buying into negative sentiment, especially if they are willing to take a long-term view. The long-term nature should not be underestimated, given that most economic recessions prove temporary and are recoverable in the investor timeframe.

By taking such an approach, we can be anti-cyclical (or “contrarian”) when others aren’t. Furthermore, weathering a recession will likely be easier if the motive is to be fearful when others are greedy and greedy when others are fearful, to paraphrase Warren Buffett. We seek to not only navigate downturns, but to help our investors profit from them. This tends to be possible because negative sentiment is often exacerbated in a crisis. For evidence, we show the difference between changes in sentiment and fundamentals during the Great Financial Crisis of 2007 to 2009.

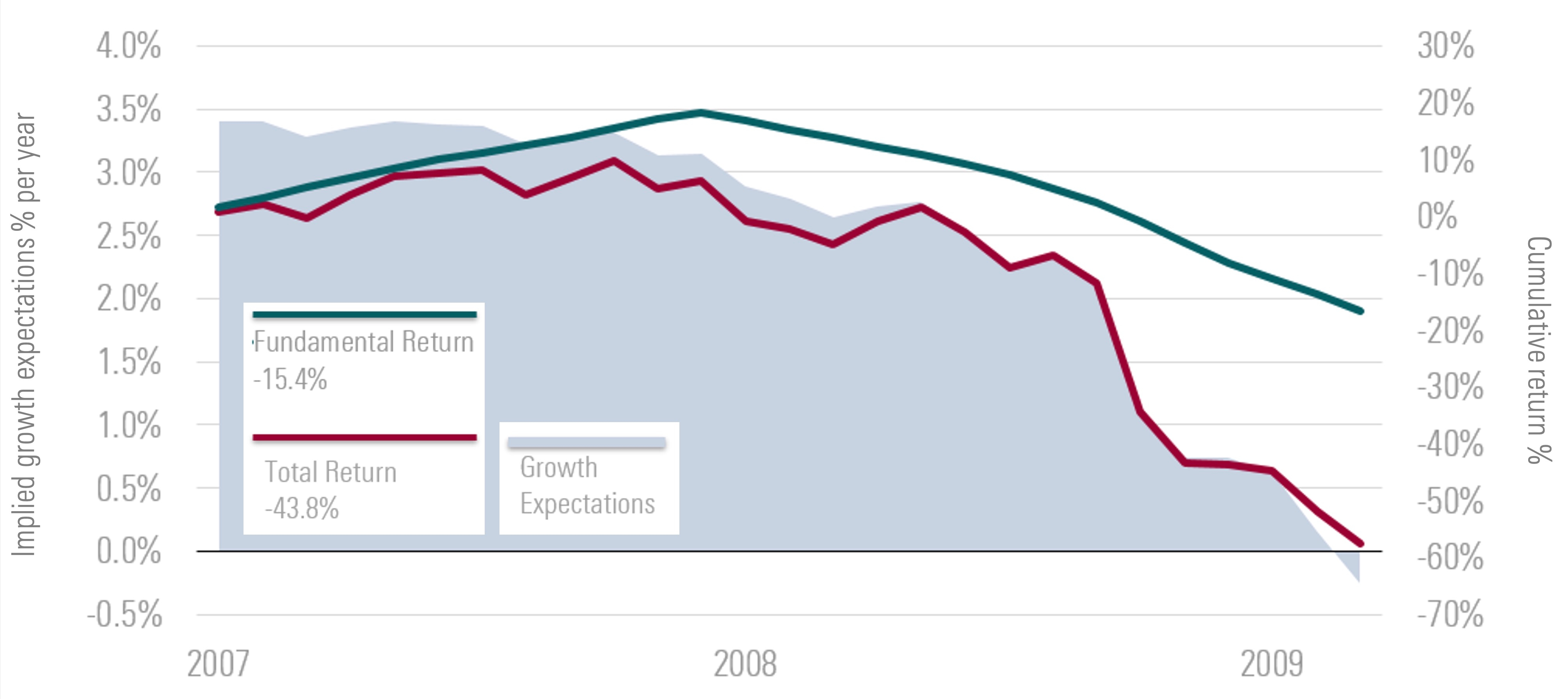

Exhibit 2: During the financial crisis of 2007 to 2009, prices fell far more (as a function of negative sentiment) than corporate fundamentals. Such periods are an opportunity to add value.

Source: Morningstar Investment Management calculation. For Illustrative purposes only.

Note: Total Return is the return of the S&P 500 Index, Fundamental Return is the return of total payout yield plus the growth in total payouts, Growth expectations is the market’s implied growth rate assuming a constant cost of equity.

The second consideration in a multi-asset context is to diversify our risk drivers. This goes beyond questions such as whether U.S. companies can sustain high profits or for how long inflation may rise. We may seek to understand the answers to these questions (and many more) within the context of valuations, but we should also acknowledge the role of uncertainty.

Diversification Is Not Only About Spreading Your Eggs

Diversification is an important tool to manage uncertainty, however we believe it must go beyond “spreading your eggs across multiple baskets”. To us, it is about understanding the underlying risks to assets—whether that be economic or market-risk factors—not just volatility or correlations (as these can change quickly and drastically).

For example, corporate bonds and equity markets can behave very differently, yet both are susceptible to an economic shock (damage to corporate earnings could cause equity values to fall and bond spreads to widen). All else being equal, this offers less diversification than holding equities with an unrelated asset, such as inflation-linked bonds or nominal government bonds. The message is to diversify against fundamental risks and be very intentional with how you are diversifying if you want to reduce the impact of an economic recession.

Today’s Positioning Points & an Opportunistic Mindset

The current crisis has been impacting valuations of assets classes—obviously in Russia, but also beyond the Russian markets. Most notably, the sovereign bond yields of other central and eastern European countries have risen, and their currencies have fallen. In addition, corporate bonds have also been hampered, with credit spreads widening—both for high yield and investment-grade debt—not just in Europe but also in the U.S. market.

Within equities, there have been clear winners and losers, with global energy firms rallying and stock markets more closely tied to Russia suffering large losses, such as Germany’s. These are potential investment opportunities we are deeply researching in the hope it will provide robust risk-adjusted returns for our investors in the future.

Bringing this together, we don’t necessarily buy into the rhetoric that one should engage in widespread selling based on fears of an economic recession. Naturally, we want to be diversified to reduce the impact of any downturn, but by taking a long-term view, we should only really care about a permanent impairment to earnings and the price paid for those assets. Moreover, if the economic cycle dents corporate profits in the near term, we may have the opportunity to buy into the negative sentiment and ride it out until the cycle reverts. This is one of many areas where we can add value, by maintaining a long-term view when others won’t.