(Morningstar Managed Portfolios / Philip Straehl) 2023 continues to be positive, with the market balancing optimism about peak interest rates versus the prospects of a weaker economy. Underlying the back and forth of sentiment is falling inflation and changing expectations for central bank policy. Despite banking concerns, investors seem convinced that central banks have contained the problem, and much of the stock market was able to weather the storm and rallied in the aftermath. Corporate earnings remain soft, but investors are taking this mostly in stride as much of this was priced into the market last year.

Heading into the mid-point of 2023, bearish sentiment among investors is coming off a very low base. The overall valuation landscape still looks reasonable, but there are many assets that remain around fair value and risks remain elevated. The market seems to be pricing in a “soft landing,” which is just one of many plausible scenarios. In such an environment, we continue to balance opportunities against risks.

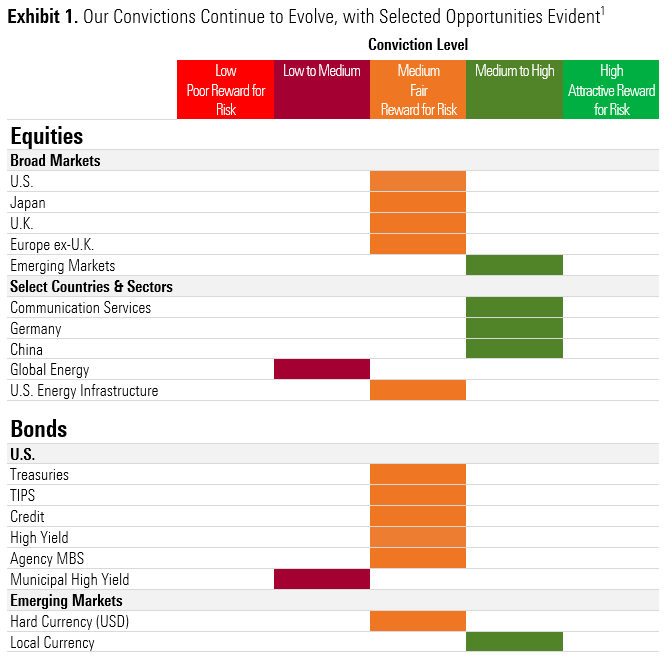

Source: Morningstar Investment Management LLC. Views as of April 15th, 2023 and subject to change. For illustrative purposes only.

Overall Market Context

As the second quarter of 2023 takes shape, the question facing investors (and central banks) is whether the banking scare has passed and if the pressures will cause the economy to slip into recession. Obviously, this is difficult to predict. What is clear is that investors and central banks are watching these developments closely, with the risk of further bank failures (and undesirable knock-on effects) being downplayed and the potential for a friendlier interest-rate outlook being favored.

From an asset-class standpoint, we’re also witnessing a few noteworthy developments:

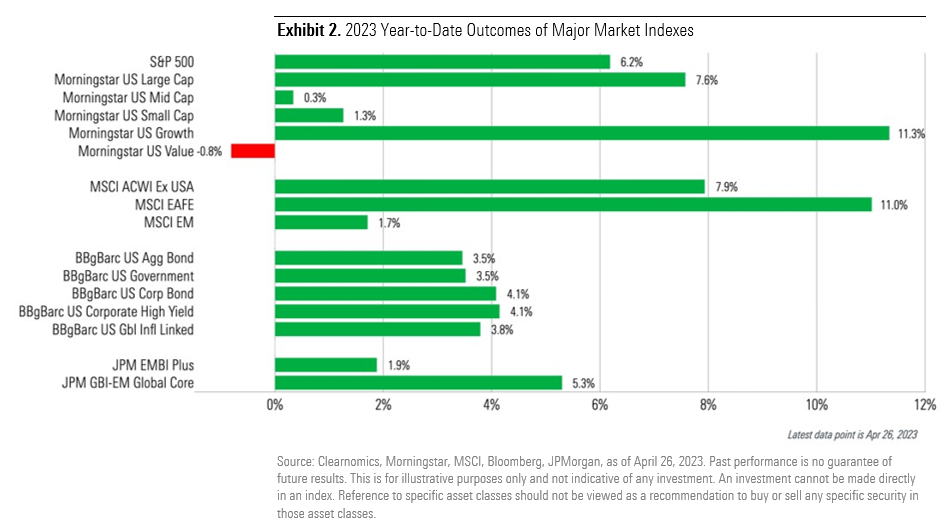

- A reversal of 2022 trends, with assets that benefit from lower/falling interest rates clustering at the top of the leaderboard. This includes blue-chip names and mega-caps, often in the growth segment.

- A shift to quality, or perceived quality, has taken place. The “quality factor” (using MSCI definitions) is the top performing factor among U.S. stocks this year.

- Listed property has fallen out of favor with investors, with office buildings facing pressure and broader debt concerns in the sector. The banking sector is under pressure, but large banks have held their ground and, in many cases, benefitted from regional bank issues.

Given that major asset classes are positive, it can be inferred that negative sentiment is partially unwinding. However, the negative sentiment expressed toward banks is prominent and has been reminiscent of the second quarter of 2008, when market participants sought the next weakest financial institution. The Global Financial Crisis has left an indelible mark on the minds of investors, so it’s not surprising that this experience is influencing the perspective of investors.

Thinking about investment opportunities, the investment landscape is mixed. We don’t see flashing danger signals, but we’re not smelling roses either—thus, a measured approach is warranted. While some of the best investment opportunities could emerge among the banks, a greater “margin of safety” is required given near-term risks. In such an environment, we remain determined to balance opportunities against risks. With a contrarian mindset, we’ll look at this resourcefully.

U.S. Equities Outlook - Medium Conviction

After a punishing bear market in 2022, U.S. equities rallied to start the year, despite continued twin worries of Fed rate hikes and inflation. The pile of worries introduced a new entrant in the form of a banking crisis, but despite it, U.S. stocks rallied in the face of resistance. Information technology and communication services sectors had the strongest returns, while the energy sector lost ground following strong gains in 2022.

Bad news dominates headlines, while good news compounds slowly. The good news? The S&P 500 has now gone six months without a making a new 52-week low after entering a technical bear market. Only two bear markets in history have observed this and gone on to make news lows—1946 and 2001. The other 11 times saw gains, some of which went on to form significant new bull markets. Put simply, the market making new lows from here would be extremely rare in the context of history.

Consensus earnings expectations have been pulling in for the 2023 and 2024 calendar years. Based on the current trajectory, consensus expectations are close to forecasting a decline in U.S. aggregate earnings in 2023 versus 2022. This does not seem irrational as economic activity seems to be moderating and inflationary pressures—while less emphatic than last year—continue amid a still-firm labor market.

It’s important to note that our conviction for the U.S. equity market remains a Medium overall conviction—which implies a balanced approach is warranted. The scores across two key “pillars”—absolute valuation and relative valuation—have improved moderately, while scores for contrarian indicators and fundamental risk remained unchanged. This is not to say that we consider U.S. equities to be an outright bargain—we don’t. But our process tells us that the situation has moderately improved, which is reflected in our conviction.

At a deeper level, valuation spreads—the disparity in valuation levels between sectors—has narrowed. More pointedly, in this environment, we see fewer opportunities to be granular. In 2020–21, we identified opportunities clustered in more cyclical (or economically sensitive) areas of the market. Specifically, regarding energy stocks: Our valuation approach incorporates a mean-reversion framework for energy prices longer term, which leads us to conclude that energy producers in particular have become fairly valued, but we acknowledge that a prolonged period of structurally higher commodity prices has not been fully priced into these shares and also that companies have shown fairly strong capital discipline even as pricing has firmed, which is a significant, positive departure from previous cycles. Energy infrastructure shares remain relatively appealing within the energy sector. On financials, our research leads us to believe that large U.S. banks are still relatively attractive. The last area on our radar is defensive sectors, most notably healthcare, which have improved in our relative rankings and could help offset equity risk as it is not highly correlated with economic cycles. Regarding technology stocks, we don’t assess these stocks with a broad brush, though our own sentiment index would suggest the extreme popularity has subsided. We acknowledge that valuations have improved; with that said, the sector in aggregate has been “over-earning” relative to its own history (meaning, profit margins of late have been elevated versus long-term averages) for good reason in some ways. So, care is required in this space, especially with interest-rate rises and valuation multiple implications from those increases.

All this to say—a long-term perspective remains a critical ingredient for investor success. This is perhaps even more relevant during periods of market volatility.

Europe ex-U.K. Equities - Medium Conviction

European stocks advanced amid better-than-expected economic activity and signs that inflation was trending lower. Gains were tempered late in the quarter, as worries about the health of the European banking system pressured markets. However, there were also signs that the European economy could avoid a recession this year. LVMH—one of the largest companies in Europe and a barometer for consumer health—reported record-high revenue, driven by strong consumer spending and the return of international travel and tourism.

Like the U.S., significant amounts of negativity were previously priced into markets, and European equities sustained a rally, outperforming U.S. equities in the process. While one quarter of outperformance doesn’t designate a trend, it’s a data point worth monitoring. U.S. equities have outperformed European stocks for the better part of a decade, and market history continuously teaches us extreme outperformance doesn’t continue forever. As has been said, trees don't grow to the sky.

Going forward, attractive valuations and interesting opportunities are available to European investors. While valuation comparisons between countries aren’t a perfect science, certain industry groups in Europe have some of the most reasonable valuations in the developed world.

While we generally like European stocks, we find attractive opportunities when wedig into country and sector differentials. For example, we’ve reaffirmed our attraction to German stocks, which remain anappealing area despite the impact of the Russian conflict. In aggregate, we find German stocks offer solid balance sheets and potential upside toearnings—without eye-popping valuations. At a sector level, our positive view on European-integrated energy companies hasmoderated following recent strength, as it no longer offers the same valuation appeal. European banks, on the other hand, look more attractive on our analysis.

U.K. Equities - Medium Conviction

U.K. equities rallied along with broader Europe benefitting from better-than-expected economic activity and signs that inflation was slowing. The U.K. markets slowed more so than broader Europe late in the quarter, given their market has larger exposure to financial stocks. Following the collapse of Silicon Valley Bank, contagion fears spread to numerous European financial institutions, many of which are based in the U.K.

While the banking sector is under pressure, there are few indications that a major crisis is brewing. The U.K. banking sector remains well capitalized and tightly regulated. In addition, like the rest of Europe, the U.K. economy appears more resilient than many predicted, benefitting from strong consumer trends.

Our overall conviction score for the U.K. remains at Medium. While relative valuations remain at Medium to High, absolute valuations have fallen to a Low to Medium, reflecting recent performance.

This means our long-standing belief that investors were being well compensated for the risk of investing in U.K. stocks has softened, coming more in line with international peers. That said, they remain a solid dividend play, where we have seen many companies reinstate their dividends at more sensible and sustainable levels. Revenue is cyclical given the underlying key sectors of financials, energy, and materials, and we don’t expect any material changes to this going forward. Both operating and financial leverage are also stable. From a fundamental standpoint, we note that most U.K. corporates are high-quality businesses, although certain scenarios pose a risk to corporate profitability.

Australian Equities - Medium Conviction

Australian equities rallied alongside global equities in the quarter. Australia benefitted from easing inflation, and there is growing optimism that inflation may have peaked. Peak inflation could be followed by slower rate hikes, or possibly an end to rate hikes for the time being, usually a positive sign for equities. At its March meeting, the Reserve Bank of Australia (RBA) hiked its key rate for the 10th consecutive time, before pausing in April. Over the quarter, financials were the weakest Australian sector followed by energy.

Australian shares retain a Medium conviction, in line with many major global peers according to our analysis. While opportunities do exist at a more granular level—especially for those willing to invest differently to the index—we continue to see greater merit in global exposure, including Germany, China, and other select emerging markets. It would take a further decline in prices before we see outright attraction in this asset class.

Japanese Equities - Medium Conviction

Japanese equities were one of the better-performing global equity markets last year, and that trend continued in the first quarter. While surging inflation is considered an economic threat in the U.S. and Europe, Japan has a recent history of disinflation and low wage gains.

Thus, inflation could serve as a catalyst for breaking that cycle, creating an opportunity for the Bank of Japan to move away from quantitative easing. Warren Buffett recently increased his exposure in Japanese equities through large positions in five Japanese trading conglomerates, which could potentially send a signal to other market participants that Japanese equities are becoming more attractive.

We continue to see merit in Japanese equities. For the most part, our conviction in Japanese stocks is built on some major structural change taking place at a corporate level. While much of this structural tailwind is now behind us, we still see scope for a continuation of improving shareholder interests, rising dividend payouts, and board independence. Japanese stocks also carry attractive diversifying properties that can help in broad market setbacks. Sentiment toward Japanese financials has improved significantly over recent months as the Bank of Japan has adjusted its prolonged quantitative-easing program, a step toward interest-rate normalization.

Emerging-Markets Equities - Medium to High Conviction

Emerging-markets stocks advanced, helped by a weaker dollar and signs the U.S. Federal Reserve may pause rate hikes later this year. However, challenges remain in the form of higher inflation than in the developed world, volatile currencies, and in certain cases, political strife.

China—the largest emerging-markets country—had another positive quarter of returns but gains cooled dramatically from the fourth quarter. China's economic recovery has been bumpy since the government suddenly abandoned strict COVID-19 measures late last year. In March, President Xi Jinping solidified his leadership team for his third term. Top party officials vowed to support private sector businesses and sought to reassure foreign investors about doing business in China, which is hopefully a positive sign for Chinese equities.

Broadening out, the structural story around emerging markets remains intact. Emerging markets represent 80% of the world’s population and nearly 70% of the world's GDP growth, but only 10% of the total global equity market cap. A burgeoning middle class continues to develop in emerging markets and should present interesting opportunities for investors, albeit with higher volatility.

We retain our conviction at Medium to High. We consider emerging-markets equities to be among our preferred equity regions (alongside selected European equities), although recent strength softens this view. Some of this strength corresponded with increased investor optimism toward China, following a softening in the regulatory pressure being applied to Chinese tech companies together with a reopening after COVID spikes hit major metropolitan areas.

We also need to remember that emerging markets are heterogeneous. Investors tend to bucket emerging markets as one, but often the real opportunities present themselves at a country, sector, or regional level.

Global Sectors

Inflation and interest rates have been the biggest forces hanging over financial markets this past year. From a sector perspective, there’s an uneven distribution when it comes to winners and losers from those forces.

While financials are the worst-performing sector year to date, they were only down modestly in the quarter, hardly the demise some might expect given the news cycle. Other sectors like technology, communications, and consumer discretionary picked up the slack and more—at least when it comes to pushing equities higher—and are all up more than double digits for the year.

The opportunity to add value via sector positioning has narrowed. That said, we continue to see opportunities, especially at the defensive end. Let’s start with energy stocks, given their extraordinary run. This sector was among our highest-ranking opportunities last year and has enjoyed a period of elevated commodity prices. However, this opportunity has narrowed.

Communication services continue to offer one of the most attractive opportunities among the sectors we cover, despite a move higher in the early part of this year. Encompassing internet media companies, media and entertainment companies, and telecom services providers, the sector had been impacted by rising discount rates together with macroeconomic concerns. While we do see a potentially more significant level of fundamental risk present in the sector as opposed to other asset classes, valuations (both absolute and relative) as well as contrarian elements tip the scales on our conviction in favor of Medium to High overall.

Defensive value-oriented areas of the market continue to live up to their reputation and have held up relatively well during the downdraft. Sectors include healthcare, utilities, and consumer staples, all of which provide services that are required in both good and bad times. Generally, stocks in these categories are less volatile and less affected by the ups and downs of long-term market cycles. This could be important if we see a broad-based decline in corporate earnings.

Developed-Markets Sovereign

- U.S. - Medium Conviction

- Europe - Low to Medium Conviction

- Japan - Medium Conviction

Like equity investors, bond investors can also breathe a sigh of relief, as bonds rallied in the first quarter. Bond markets advanced as investors adjusted rate expectations going forward, suggesting that many see rate cuts coming before the end of the year. Fed and European Central Bank (ECB) officials continued to raise rates in March, but they made significant adjustments to the language and tone in their most recent statements alluding to the impact of the banking crisis.

Given where yields sit today, it’s not unreasonable to believe the worst could be behind us. A key aspect of the bond market is that interest rates adjusting higher from zero hurts most at the beginning. An increase in rates from 3% to 4% will be much less dramatic than the move from 1% to 2%, for the simple fact that if you’re getting paid a coupon of 3%–4%, and you reinvest, it has a tremendous compounding effect that isn’t replicated with 1%–2% yields. Higher yields will ultimately translate to higher future returns.

The material increase in bond yields has improved the forward-looking prospects, which applies positively to the U.S., U.K., and Australia. Europe is also rising from a very low base, although the absolute yields remain broadly unattractive. In all cases, yields fail to cover current inflation, but that ought to be expected given the environment. However, yields are now in excess of our long-term inflation expectations. Going slightly deeper, the ability to add income to portfolios while mitigating duration/default risk looks attractive to us currently. Rising government bonds are a positive for future return generation, and we expect this asset class to continue playing a role for investors.

That said, overall, we feel that managing duration risk makes sense in most scenarios. We are cognizant of the rather sizeable drawdown in government bonds in 2022, and adding materially to duration might make sense at some point. But any changes should be measured and deliberate, given the fast-changing response from central banks and the threat of stickier inflation.

In this sense, government bonds are in an odd spot. On the one hand, the global macro environment is widely uncertain with a range of outcomes. The domestic economy is challenged with slowing growth and surging inflation that has the potential to reduce aggregate demand. To complicate matters, central banks have been late to make decisions to address inflation that could ultimately lead them to a tough bridge—fight inflation aggressively or do what you can to maintain the economic recovery. Unfortunately, at this stage, these decisions seem to be mutually exclusive. Further, given the delicate nature of both the domestic and global economy, long-term sovereign bonds seem appropriate to hedge against risks, whether that is aggressive central bank action, a weakening of demand, or both.

Investment-Grade Credit

- U.S. - Medium Conviction

- Europe - Low to Medium Conviction

Like government bonds, investment-grade credit rallied in the quarter. The payback from 2022—a year that saw a historic pace of rate hikes—comes in the form of higher interest rates, which means higher bond yields for investors. When yields were low—or even negative—investment-grade bonds faced constraints from effective lower bounds during risk-off episodes. But after a painful adjustment to higher yields, investment-grade credit now offers some of the most attractive levels of income in more than a decade.

Both locally and globally, the higher yields have improved the attractiveness of this asset class over the long run, albeit from a low base. A key element is credit spreads—the difference between corporate-bond yields and government-bond yields—which have moved closer to fair value in our analysis, although not enough to be deemed attractive. In this regard, one should be careful of lower-rated companies with high debt levels, as a heightened default cycle can’t be ruled out. From a fundamental standpoint, the Federal Reserve’s increased involvement in this asset class had provided a backstop, although withdrawal of that support, increasing leverage ratios, and the possibility of higher yields are a cause for concern over the medium to long term.

In summary, this space has improved, but the inherent appeal remains muted. We see some attraction as a middle ground—providing some extra yield versus government bonds and a duration profile that can help in portfolio construction.

High-Yield Credit

- U.S. - Medium Conviction

- Europe - Medium Conviction

High-yield bonds rallied in the quarter alongside the broader bond market. High-yield bonds suffered last year because of rising interest rates, but there are now parts of the high-yield bond market in the U.S. and Europe yielding high single digits, and in some cases, low double digits.

Risk will be significantly higher in these types of bonds, but to some investors, these yields could draw in money that previously would’ve been invested in stocks. It’s been a long time since bonds have competed with stocks for investor dollars.

Improved valuation, both on an absolute and relative basis, leads to our overall conviction of Medium. In our view, this bears watching—but it’s not a “fat pitch” opportunity yet. While headline default risks are still deemed to be low, this could change with central banks tightening conditions and recessionary preconditions festering. A shorter duration profile relative to other bonds is also a potential positive in a rising-rate environment.

Emerging-Markets Bonds

- Local Currency - Medium to High Conviction

- Hard Currency - Medium Conviction

Emerging-markets bonds participated in the “risk on” rally to start the year. Like high-yield bonds, headline yields in emerging-markets bonds are rising to enticing levels, in the high single-digit range. This reflects the reality that many emerging-markets central banks have raised interest rates far in excess of their developed market counterparts to combat inflation pressures.

Central bank tightening cycles, global growth and inflation concerns, and China’s reopening will all play key roles in determining where emerging-markets bonds go from here.

Emerging-markets debt in local currency, which we still prefer over hard currency, continues to offer healthy absolute yields, accounting for the added risk. Our view remains that many emerging-markets sovereigns, though with notable exceptions, have improved their fundamental strength compared to history. This includes improved current account balances, enhanced reserves, movement to orthodox monetary policy, and a build-out of a local investor base allowing for a shift to local currency funding. In addition, the aggregation of emerging-markets currencies also look undervalued overall and could offer a tailwind over time.

The area can be volatile, yet even allowing for some pessimistic assumptions, our research suggests that investors could see upside if they’re willing to risk short-term volatility. In other words, we think investors can expect to be compensated for this risk over time, especially for local-currency bonds.

U.S Agency MBS - Medium Conviction

U.S. mortgage-backed securities (MBS) were positive to start the year like other key sectors of the bond market, though they did underperform government bonds and investment-grade bonds. The housing market appears to be bouncing off the lows observed last year, which could foreshadow more MBS supply coming to the market as the year progresses.

Overall, considerable weakness has been experienced while fundamentals remain solid. Given the sharp rally in mortgage rates and significant duration extension, the attractiveness of this asset class has improved. Investors will continue to watch inflation and the result it has on overall consumer demand. The idea of slowing economic activity should support higher-rated assets, such as agency MBS, as there is little inherent default risk. That said, further spread widening may take place before it turns in investors’ favor.

Global Inflation-Linked Bonds - Medium Conviction

Treasury Inflation-Protected Securities (TIPS) advanced against a backdrop of still-elevated inflation. TIPS didn’t serve as an inflation hedge last year, which was confusing to many investors, and there are a couple reasons for this: TIPS help protect from unexpected inflation, which we had more of in 2021 than we did in 2022, despite the record prints on actual inflation last year. The second reason for negative performance was rising rates. When rates rise suddenly, TIPS will act more like a bond than an inflation hedge.

Given inflation is cooling, it seems likely TIPS will serve the role investors expect going forward.

The increase in yields dwarfed the increase in inflation last year, a situation that is unlikely to repeat this year. TIPS should benefit from higher interest rates. In addition, recent trends in inflation indicate it may be falling from peak levels, yet it wouldn’t take much for markets to reprice inflation should something give. One important consideration is duration risk, where inflation-linked bonds are often longer-dated securities with meaningful interest-rate sensitivity.

U.S. Municipal Bonds - Medium Conviction

Municipal bonds advanced with a broader bond market to start the year, and credit fundamentals continue to be stable. Higher employment and increasing wages have bolstered tax receipts. Home values, a factor in property tax revenues, are facing headwinds in the form of rising mortgage rates.

Yields on high-quality municipal bonds have trended higher and look attractive on a tax-adjusted basis. Considering the uncertain economic environment, we expect volatility to persist, however, given the higher-quality nature of municipal securities, downside risks look manageable compared to similar quality corporate bonds.

Fundamentals of state and local governments have held up better than expected in the wake of the pandemic. That said, uncertainty around further interest-rate increases and high inflation could lead to further outflows, which can hinder the performance of the overall asset class.

Global Infrastructure - Low to Medium Conviction

- U.S. Energy Infra & MLPs - Medium Conviction

Global infrastructure represents a wide collection of income-producing assets, which includes airports, rail, and energy-related holdings. Transportation infrastructure, namely airports and toll roads, fared well over the quarter. Several European airports announced a return to paying out dividends this year, after a 2-3-year hiatus, with current passenger volumes returning to around three-quarters of pre-COVID-impacted 2019 levels. Major toll road assets have benefitted from the higher inflation environment, as tolls charged are typically linked to inflation-linked price index levels.

We expect a return to higher, normalized income levels for airports as passenger travel volumes continue to revert to pre-COVID-impacted levels. That said, infrastructure at an overall asset class level does not present as attractively priced as broader equities at the present time. Within infrastructure there are pockets of relative value, with railroads currently looking more attractively priced than toll roads, as recession and inflation concerns have weighed on railroads more heavily.

Oil prices are significantly higher, and energy infrastructure equity prices have rebounded strongly—which has served, at the margin, to mute our historically positive view of this asset class. That said, we continue to see some appeal given the relatively high-dividend yields and continued demand recovery. We also cite further governance and capital-allocation discipline. Specifically, our expectation is for a meaningful reduction in capital expenditures by energy infrastructure companies, with overall spend being reduced toward maintenance or steady-state levels. Headwinds remain amid the push to address climate change, but the transition to renewable energy is likely to be a long path, potentially allowing for an extended period of robust free cash flow generation for the industry—which we anticipate will be used to strengthen balance sheets and return cash to shareholders.

Listed Property - Low to Medium

After rallying strongly at the start of the year, global real estate investment trusts (GREITs) experienced some selling pressure in the later stages of the March quarter. Rising interest rates, higher debt service, and inflation leading to higher construction costs have been key themes hanging over the asset class. Recent concerns over potential tenant bankruptcy risk and the ongoing availability of bank debt funding have particularly weighed on the outlook for office REITs and REITs seen to be carrying high levels of debt. Office REITs face a more depressed rental-growth outlook over the short term on recession concerns and an uncertain outlook over the medium to long term due to uneven work patterns between employees working from home versus working physically in an office building.

REITs continue to remain dually exposed to economic conditions, both from a top-line rental growth perspective and also from a funding conditions perspective. As trusts that pay out high levels of earnings as dividends, REITs rely heavily on debt (and equity) markets to fund their highly capital intensive operations. With debt funding costs and construction costs on the rise, investors need to be wary of trusts exhibiting highly leveraged balance sheets and/or large property development exposure. Following price falls this year, listed property is starting to present better value, but remains relatively unattractively valued compared to broader equities.

Alternatives

Alternatives offered a partial ballast last year. Of course, this depends on the strategy being adopted. Our view remains that alternative offerings should exhibit genuinely diversifying assets with reasonable costs and liquidity. More specifically, with rising bond yields implicating both stocks and bonds in similar ways, alternative assets can appeal given that returns from this asset class tend to have a lower direct relationship with the performance of traditional asset classes such as equities and bonds.

Currency

While currencies are notoriously volatile, we tend to think of currency positioning via the lens of portfolio robustness (focusing on those currencies with defensive characteristics where sensible) but also as a potential source of upside at extremes. Looking ahead, we see merit in currencies outside the U.S. dollar, although more recent falls in the U.S. dollar moderate this view. The yen has the potential to provide diversification qualities and potentially help preserve capital in times of extreme economic and market stress, as well as provide potential upside.

Cash

Cash rates have improved, but remain well below the inflation rate, so losing money in real terms. However, we balance this view, as the market vulnerabilities are worth protecting against. More pointedly, we see cash serving three purposes. First, cash helps reduce the sensitivity to interest-rate rises, especially relative to long-dated bonds, which is still an important risk to manage. Second, cash should help buffer from any future volatility resulting from a fall in equity markets. And third, cash provides ample liquidity to take advantage of investment opportunities as they arise.

* The Overall Conviction level and Key Long-Term Drivers reflect the opinion of Morningstar Investment Management. These opinions are as of the date written, subject to change without notice, do not constitute investment advice, and provided solely for informational purposes. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses, or opinions, or their use. This document contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results to differ materially and/or substantially from any future results, performance, or achievements expressed or implied by those projected in the forward-looking statements for any reason. Investments in securities (e.g., mutual funds, exchange-traded funds, common stocks) are subject to investment risk, including possible loss of principal, and will not always be profitable. Prices of securities may fluctuate from time to time and may even become valueless. Securities in this report are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. There can be no assurance any financial strategy will be successful. Common stocks are typically subject to greater fluctuations in market value than other asset classes as a result of such factors as a company’s business performance, investor perceptions, stock market trends, and general economic conditions. Investing in international securities involves additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may increase these risks. Bonds are subject to interest-rate risk. As the prevailing level of bond interest rates rise, the value of bonds already held in a portfolio declines. Portfolios that hold bonds are subject to fluctuations in value due to changes in interest rates. Diversification and asset allocation are methods used to help manage risk; they do not ensure a profit or protect against a loss. Morningstar Investment Management LLC is a registered investment adviser and subsidiary of Morningstar, Inc. Investment research is produced and issued by Morningstar, Inc. or subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. The terms “we,” “us,” and “our” throughout this document refer to Morningstar Investment Management LLC. The term “Morningstar” refers to Morningstar’s Equity Research Group. The information, data, analyses, and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete, or accurate. The information contained herein is the proprietary property of Morningstar Investment Management and Morningstar Investment Services and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar Investment Management or Morningstar Investment Services. Opinions expressed are as of the current date; such opinions are subject to change without notice. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved. This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. Past performance does not guarantee future results. Morningstar® Managed PortfoliosSM are offered by the entities within Morningstar’s Investment Management group, which includes subsidiaries of Morningstar, Inc. that are authorized in the appropriate jurisdiction to provide consulting or advisory services in North America, Europe, Asia, Australia, and Africa. In the United States, Morningstar Managed Portfolios are offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC, both registered investment advisers, as part of various advisory services offered on a discretionary or non-discretionary basis. Portfolio construction and on-going monitoring and maintenance of the portfolios within the program is provided on Morningstar Investment Services behalf by Morningstar Investment Management LLC. Morningstar Managed Portfolios offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment adviser or investment adviser representative. Investing in international securities involve additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Morningstar Investment Management cannot guarantee its accuracy, completeness or reliability.