(Morningstar Investment Management) Nobody likes paying higher prices. According to recent reports, individuals are paying approximately $276 a month more than they did before, with rising interest rates potentially set to pressure household budgets even further. Businesses also get hurt, paying higher interest on loans, and business values are often squeezed.

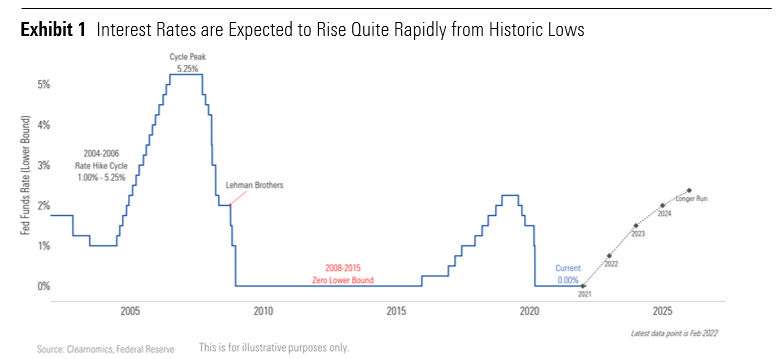

A full 1% increase in interest rates is now expected in 2022, coming in pretty short order, which is something we haven’t seen for well over a decade. This is nerve-racking for many individuals and businesses, and it’s certainly something that investors of all varieties (including professionals like us) are trying to digest.

The cause is primarily due to 40-year–high inflation numbers, but low unemployment is also a factor, as these represent the dual mandate of the Federal Reserve’s interest-rate decisions. Regarding the former, a lot of folks have been surprised by the outburst in inflation, and many are expecting (and hoping) inflation will show signs of cooling—if not now, then in the coming months.

Whether investors are reacting to an eventual, steady increase in interest rates, or whether they're reacting to the idea that there's going to be an aggressive movement, the volatility is a sign that investors aren’t quite sure what to expect. Herein lies potential opportunity.

At Morningstar Investment Management, we always prepare for what isn't built into the markets. So, one thing that we're thinking about, of course, is what happens if inflation continues at higher rates than people are expecting, and how do you position for that?

For Stocks, What is the Likely Market Impact of Interest-Rate Rises?

The stock market hates two things above all else: negative surprises and uncertainty. Inflation running at 40-year highs ticks both boxes, so there is a clear story that you can pull from recent price movements.

What we're seeing is a market that has been priced to perfection, especially those market darlings such as the big tech stocks. And any sort of negative surprise is going to rattle investors. That said, we focus on high-quality businesses. This includes companies with economic moats or significant competitive advantages. These firms are generally in a better position to pass along price increases to their customers. They may have power over suppliers as well—power that can help limit rising input costs. We also tend to favor more profitable companies (especially asset-light firms) with solid balance sheets. These businesses just tend to hold up better during challenging times and perhaps even improve their competitive positioning as weaker firms struggle. Our philosophy and approach to investing provides some potential protection here, especially over the long run—but all else being equal, we'd expect downside pressure on the stock market if interest rates rise faster than expected.

Perspective is important, as we live in a multivariable world, not a single-variable world. And behaviorally, we all tend to think in a linear fashion. We think of one variable, such as inflation, and the impact that inflation is going to have on portfolios. But obviously, there's a myriad of things that are interacting. There's inflation, interest rates, high valuations, and the potential for something bad geopolitically—such as war in Ukraine, or anything else that we can't predict. On the other side of the coin, we could see positive surprises from any number of variables.

For Fixed Income, What is the Likely Market Impact?

For the most part, over the past 40 years, fixed-income markets have become accustomed to a broad regime of falling policy rates and bond yields. This has served as a long-term tailwind for fixed-income returns. To the extent this regime shifts (and with U.S. fed funds near zero, other policy rates below the zero bound, and prevailing inflation well above policy objectives, it's not impossible to envision such a shift), fixed-income returns could be vulnerable. Inflation tends to erode real returns, and rising policy rates deployed in an effort to offset inflation tend to negatively impact bond pricing, creating a "double-whammy" of sorts for fixed-income investors. This looms even larger when we consider that some $53 trillion of fixed-income investments are held by U.S. households and non-profits, accounting for about 33% of assets and approximately 37% of net worth.

There are some important, potentially offsetting considerations. Generally, increases to policy rates tend to be driven by an economy that could sustain higher rates, acknowledging that the economy is strong. Certain fixed-income markets benefit from that. More economically sensitive sectors, such as U.S. high-yield and emerging-markets sovereign debt are potential examples. Furthermore, even with higher policy rates, fixed-income investors would benefit from re-investment of coupons at higher rates in the new higher-yield regime, so the impact from price loss due to yields moving higher is mitigated to some extent.

Additionally, historically speaking, we’ve observed that after yields adjust, there have been periods of positive returns in fixed-income markets despite rising policy rates.

Do We See Opportunities in This Environment?

As investment managers, we think through all of the different scenarios and consider how to position portfolios. And we approach that probabilistically. How likely is there to be an inflation surprise? How likely is there to be some sort of pullback based on valuations? As we position in the market, we're certainly thinking about those assets that help protect against inflation.

In terms of differences with our portfolio construction, the obvious one—and one that is worth expanding on a bit—is the tools we have to implement fundamental diversification. So, if your universe is strictly U.S. equities, you are mostly thinking about sector or industry diversification, focusing on quality, and so on. Whereas in a multi-asset portfolio, and especially in a multi-asset portfolio that is not tied to a market-based benchmark, we really get the most bang for our buck in being intentional about where we are positioned on the fixed-income side. The intent there is to offset the risks we are taking on the equity side so that the opportunity cost is less severe.

Therefore, when preparing for a rising-rate environment, we think our equity positioning is set up quite nicely in terms of where valuations are today and our favored areas of the market. We're also thinking about the benefits of a low-duration profile in fixed-income markets. But we equally want to know where this could go wrong. And, perhaps ironically, the scenario where our equity positioning could disappoint is in an economic downturn that is accompanied by a fall in longer-term rates. For this reason, we do not want to completely remove some of our longer-term nominal treasury exposures, as those are key exposures to offset any losses incurred in our equity positioning in that environment.

So even if you're concerned about inflation and interest rates, there still is a case to be made for some of these asset classes if the expectations that you have today are a little bit different from what actually plays out.

What Positioning Makes Sense in Today’s Uncertain Conditions?

Near-term, we’re aligned with what we’re hearing from a lot of other people: expect continued volatility. One of the reasons we say that relates to where valuations are, given the longer-term trend of the market. It has been a tremendous time to be an investor. Really, from the global financial crisis on, certainly, we've had periods of disappointment, periods of volatility. But by and large, people have made money hand over fist.

Among equities, it is worth noting that we are being very disciplined in buying and selling. We believe valuation really matters. So, we seek to buy assets at significant discounts to our estimate of their intrinsic value. We think this may offer a margin of safety if inflation flares up further or interest rates rise more than we expect. When stocks approach or exceed our estimate of intrinsic value, we’ll strive to be disciplined about selling as well.

Yet, even at current market prices, we can identify assets that are more attractive than others. That's led us to energy. It's led us to financials. It's led us to value-leaning areas more broadly, and small caps on a marginal basis. We also like international stocks, which offer a more attractive overall proposition with lower valuation pressures. And that's how we're positioned.

So, as we navigate 2022, you could argue that any disappointment, any concern about the economy, can lead to short-term volatility. But longer term, any meaningful bout of volatility could be a catalyst of opportunity.