(by Nabil Salem, Mike Coop, and Mark Murray, Morningstar Investment Management)

China’s crackdown is a stark reminder that investing is complex. It is more than just supply and demand, buying low and selling high, or finding high-quality businesses at low prices. Ultimately, governments have the power to tax, fine, seize assets, nationalize and imprison. But their power to spend and subsidize also creates opportunities.

In truth, investors have always lived with this uncertainty and many will have been burned by a sudden policy shift at some point in their investing life—perhaps more commonly in emerging markets, but also developed markets. This doesn’t make a market uninvestible, but it does mean we need to be ready for future shifts in policy when estimating cashflows and valuing assets, ideally applying a margin of safety. This time the impact has been especially large because (a) the companies and industries most impacted were not highly regulated, and (b) policy changes have been abrupt, large and wide ranging.

So, who exactly is being targeted? So far, we have seen reigning in of independent, large, profitable companies or those whose mission is perceived to be at odds with government societal priorities, such as encouraging population growth. There has also been more focus on the structures used by foreign investors to gain exposure. Valid concerns have been raised about weaker shareholder rights and protections compared to typical ordinary shares.

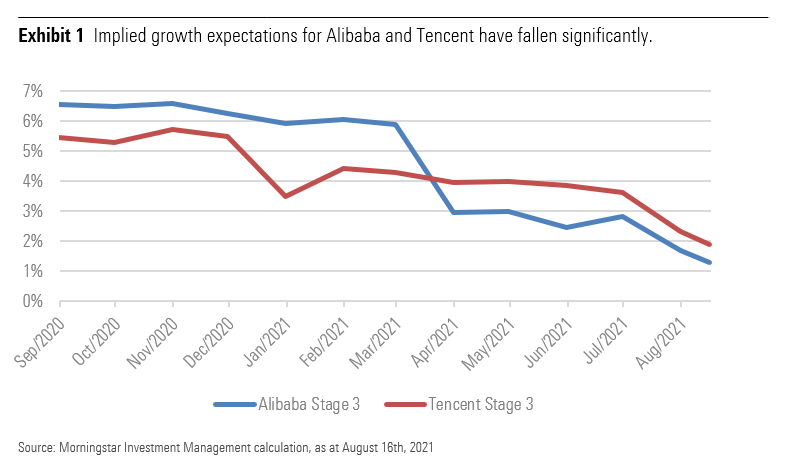

As a result, share prices have fallen sharply for large and widely held companies including Tencent, Baidu, and Alibaba—despite their dominant market positions and the strategic advantages over competitors that are hard to replicate.

The Framework to Decide if China is a Good Investment

The big question is what investors should do in response to the bad news? This is quite a delicate one to answer, as it depends on your starting position, risk tolerance, and objective. However, if your goal is to build wealth or drawdown on wealth then this problem is often best looked at from a multi-asset perspective. By taking this lens, it raises many questions around relativity. For example, do these developments mean an allocation to China is less attractive or more attractive versus other equity markets? Does it have the hallmarks of a great buying opportunity or a value trap? Would a change in exposure enhance the total portfolio outcome or bring unwanted risks?

The China crackdown has some, but not enough hallmarks, to make it a great contrarian opportunity. Our experience of prior pariahs—where we have made high returns for clients in our multi-asset portfolios—include Russia, Korea and energy equities. The common features of these contrarian opportunities included (1) terrible economic or corporate news (2) sustained selling (3) 50% + falls in share prices (4) extreme lows in price vs fundamentals, using historic and a range of potential scenarios, and (5) alarm, disdain and pessimism from the investing community.

China meets conditions 1 and 2. It is also just short of 3, with circa 40% share price falls for the Hang Seng Tech Index. However, it fails point 4, despite several companies sitting at multi year lows versus current fundamentals. As for item 5, recent investor surveys show a dramatic fall in support for global emerging markets, of which China remains the dominant part, but there are no clear signs of despair with notable investors and institutions remaining very active.

Looking to the downside, a checklist for value traps should include technological obsolescence, government policy shifts, and excessive leverage at an industry or country level. Despite some concerns around Chinese debt levels, for the most impacted companies, we can probably rule out the first and third given these companies are leading or benefiting from technological changes and are not heavily levered.

It is always worthwhile thinking about who is on the other side of any trade. At this stage, the most vocal bears on China have warned of further adverse policy shifts impacting profits. This is a fair concern and should be part of any investor’s scenario analysis. China does not have the democratic processes that slow down and make more transparent, big policy shifts. But this is not new. Additionally, many of the underlying government concerns, such as the power of big tech, are common in other countries where regulatory and tax shifts are also taking place. As we look at the range of potential scenarios, our valuation analysis suggests this is not a value trap, unless your central case is one of extreme economic policy.

Are Chinese Stocks a Worthy Addition to Your Investment Portfolio?

From a long-term, valuation-driven perspective, we believe China now offers better absolute and relative value than before the sell off, even with allowance for the impact of announcements and potential further shocks. Therefore, the case for adding exposure to China is building, albeit from a low base.

Our portfolios reflect this assessment: having had less than usual in China, we have been topping up exposure from low levels in more growth-oriented multi-asset portfolios.