(Shila Wattamwar / Morningstar) As I oversee the retail and wealth ESG strategy at Morningstar, one of my key mandates is to help provide the investor community with the tools they need to invest in a way that is sustainable—i.e., sustainable investing.

I have come to appreciate, however, that the term sustainable investing has evolved into an umbrella concept, embodying several different topics that can afford investors the ability to target very personal investing objectives and motivations. In general, all these topics embody the concept of sustaining the world and building a more just economy; however, different motivations and even different topics within these motivations resonate with more or less importance for different people. In other words, sustainable investing is defined by a personal preference.

A Deeper Dive: How Sustainable Investing Can Be Leveraged for Client Personalization

Let’s expand on this concept of personalized investing and how sustainability relates to this.

In general, personalization offers an investor the ability to align their investments with their personal investment objectives. One personal objective may be to manage risk and optimize for performance, while another personal objective may be to drive investments into areas that the client believes contribute to positive impact.

For an advisor, this provides an opportunity to convey to a client how exposed they are to these personal objectives from a sustainability lens. If one’s objective is to best position themselves for investment returns by reducing risks in their portfolio, an advisor can look at the sustainability ratings of their funds and further speak to the ESG risks they are still exposed to.

For example, being invested in companies that are not well positioned to transition to a low carbon economy can manifest as value at risk for that company and thus affect potential returns. Another relevant example would be to eliminate exposure from companies with poor governance. Through the Russia-Ukraine conflict, we’ve seen how many investors have eliminated exposure to corrupt companies linked to the Russian government.

The flipside of avoiding risk is the personalized objective of driving investments into areas of positive impact. Here, the objective is not primarily driven by returns, but rather the positive impact investors can have with their capital. For example, being invested in affordable housing projects in order to drive positive impact in surrounding communities. Or making sure a client’s portfolio is aligned with their personal values, such as decreasing exposure to alcohol or tobacco. I'll note that the positive impact may not be the only benefit and that financial performance may indeed be a benefit that accompanies certain positive-impact initiatives; there is certainly a relationship. But it is important to understand the primary benefit of one’s objective.

Those are all approaches that promote a more sustainable society and economy—but in different ways that align with someone’s personalized approach to sustainability. And I’ll once again stress that it is important for an advisor to understand their client’s personal objectives and preferences.

Personal Objectives and the Morningstar Sustainable Investing Framework

Along with overall investing objectives, many engaged investors may want to better understand the approaches that their funds are taking to achieve those objectives. For those investors, it is important to know that the fund has an intentionality around the attributes it’s trying to capture within its strategy. For example, it may be important to an investor that the funds they are invested in are committed to excluding certain types of companies. Or it may be important to another investor that the fund is practicing active ownership in the form of proxy voting and engagement.

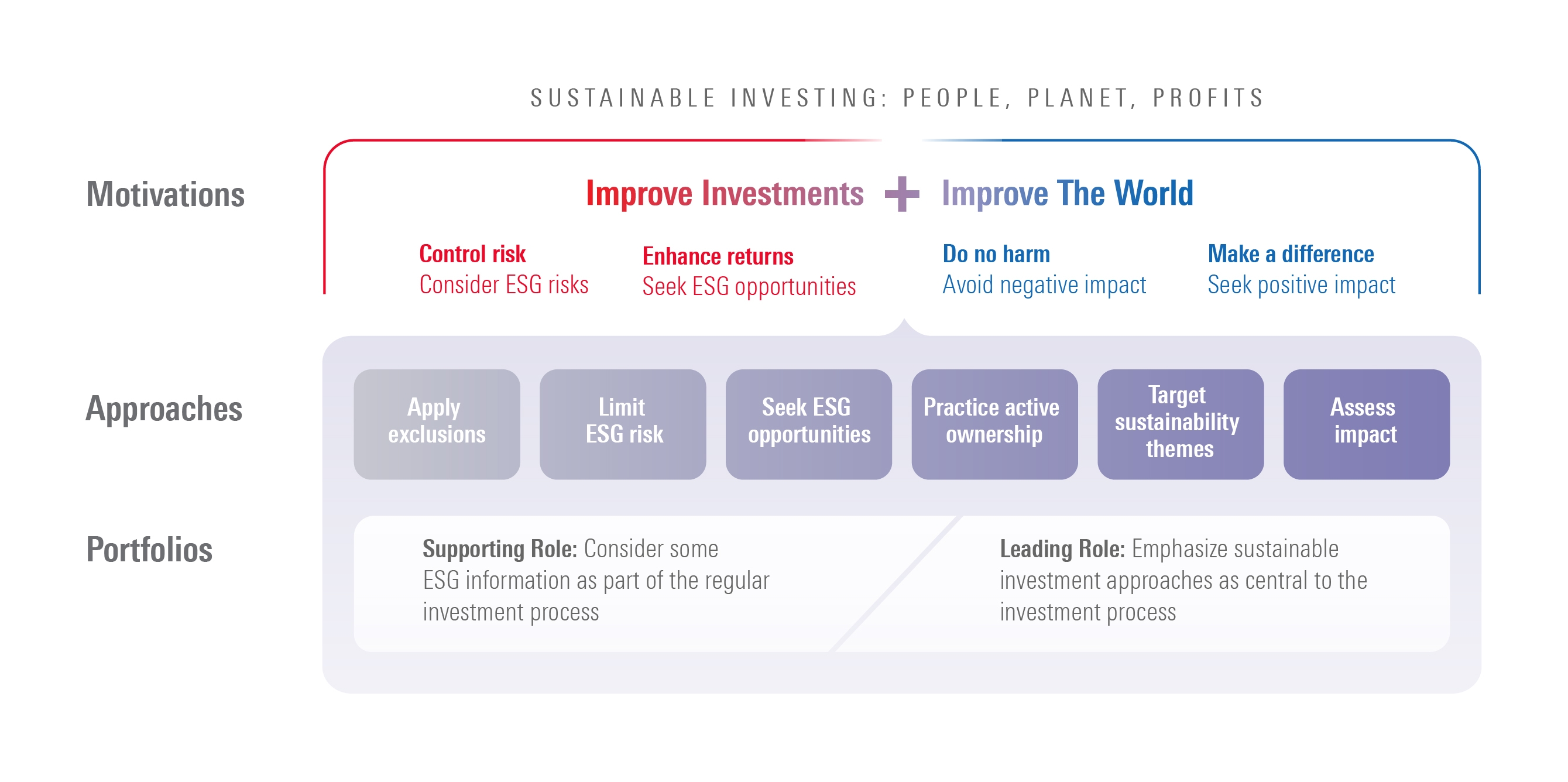

This is one of the key premises of Morningstar’s Sustainable investing framework. Morningstar ESG Director Jon Hale notes that sustainable investors can improve both performance and the world, but how to go about it is a personal choice that depends on one's own primary motivations.

Morningstar Sustainable Investing Framework

For more information on the Morningstar Sustainable Investing framework, please see the white paper.

In the framework, each approach is meant to represent a way in which a sustainable portfolio can be constructed and reported out. Essentially, each is a means by which one can better understand the sustainability attributes of their portfolio.

One can:

- Apply exclusions, such as reducing exposure to companies in their portfolio that derive revenues from areas that they would like to avoid, such as tobacco or small arms

- Limit ESG risk by making sure the funds they’re invested in are limiting exposure to material ESG risks such as human capital, bribery and corruption, climate risk, and more

- Seek ESG opportunities by investing in funds that are heavily exposed to low-ESG-risk companies

- Better understand the practice of active ownership (engagement and proxy voting) in relation to the funds they’re invested in

- Target sustainability themes such as gender equality, water, and more through the exposure of funds in their portfolios

- Understand and assess the positive impact that their investment choices have

To help with this crucial understanding, Morningstar has leveraged the Sustainable Investing Framework as a way to organize its own sustainability data points so that investors can better assess their exposures in accordance with these different approaches and thus understand their motivation. For example, if one was looking at a sustainability approach that limits ESG risks, then they would assess this by looking at the company- or fund-level sustainability ratings (the globes). On the other hand, if they were more motivated to align their investments to their own values and reduce exposure to alcohol, they would look at company- or fund-level exposure to revenues derived from alcohol manufacturing or distribution.

Personalizing ESG Directly in a Portfolio with Direct Indexing

In a world where we are seeing a growing number of investors (and thus more assets under management) across different demographics, I believe that sustainable investing can offer solutions to all of them. Direct Indexing is a notable example of a solution that truly allows an investor to take their personalized motivations into consideration and deeply align them with their investment choices. An investor can gain market exposure while still enjoying the opportunity to optimize their exposures to include companies aligned with the sustainability areas they feel most strongly about. And they can do so while maintaining a view of their general-risk and ESG-risk profile. Compared to an ESG-pooled fund, direct indexing provides an additional layer of personalization capabilities, which speaks to deeply personalized investing.

Sustainable investing is a way to help investors invest in a way that better aligns with their personal investing objectives. Sustainable investing can be transformative, as it can provide everyone with the specific benefit that is right for them.