(Marta Norton, Morningstar) Markets ended the year arguably priced to perfection, with the Morningstar US Market Index up 25.8%; in fact, 2021 marked the eighth year of double-digit gains in the past decade. But uncertainty around how long inflation would remain at high levels and the growing possibility of a shift to a less accommodative policy by the Federal Reserve became a source of volatility during the first month of the year; in January, the Morningstar US Market Index was down 5.9%.

Adding to the worries in February was the growing tension between Russia and Ukraine. As Russia became increasingly aggressive, investors grew nervous. On Feb. 22, when Russia established a military presence in the region already held by Moscow-backed separatists, the Morningstar US Market Index was down 1.1%, and the Morningstar Global Markets ex-US was down 0.7%. Within a little more than a day, with a full-scale invasion underway, fear and uncertainty roiled global markets and led to a wide array of results. On Feb. 24, the Morningstar Emerging Markets Index ended down 4.3%, the Morningstar Europe Index was down 5.6%, Intermediate Treasuries finished up 0.1%, and the Morningstar US Market Index closed up 1.8% despite rocky performance early in the day.

Markets continued to tumble by varying degrees in the week that followed, as the scale of human suffering skyrocketed and the response of Western nations isolated Russia from much of its typical economic and financial activity. From the Feb. 24 start of the invasion through March 7, the Morningstar US Market Index lost 0.7% and the Morningstar Global Markets ex US fell 7.7%, with heavily impacted markets such as Germany dropping 15.8%, as measured by the Morningstar Germany Index.

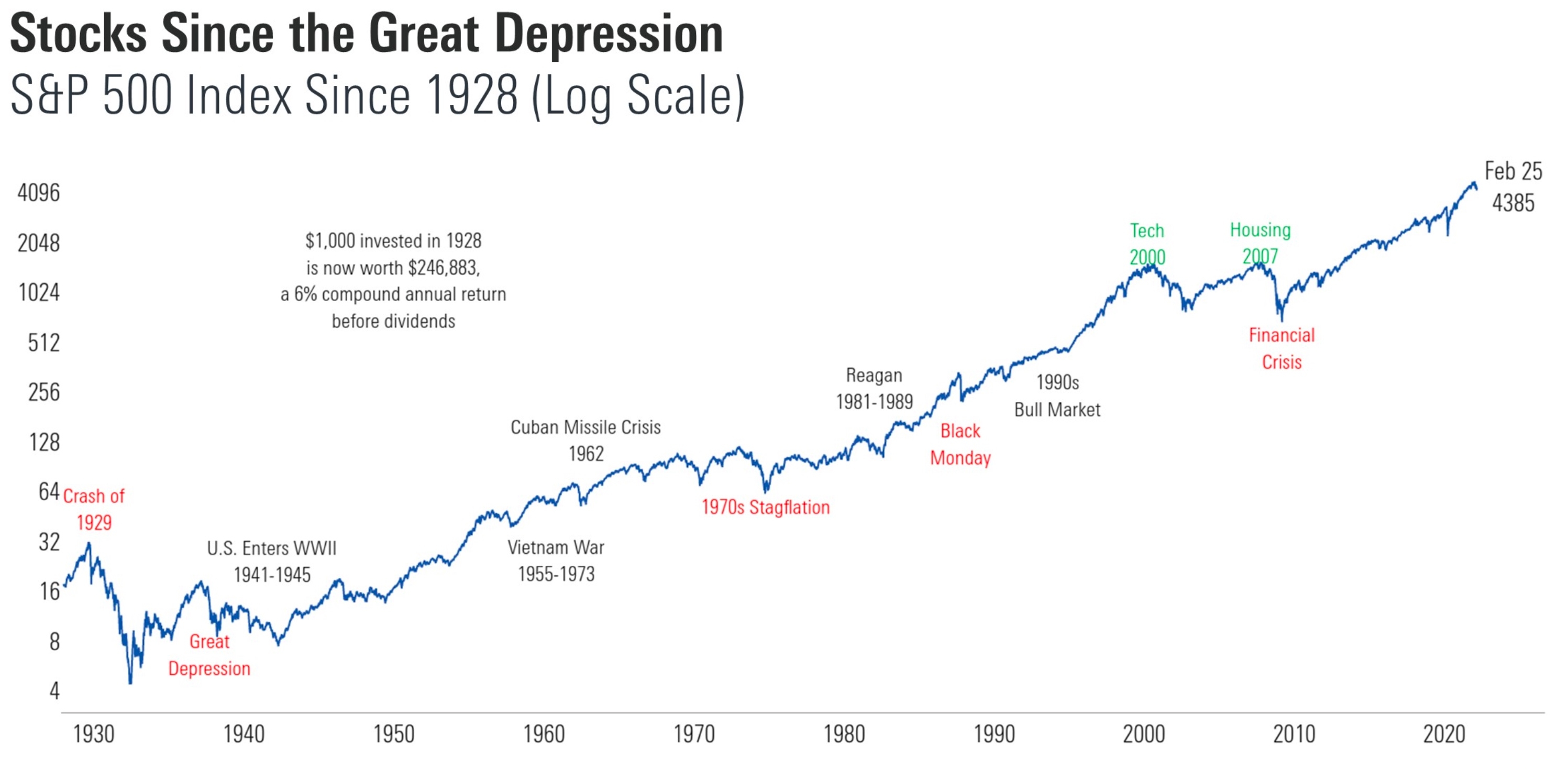

Advisors and their clients potentially have the hardest job of all. Our advice, as contrary as it may sound, is to stay the course. This is subtly different to doing nothing—it means you should review your goals, affirm your risk tolerance, and make sure they align with your portfolio. This turns a nearly impossible task (when the headlines are screaming, and we are living through history) into an actionable and positive plan. It is also worth remembering that despite a myriad of horrific wars, inflation, and other tragedies, in the long run the markets have managed to climb higher.

Source: Clearnomics, Standard & Poor’s

And if clients are in portfolios that are well calibrated to their financial goals, then adjusting as markets are selling off is less a form of risk control and more a recipe for loss. That is because not only is it hard to predict whether losses will continue, it’s also hard to predict when markets will suddenly recover. In fact, studies show that market timing is especially difficult because investors need to make two—not one—decisions: when to get out and when to get back in. Getting both decisions right has proven elusive to most investors. It’s just too complex a world.

Will we continue to see market losses?

We’ve always been of the view that anticipating price moves over the next few days, weeks, or even months is a fool’s errand. Daily price moves happen at random, and we have no advantage in predicting geopolitical outcomes. We aren’t alone in that: very few, if anyone, do. That said, history tells us investors hate uncertainty, and uncertainty remains high. So, volatility remains our default expectation; indeed, there is a wide range of potential outcomes to the current conflict and its resulting impact on related financial markets.

How is the Morningstar Investment Management team responding to the conflict and the price moves?

Our focus remains on fundamentals and the degree to which price movements become unmoored from those underpinnings. Of course, in a crisis of this magnitude, the chance that not just prices but also fundamentals are in flux is a very real possibility. As a result, our team is focusing on fundamental shifts that impact earnings, dividends, and valuations. We won’t likely know the lasting impact immediately, so in the meantime, we are watching the price behavior of asset classes that are unrelated to the conflict. Should those areas sell off in sympathy, we are more likely to consider the price gap an opportunity to add at better price points. Top of mind for us are areas such as Germany and European financials, which have suffered far more than other regions. In the case of Germany, we are considering the potential for supply-chain disruptions, given the country’s significant international trade. For European financials, and banks in particular, we are considering direct exposure to Russia and the impact potential write-downs could have on our assessment of company value. We’re also testing various macroeconomic scenarios, including a recessionary environment, given banks’ economic sensitivity.

Morningstar Investment Management is a big believer in behavioral finance. How does that impact your decision-making at this juncture?

Being big believers in behavioral finance is another way of saying we are aware of our weaknesses. As humans with all the usual mental shortcomings, we are tempted to develop attractive narratives and overweight those narratives when thinking about the outcome. Trying to think through the political and economic impact is more likely to harm than help returns.

Like everyone else, we are also prone to recency bias, meaning we let our most recent experience dictate our overall perspective. Our most recent experience of market volatility was a sharp bounce; that outcome may or may not be the case this time.

Rather than equating recent market movement with today’s environment, we take a longer look back through history and consider the wider range of outcomes that could occur. Then, at the risk of sounding like a broken record, we return to the lasting impact on the fundamentals, which in the long run drive asset-class returns.

What can we expect from Morningstar Investment Management going forward?

Know that we are laser-focused on managing the portfolios we offer you and are leveraging our global team to develop a fundamental view that we believe will ultimately drive returns over the appropriate time horizon. We’ve put enormous effort into calibrating each portfolio so that it is taking the appropriate amount of risk for its objective, and we will adjust those portfolios in real time to take advantage of opportunities as we think we see them. This means, unfortunately, that we won’t avoid all daily losses. We do believe, however, that our efforts will put investors in the best position possible to help achieve their individual financial goals over the longer term.

As always, we appreciate the opportunity to work with you and will continue to communicate our latest views as conditions evolve.