(Morningstar Wealth) Economics get a lot of headlines—with mass speculation around interest rates, inflation, and economic growth. This impacts markets directly. Asset prices change not just in response to economic change, but also in anticipation of it. Portfolio construction must account for economic change—both expected and unexpected.

The Economic Reality and Our Base Case

The Economic Reality and Our Base Case

Drawing on the macroeconomic backdrop, market participants are eager to understand the path of interest rates, inflation, and economic growth. This is naturally complex, with divergence between the developed world and emerging markets. For example, the economic trajectories of the U.S. and China are vastly different heading into 2024. The same can be said for Europe and Japan.

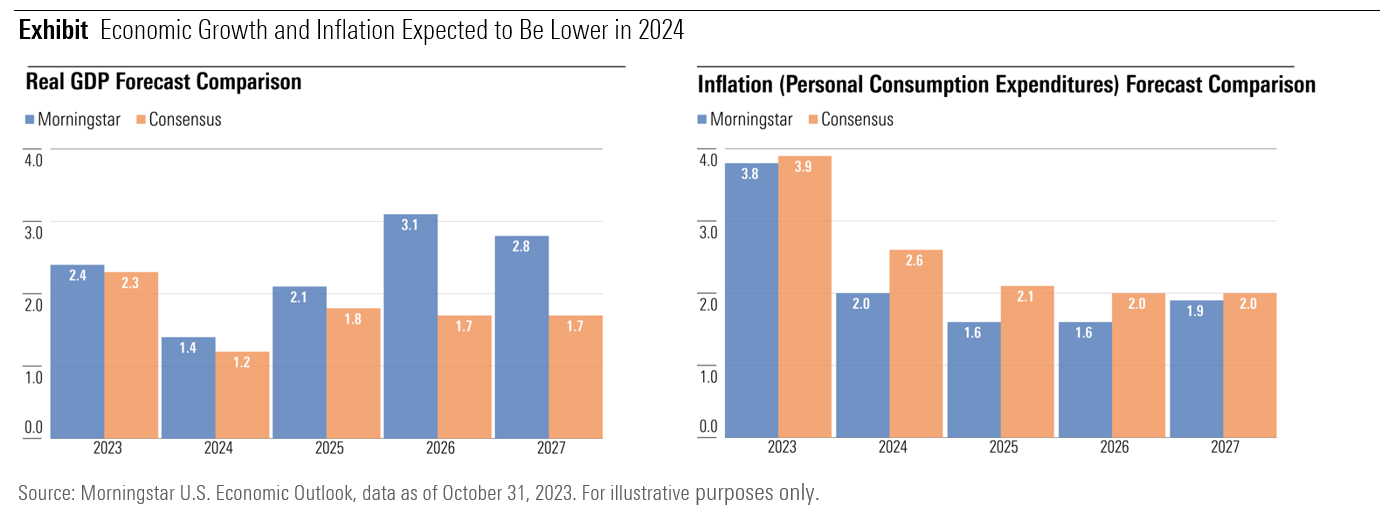

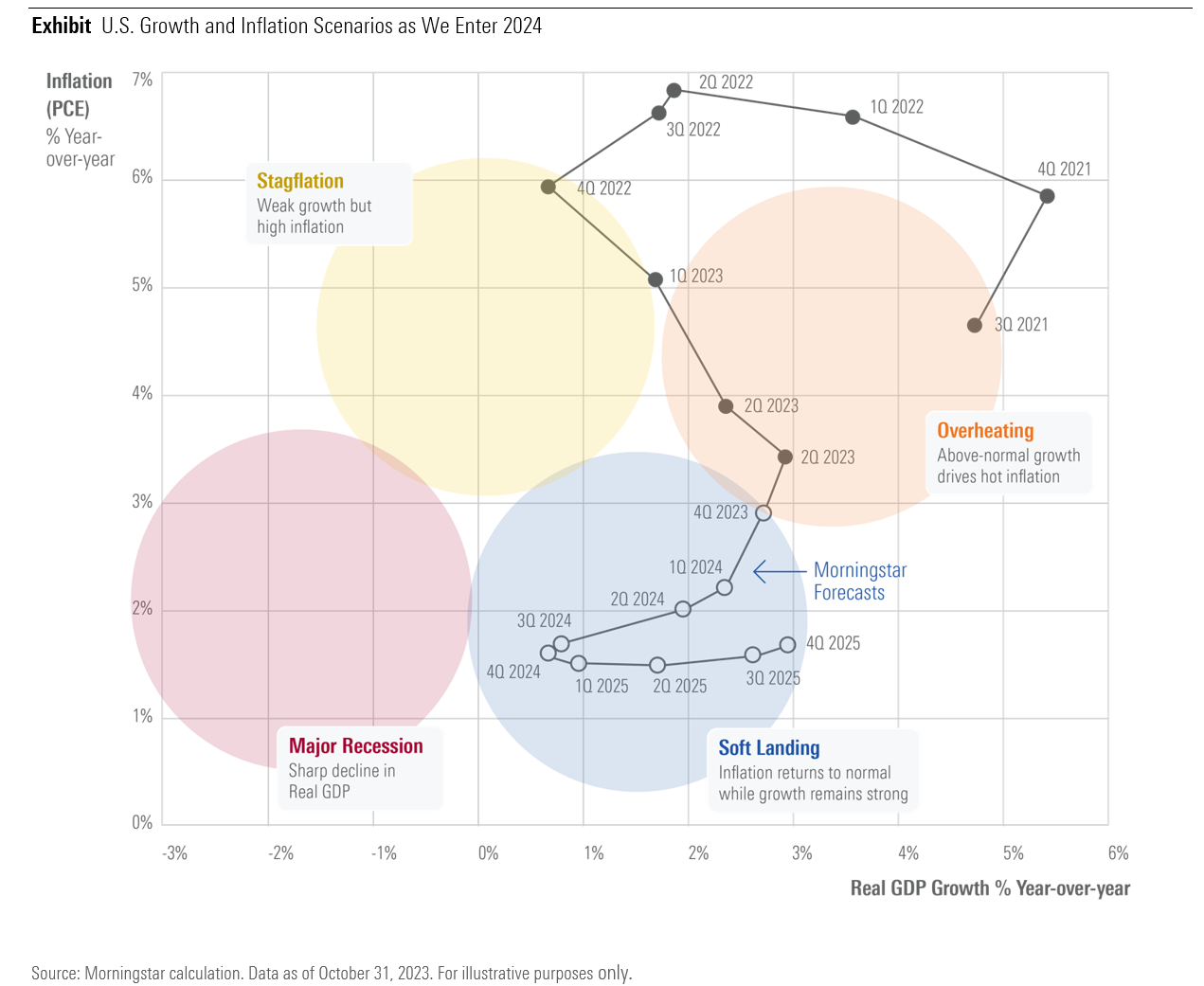

In the case of the U.S., our economic outlook is on the optimistic side—relative to expectations—with respect to U.S. GDP growth and inflation for the next several years.

To be clear, we do expect GDP growth to slow in 2024, owing to the lagged effects of Federal Reserve rate hikes, along with more cautious consumers as household excess savings deplete. But, slowing growth along with normalizing inflation could induce the Fed to begin cutting rates aggressively in 2024. We expect monetary loosening to drive a strong GDP growth rebound over 2025 to 2027, which will also be facilitated by supply side expansion in terms of labor supply and productivity.

We expect inflation to return to the Fed’s 2% target in 2024 and stay there in the following years. The supply constraints that caused a surge in inflation in 2021-2022 are now alleviating. This allowed inflation to fall dramatically in 2023 despite an acceleration in GDP growth. This process still has much room to run.

A few key observations on our base case for the U.S. include:

- Inflation normalizing in 2024 and remaining low.

- GDP growth to eke out a small positive number in 2024, then pick back up.

- Higher bond yields to lead to weaker (but still positive) growth in 2024 and 2025.

- We expect the Fed to cut interest rates meaningfully in 2024 and 2025.

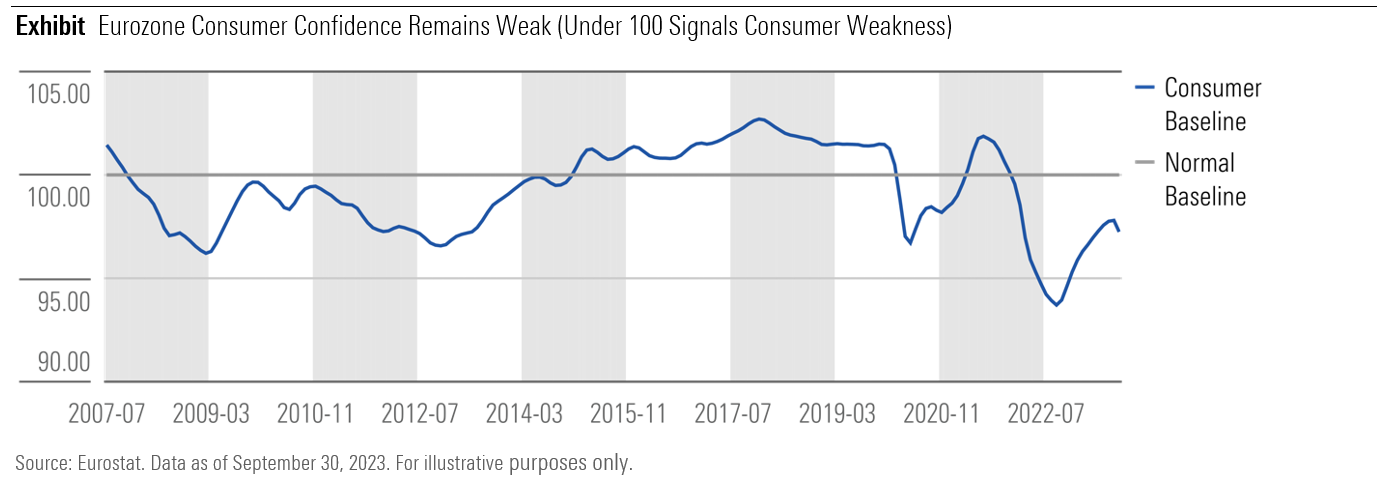

Across the pond, Europe remains more fragile economically. Economic growth has been essentially flat since Covid, with the Eurozone now likely to be in a technical recession.

Sentiment readings have been screening negative for some time now, most notably manufacturing PMIs. Wage inflation has not risen as strongly as in the U.S., meaning that consumers are left particularly cash-strapped, which is pressing heavily on consumer spending.

Inflation has fallen materially from the double-digit levels of late 2022, but remains well above central banks’ targeted levels. With the European Central Bank (ECB) and the Bank of England (BoE) projecting that inflation will remain high in 2024, central banks are walking a tight-rope between reducing inflation and strangling a struggling economy.

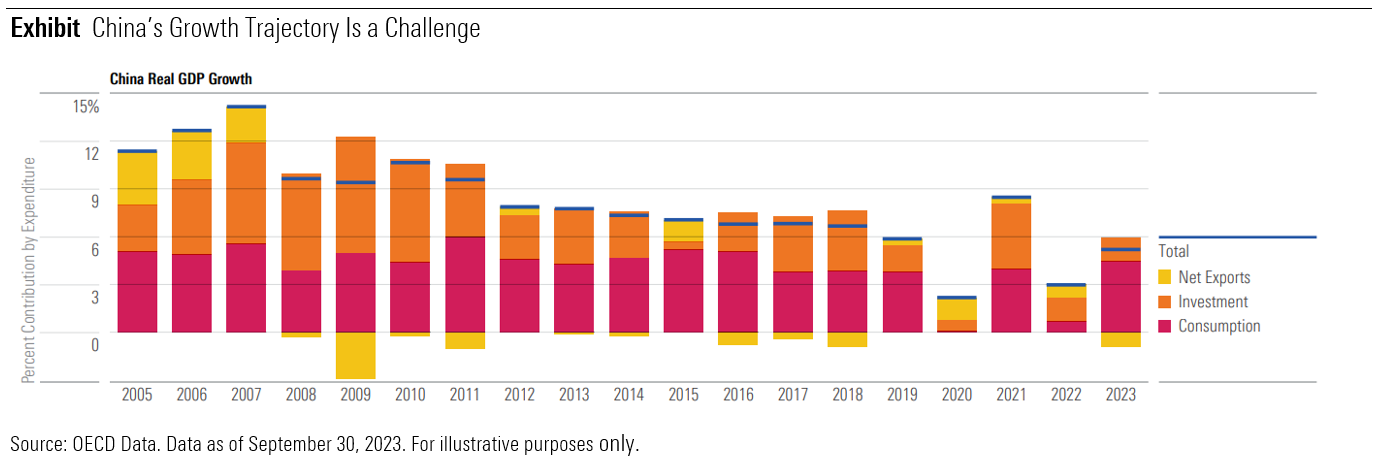

Turning our attention to the emerging markets, it's crucial to note the diverse economic dynamics at play within this block. Many eyes are directed at China, where inflation is less of an issue. Economic weakness could still present a challenge in 2024 though, as well as geopolitical threats over Taiwan and commercial property risks. Elsewhere, despite the economic slowdown, certain markets in Asia and Africa are demonstrating resilience and offer attractive growth prospects. However, external debt vulnerabilities, commodity price volatility, US dollar strength, and geopolitical risks necessitate a degree of caution.

Turning our attention to the emerging markets, it's crucial to note the diverse economic dynamics at play within this block. Many eyes are directed at China, where inflation is less of an issue. Economic weakness could still present a challenge in 2024 though, as well as geopolitical threats over Taiwan and commercial property risks. Elsewhere, despite the economic slowdown, certain markets in Asia and Africa are demonstrating resilience and offer attractive growth prospects. However, external debt vulnerabilities, commodity price volatility, US dollar strength, and geopolitical risks necessitate a degree of caution.

Swing Factors

Swing Factors

Our base case scenario is the most likely, but not the only outcome possible. As always, there are swing factors that can push inflation, economic growth and interest rates, up or down. Many of these have dramatically changed the course of economies and markets in recent years. Here are three that we believe have the potential to result in a wider range of outcomes than seen in more stable environments.

- Geopolitics has become a greater swing factor in recent years, with the return of military conflict in eastern Europe and the Middle East. We’ve also seen more abrasive relations between China and the U.S. and scope for elections to result in large policy shifts. As investors anticipate change and adapt to new risks, these conflicts have already impacted prices, with potential knock-on effects on commodity prices including critical energy supplies. We must also weigh the economic effects of an ongoing rise in military spending in Europe, the U.S. and Asia.

- Natural events impacting our physical environment and health have the potential to impact growth and inflation depending on the severity and government responses. Extremes in weather impacted energy demand in 2021 with shortfalls in solar and wind in North Asia causing higher demand and prices for gas while pandemics had tragic impacts and ongoing constraints on supply that especially impacted the economy in China from 2020 to 2022.

- Our third swing factor is the take up of technological innovation. Only when the breakthrough discoveries of the past like the printing press, steam engines, electricity and computing were applied at scale did they enhance productivity, increase growth, and ease inflationary pressures. The faster artificial intelligence is applied, the faster the effects will be felt, and we are at the point now where application is expected to ramp up.

So, in periods of change like today, investors need to prepare themselves for a wider-than-usual range of potential outcomes.

How Much of the Economic Challenge Is Priced In?

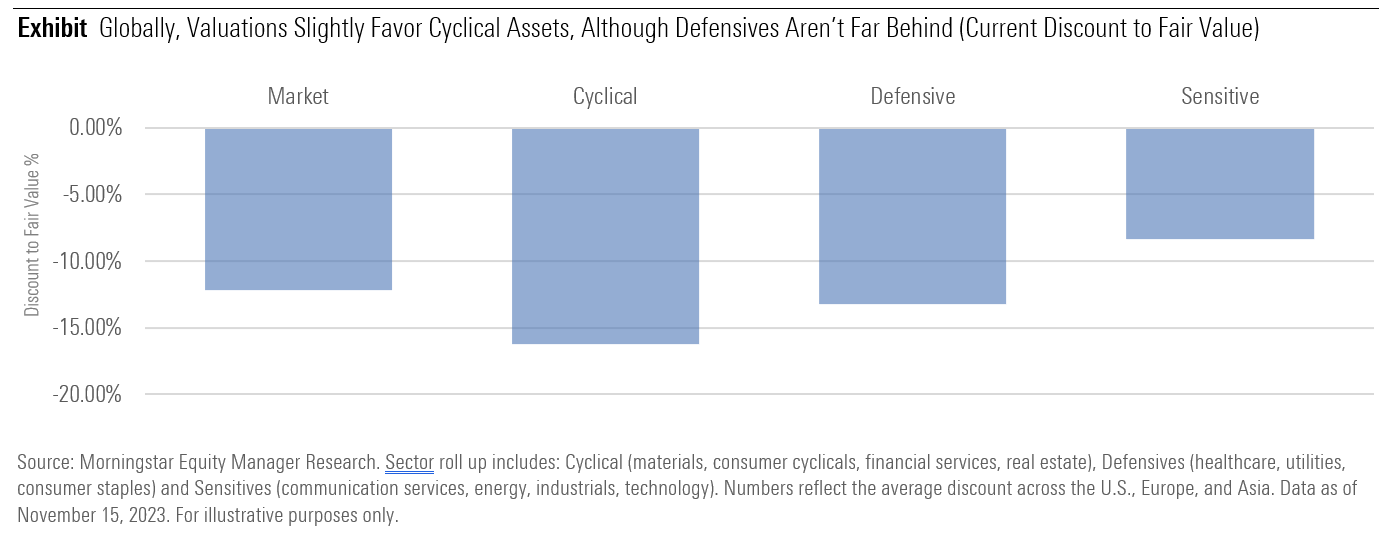

So far, we’ve laid out the base case for lower (but positive) economic growth, lower inflation and a deteriorating jobs market, which could pave the path for interest rates to come down from their 5%+ levels. Has the market priced this in?

We can assess how the market is pricing economic expectations by segmenting stocks by cyclical, defensive, and sensitive factors and comparing their relative valuations. If a recession were top of mind, we’d expect a steep discount in cyclical and sensitive stocks, but higher valuations within defensive stocks. However, while we see valuation dispersion between cyclical and defensive stocks, in aggregate both markets are offering discounts, while sensitive stocks are closest to fair value. This pricing is closer to a soft landing expectation and suggests a recession could catch broad markets off guard. However, at a more granular level, across our North America Market Outlook, Europe Market Outlook, Asia Market Outlook, Australia Market Outlook, and Global Convictions and Outlook, we can see utilities, communication services, and financial services all look to be pricing in an economic deterioration.

Accounting for a Range of Potential Scenarios

Taking the above into account, we employ scenario analysis to assess portfolio robustness and readiness in the face of abnormal circumstances. This proactive approach arms us with the necessary tools to navigate through both steady and turbulent times—regardless of the economic direction.

In terms of portfolio positioning, our base case macro outlook of lower growth, inflation, and rates, but without a recession, is supportive of classic multi-asset portfolios invested in bonds and equities. Bonds, in particular, have become more attractive as yields have increased.

We are mindful that investors need to stay the course to attain their financial goals, so holding well-priced assets that can also support portfolio values in alternative scenarios is valuable, in terms of different economic growth and inflation scenarios.

Treating this as a form of insurance, inflation-linked bonds have become more attractive because their price has fallen, if inflation does turn out to be higher than expected. Defensive equities still offer value and help smooth outcomes in scenarios where economic growth is weaker than expected. Should economic growth turn out to be higher than expected, there are attractively priced cyclicals including financials and smaller companies.

Based on our scenario testing, the key portfolio positions that can help facilitate robustness include:

- Defensive equities, including healthcare and utilities

- Inflation-linked bonds

- Diversified currency exposure outside the U.S. dollar

We acknowledge that this outlook comes amid recent volatility and a wide range of possible outcomes. In the coming years, we anticipate a complex macroeconomic playing field, influenced by various global influences and resultant investment implications. From a portfolio management perspective, these fluctuations carry both risk and opportunity, which we are keen to navigate wisely on behalf of our clients.

At Morningstar Wealth, our mission is to empower investor success, and we're pleased to offer these resources to help you and your clients reach their financial goals. Our investment approach is designed to be risk aware, intentional, contrarian, and valuation-driven.

Advisors who use model portfolios can often find more time to grow their practice, focus on what matters to prospects, and build stronger, lasting relationships with clients. To learn more about using model portfolios in your practice, call +1 800 866-1749 or email wealth.us@morningstar.com to reach your regional sales representative.