Most investors want to see their investments appreciate, however, they may not be prepared for the capital gains taxes that could arise when selling. One way to potentially reduce the impact of taxes is to utilize a direct indexing strategy that uses active tax-loss harvesting to help offset realized gains. Investment Strategist Greg Kanarian gives a brief overview of what direct indexing is and how it may be an “all-weather” strategy – even in volatile times.

What is direct indexing?

Direct indexing is an equity investing strategy where stocks are purchased to build a portfolio that matches the performance of a pre-selected index, such as the S&P 500® Index. The goal is to match the performance on a pre-tax basis, but outperform on an after-tax basis. Direct indexing is mostly a vehicle for taxable accounts but can be used in retirement accounts if customizations are added.

Direct indexing strategies can generate better after-tax returns in two main ways. The first being tax-loss harvesting, which is selling a stock when it's down and replacing it with another security. By selling a stock when it is down, investors get to book that loss for tax purposes.

The second is deferring gains to the future. If an investor sells a stock at a short-term capital gain, they will pay tax rates commensurate with their ordinary income. If a stock is sold after holding it for a year, the investor benefits from the lower capital gains rate. By waiting just one day for a stock to go from short-term to long-term, depending on the tax bracket, an investor could save up to 20% in taxes.

How does direct indexing work?

The "direct" part of direct indexing means an investor owns stocks outright in a separately managed account (SMA), which allows for some customization. To closely track the performance of the S&P 500®, investors don't need to own all 500 stocks. An index fund or an index ETF will do that. Investors shouldn’t own all 500 stocks because, when a stock is sold for a loss, it may need to be replaced with another stock in the index. Investors can’t simply buy back the same stock because that will result in a violation of the wash sale rule, which disallows the loss for tax purposes if the same stock is repurchased within 30 days. By utilizing direct indexing, investors harvest losses and invest the proceeds in a replacement security, which lets them stay invested in the market and can defer the payment of capital gains tax.

When an individual stock is down, for example you bought it at $100 and now it's at $90, that stock can be sold at a loss. The $10 loss can be used to offset other realized portfolio gains. If there aren’t other gains, the tax write-off can be used to reduce taxable income by $3,000 in that tax year or carried forward to offset future gains. If the same stock is down within an ETF, the loss for the individual stock will be reflected in the performance of the ETF, but the client doesn’t get the flow through of that tax benefit on their own tax return.

Often advisors have clients with concentrated or low-basis positions in a stock. This scenario can be good and bad. It’s good because it’s likely a low-basis stock because the security has done well, and the client has profited from that. It’s a bad thing when, because of that security’s success, the client may get emotionally attached to the security and have a difficult time deciding when to de-risk or diversify their portfolio.

While it might be painful to take a gain and pay taxes, it’s usually less painful than seeing that stock decline 20% in a day because they missed earnings. Now you suddenly can recognize a gain and keep that cash.

What are the benefits of direct indexing?

One of the big benefits of direct indexing is, when you harvest a loss, it’s the client’s loss that can be used on their tax return. Mutual funds, however, cannot distribute net losses to clients.

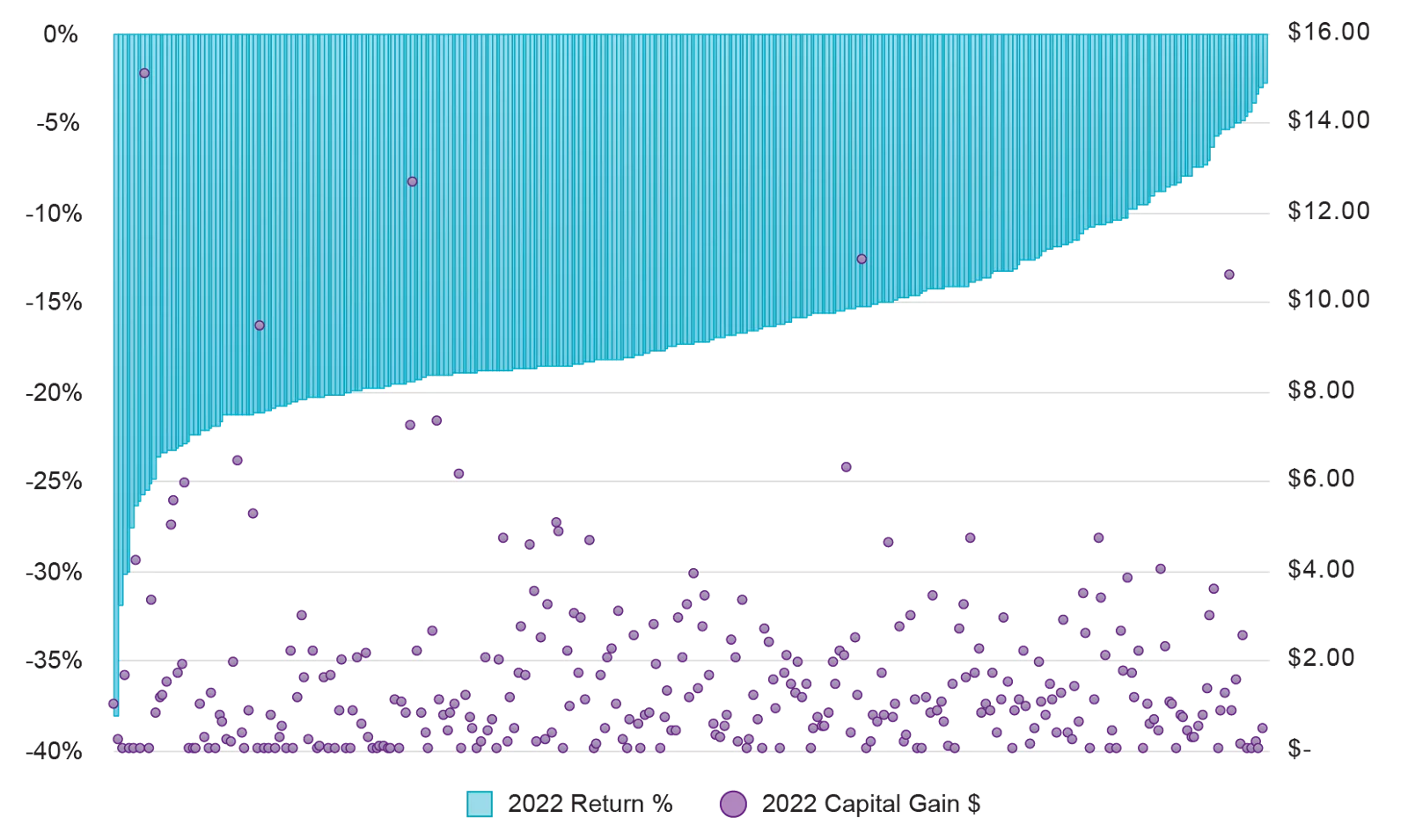

In 2022, the S&P 500® Index was down 18.1%. If you looked at the 308 large-cap blend funds in the Morningstar universe, 100% of those funds lost money, however, 83% of those mutual funds paid a capital gain. See Figure 1. At that time, a lot of investors wanted to sell out of mutual funds.

Figure 1 – 2022 Highlights the “Mutual” Sharing of Tax Burden

When the mutual fund manager receives a sell order, they need to raise cash and sell securities in their portfolio. They’ll usually sell stocks they’ve held for a while, perhaps the stocks that are overweight in the portfolio that have a gain. They’re selling those stocks and generating gains. If you’ve been an investor at the beginning of the year through the end of the year, they must distribute those gains to you, even if they had a net-loss position. That is an important distinction: direct indexing in a separately managed account provides taxpayers with harvested losses they can use to offset other realized gains.

When should someone consider this investment strategy?

One of the most important parts of wealth building is to stay invested in the market, no matter what. One benefit of direct indexing is that it helps clients stay invested in the market during volatile times. With the past two years of strong market performance, one might expect to see more volatility in the future. When there is market volatility, clients typically want their advisor to do something for them when the market is down. Advisors know that it might be best to sit still, but clients often want to see action. With direct indexing, they can see that action in their accounts because they have 150 stocks that are actively being loss harvested. That gives clients comfort that their advisor isn’t just watching the portfolio value decline, but instead they are capitalizing on the down market.

What is Natixis’ process for buying and selling securities?

Natixis direct indexing provides fully customizable separately managed accounts. We leverage a multi-factor algorithm that systematically looks at each account. The accounts typically consist of 150 stocks and, every time cash is added, shares are purchased. We have individual tax lots so a stock can be down, but that doesn’t necessarily mean there is a loss.

We have thresholds on when we want to harvest losses. We look at all the lots to determine if there is a loss and if so, is the loss large enough that we should be trading? Short-term losses are worth more than long-term losses, so a stock doesn’t have to be down as much on a short-term basis for us to want to harvest that – usually down 4%-5%.

Once we’ve decided to harvest a loss, we determine where the money will go next. We want to make sure we maintain exposure to the same sector. If we sell something in technology, for example, we want to buy something else in technology.

Often clients use direct indexing to tax-efficiently sell a low-basis, concentrated position in, we’ll call it company A, for example. A client funds an account with $20,000 of company A and also gives us $80,000 in cash, creating a $100,000 portfolio. We typically build a portfolio of 150 stocks, so in this case we’d take that cash and buy 149 other stocks. We systematically look at the portfolio for losses on a quarterly basis. If there is a loss, we will recognize it. Let’s say company B is down 10%, we’ll sell company B and take a loss. We will then take the proceeds from company B and we’ll buy company C. Simultaneously, we’ll recognize gains in company A equal to the loss realized in company B. The net result is tax neutral to the client in that quarter.

Why is diversification so important?

There are opportunities to sell securities when they’re down and replace them with another security. If the market goes up, usually the replacement securities bounce back. At the end of the year, the performance is going to look like the index, but losses have been generated. For instance, during the last 18 years when the S&P 500® Index had positive returns, we were able to generate net losses for clients in 16 of those years.

Direct indexing SMAs allow advisors to deepen client relationships and create partnerships with clients’ tax professionals by setting up a “loss-harvesting engine” that can help mitigate tax expenses.

What is tax loss harvesting?

A portfolio can harvest its losses for tax purposes by selling investments when their current value is less than the price originally paid for the security. These losses can be used to offset other capital gains on an investor’s tax return. If there are excess losses, they can be used to offset up to $3,000 in ordinary income – or be banked for use in future years.

Tax-managed investment strategies

Natixis Investment Managers Solutions provides design, development and execution of portfolio strategies tailored to clients’ specific investment objectives and unique portfolio constraints.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

The S&P 500® Index is designed to measure the performance of the large-cap segment of the US equity market.

This material is provided for informational purposes only and should not be construed as investment or tax advice. Investors should not make investment or tax advice choices solely on the content contained herein, nor should they rely on this information to apply to their specific situation or any specific investments under consideration. This is not a solicitation to buy or sell any specific security. Although Natixis Investment Managers Solutions believes the information provided in this material to be reliable, it does not guarantee the accuracy, adequacy, or completeness of such information.

This information does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

Diversification does not ensure a profit or guarantee against a loss.

Natixis Advisors, LLC provides advisory services through its division Natixis Investment Managers Solutions.

7196480.1.1