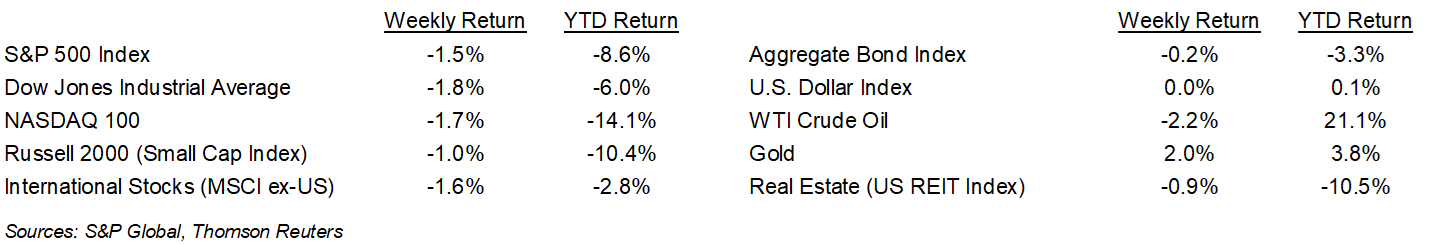

(Novapoint) Concern over tensions between Russia-Ukraine, and impact of inflation and Fed actions in the U.S. have built a wall of worry year-to-date that the equity markets have yet to be able to climb. The S&P 500 Index ended the week -1.5%, the Dow was -1.8%, and the NASDAQ was -1.7%. The U.S. 10-year Treasury bond yield increased to 1.927% at Friday’s close versus 1.918% the previous week, but its yield was back above 2% again intraweek for the second week in a row.

For the fourth quarter of 2021, 417 companies in the S&P 500 Index have reported earnings results and 77.9% have reported earnings above analyst estimates. This compares to a long-term average of 65.9% and prior four quarter average of 83.9%. The current consensus forecast is for fourth quarter earnings to grow 31.8% on 14.5% revenue growth versus an expectation of 22.4% earnings growth on 12.1% revenue growth at the start of the earnings season. During the coming week, 55 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at what is causing the worry in the markets. [Editor's Note: This calm, measured and above all realistic approach to the headlines is one of the things that makes NovaPoint stand out. You can see how it plays out in their investment performance HERE.]

Financial Market Update

Dissecting Headlines: Sources of Worry

Stocks typically climb walls of worry because investors see the worry as temporary. This hasn’t been the case year-to-date. The dual concerns over persistent inflation and the Federal Reserve’s looming interest rate increases and the situation between Russia-Ukraine have pressured markets since the start of 2022. Resolution of these concerns are likely important gating factors to a recovery in stock prices.

The Federal Reserve has outlined a plan to remove monetary stimulus through tapering of monthly bond purchases and increases in the Fed funds rate. The tapering is currently underway and should be complete before the end of March. The next Federal Open Market Committee (FOMC) meeting is scheduled for March 15th and 16th. The FOMC likely begins a series of increases in the Fed funds rate at that time. Several Fed officials have been in the news lately offering their views on what actions to take. St. Louis Fed president James Bullard has advocated for a 0.50% increase at the March meeting and have the Fed funds rate at 1.00% by July 1st. New York Fed president John Williams has advocated for a more measured approach, likely a series of 0.25% increases. How fast and how far the FOMC moves on interest rates is a worry as well as how it works to combat inflation.

The situation between Russia and Ukraine has economic implications for the market. Destabilizing the region would create economic disruption both locally and across Europe. Disruptions in oil and gas exports would also continue to push energy prices higher globally. In an economic environment already dealing with inflationary pressures, a further increase in energy prices would negatively impact growth.

For more like this that you can share with your clients, NovaPoint is happy to share. They were the first firm on my screen with this week's analysis and I suspect they're always going to be first . . . on your schedule or whenever market developments dictate.